- Taiwan

- /

- Semiconductors

- /

- TPEX:6494

Nyquest Technology Co., Ltd.'s (GTSM:6494) Stock Has Seen Strong Momentum: Does That Call For Deeper Study Of Its Financial Prospects?

Nyquest Technology's (GTSM:6494) stock is up by a considerable 65% over the past three months. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. Specifically, we decided to study Nyquest Technology's ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

Check out our latest analysis for Nyquest Technology

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Nyquest Technology is:

13% = NT$85m ÷ NT$663m (Based on the trailing twelve months to September 2020).

The 'return' is the income the business earned over the last year. That means that for every NT$1 worth of shareholders' equity, the company generated NT$0.13 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Nyquest Technology's Earnings Growth And 13% ROE

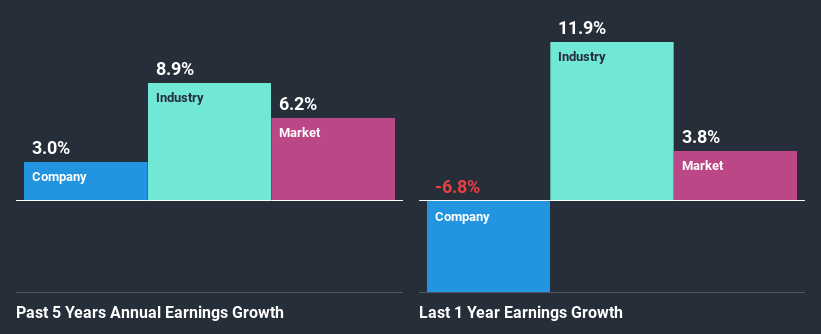

To start with, Nyquest Technology's ROE looks acceptable. And on comparing with the industry, we found that the the average industry ROE is similar at 11%. Nyquest Technology's decent returns aren't reflected in Nyquest Technology'smediocre five year net income growth average of 3.0%. So, there could be some other factors at play that could be impacting the company's growth. For instance, the company pays out a huge portion of its earnings as dividends, or is faced with competitive pressures.

As a next step, we compared Nyquest Technology's net income growth with the industry and were disappointed to see that the company's growth is lower than the industry average growth of 8.9% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Nyquest Technology is trading on a high P/E or a low P/E, relative to its industry.

Is Nyquest Technology Using Its Retained Earnings Effectively?

With a high three-year median payout ratio of 83% (or a retention ratio of 17%), most of Nyquest Technology's profits are being paid to shareholders. This definitely contributes to the low earnings growth seen by the company.

In addition, Nyquest Technology has been paying dividends over a period of six years suggesting that keeping up dividend payments is way more important to the management even if it comes at the cost of business growth.

Conclusion

Overall, we feel that Nyquest Technology certainly does have some positive factors to consider. However, while the company does have a high ROE, its earnings growth number is quite disappointing. This can be blamed on the fact that it reinvests only a small portion of its profits and pays out the rest as dividends. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. To know the 3 risks we have identified for Nyquest Technology visit our risks dashboard for free.

When trading Nyquest Technology or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Nyquest Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6494

Nyquest Technology

Research, designs, and sells integrated circuits (ICs).

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success