- Taiwan

- /

- Semiconductors

- /

- TPEX:6683

Update: Keystone Microtech (GTSM:6683) Stock Gained 41% In The Last Year

Keystone Microtech Corporation (GTSM:6683) shareholders might be concerned after seeing the share price drop 11% in the last month. While that might be a setback, it doesn't negate the nice returns received over the last twelve months. To wit, it had solidly beat the market, up 41%.

Check out our latest analysis for Keystone Microtech

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

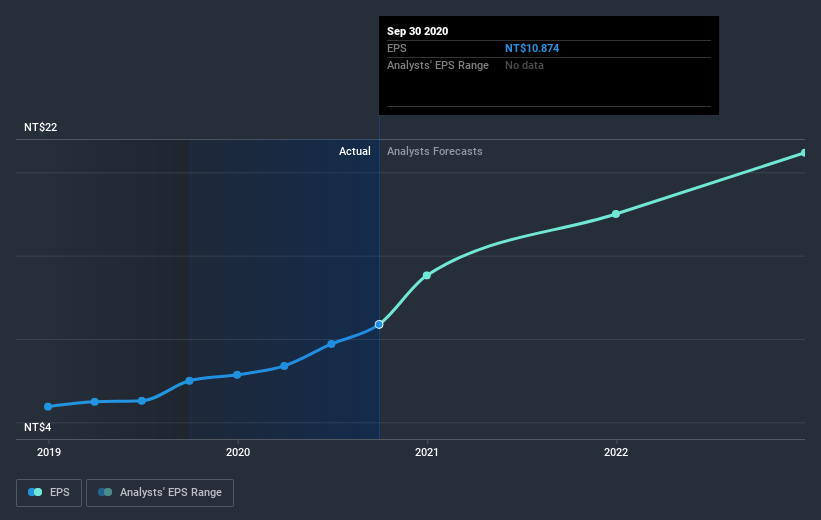

Keystone Microtech was able to grow EPS by 45% in the last twelve months. We note that the earnings per share growth isn't far from the share price growth (of 41%). This makes us think the market hasn't really changed its sentiment around the company, in the last year. It looks like the share price is responding to the EPS.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Keystone Microtech has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Keystone Microtech stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Keystone Microtech shareholders have gained 43% over the last year, including dividends. A substantial portion of that gain has come in the last three months, with the stock up 18% in that time. This suggests the company is continuing to win over new investors. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for Keystone Microtech you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade Keystone Microtech, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Keystone Microtech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6683

Keystone Microtech

Operates in the semiconductor industry in Taiwan and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives