- Taiwan

- /

- Semiconductors

- /

- TPEX:6684

Algoltek (GTSM:6684) Shareholders Have Enjoyed An Impressive 270% Share Price Gain

When you buy shares in a company, there is always a risk that the price drops to zero. But if you pick the right stock, you can make a lot more than 100%. For example, the Algoltek, Inc. (GTSM:6684) share price has soared 270% in the last year. Most would be very happy with that, especially in just one year! It's also good to see the share price up 59% over the last quarter. Algoltek hasn't been listed for long, so it's still not clear if it is a long term winner.

View our latest analysis for Algoltek

Given that Algoltek only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over the last twelve months, Algoltek's revenue grew by 11%. That's not great considering the company is losing money. So we wouldn't have expected the share price to rise by 270%. The business will need a lot more growth to justify that increase. It's quite likely that the market is considering other factors, not just revenue growth.

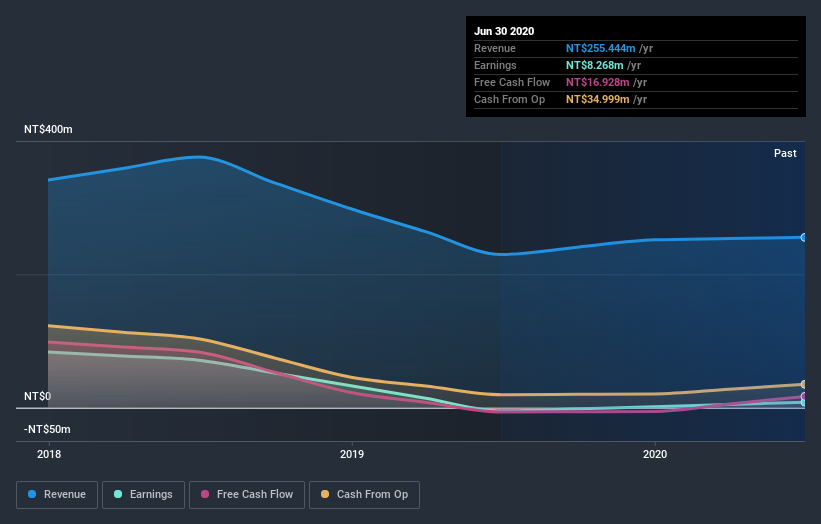

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Algoltek stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Algoltek shareholders have gained 270% over the last year. A substantial portion of that gain has come in the last three months, with the stock up 59% in that time. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Algoltek (at least 1 which is significant) , and understanding them should be part of your investment process.

Of course Algoltek may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you’re looking to trade Algoltek, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6684

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives