Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Avid Electronics Corp. (GTSM:6103) makes use of debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Avid Electronics

What Is Avid Electronics's Net Debt?

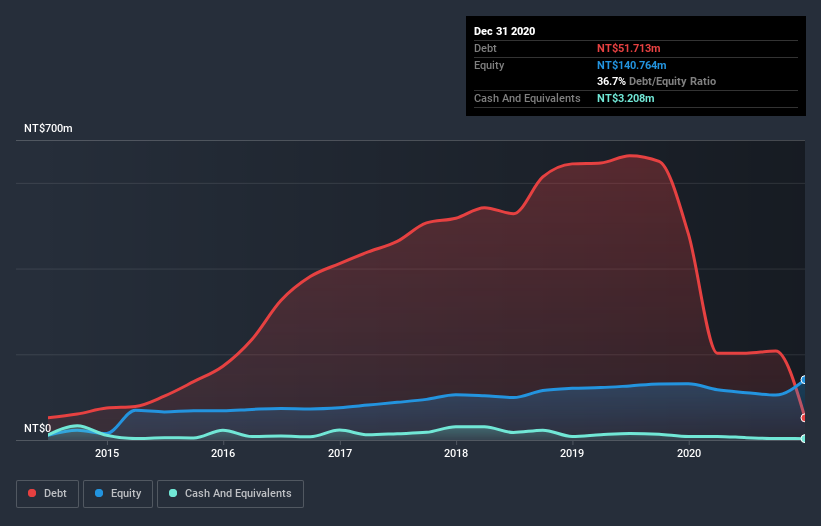

The image below, which you can click on for greater detail, shows that Avid Electronics had debt of NT$51.7m at the end of December 2020, a reduction from NT$480.9m over a year. On the flip side, it has NT$3.21m in cash leading to net debt of about NT$48.5m.

How Healthy Is Avid Electronics' Balance Sheet?

We can see from the most recent balance sheet that Avid Electronics had liabilities of NT$62.4m falling due within a year, and liabilities of NT$15.7m due beyond that. Offsetting this, it had NT$3.21m in cash and NT$178.5m in receivables that were due within 12 months. So it can boast NT$103.6m more liquid assets than total liabilities.

This surplus suggests that Avid Electronics is using debt in a way that is appears to be both safe and conservative. Because it has plenty of assets, it is unlikely to have trouble with its lenders. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Avid Electronics will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Avid Electronics had a loss before interest and tax, and actually shrunk its revenue by 99%, to NT$14m. That makes us nervous, to say the least.

Caveat Emptor

Not only did Avid Electronics's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost a very considerable NT$130m at the EBIT level. Looking on the brighter side, the business has adequate liquid assets, which give it time to grow and develop before its debt becomes a near-term issue. But a profit would do more to inspire us to research the business more closely. So it seems too risky for our taste. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 5 warning signs we've spotted with Avid Electronics (including 3 which make us uncomfortable) .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade Avid Electronics, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6103

Proven track record with adequate balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026