- Taiwan

- /

- Semiconductors

- /

- TWSE:5244

Should Brightek Optoelectronic Co., Ltd. (GTSM:5244) Be Part Of Your Dividend Portfolio?

Today we'll take a closer look at Brightek Optoelectronic Co., Ltd. (GTSM:5244) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

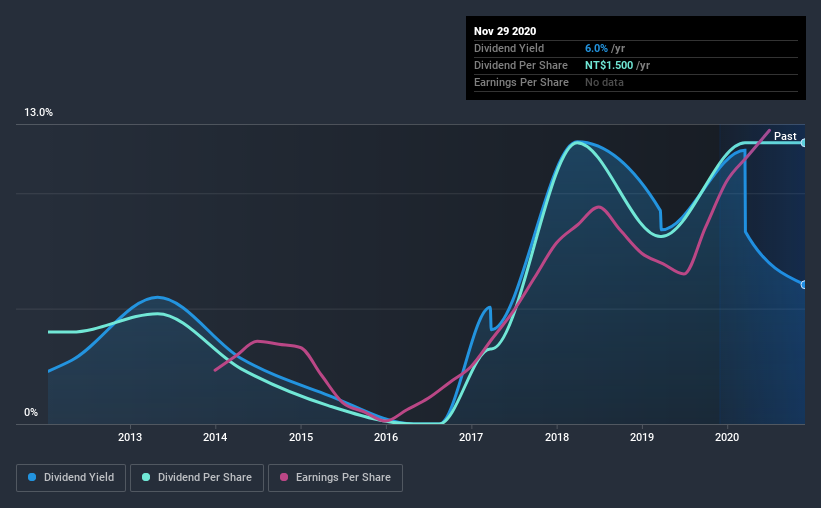

In this case, Brightek Optoelectronic likely looks attractive to dividend investors, given its 6.0% dividend yield and nine-year payment history. We'd agree the yield does look enticing. Some simple analysis can reduce the risk of holding Brightek Optoelectronic for its dividend, and we'll focus on the most important aspects below.

Explore this interactive chart for our latest analysis on Brightek Optoelectronic!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. In the last year, Brightek Optoelectronic paid out 59% of its profit as dividends. This is a fairly normal payout ratio among most businesses. It allows a higher dividend to be paid to shareholders, but does limit the capital retained in the business - which could be good or bad.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Brightek Optoelectronic's cash payout ratio in the last year was 37%, which suggests dividends were well covered by cash generated by the business. It's positive to see that Brightek Optoelectronic's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

While the above analysis focuses on dividends relative to a company's earnings, we do note Brightek Optoelectronic's strong net cash position, which will let it pay larger dividends for a time, should it choose.

Consider getting our latest analysis on Brightek Optoelectronic's financial position here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Looking at the last decade of data, we can see that Brightek Optoelectronic paid its first dividend at least nine years ago. Although it has been paying a dividend for several years now, the dividend has been cut at least once, and we're cautious about the consistency of its dividend across a full economic cycle. During the past nine-year period, the first annual payment was NT$0.5 in 2011, compared to NT$1.5 last year. Dividends per share have grown at approximately 13% per year over this time. Brightek Optoelectronic's dividend payments have fluctuated, so it hasn't grown 13% every year, but the CAGR is a useful rule of thumb for approximating the historical growth.

So, its dividends have grown at a rapid rate over this time, but payments have been cut in the past. The stock may still be worth considering as part of a diversified dividend portfolio.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share (EPS) are growing - it's not worth taking the risk on a dividend getting cut, unless you might be rewarded with larger dividends in future. It's good to see Brightek Optoelectronic has been growing its earnings per share at 31% a year over the past five years. Earnings per share are sharply up, but we wonder if paying out more than half its earnings (leaving less for reinvestment) is an implicit signal that Brightek Optoelectronic's growth will be slower in the future.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. First, we think Brightek Optoelectronic has an acceptable payout ratio and its dividend is well covered by cashflow. Next, earnings growth has been good, but unfortunately the dividend has been cut at least once in the past. Brightek Optoelectronic has a number of positive attributes, but it falls slightly short of our (admittedly high) standards. Were there evidence of a strong moat or an attractive valuation, it could still be well worth a look.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've picked out 2 warning signs for Brightek Optoelectronic that investors should know about before committing capital to this stock.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

When trading Brightek Optoelectronic or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Brightek Optoelectronic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:5244

Brightek Optoelectronic

Provides LED and sensor packaging, and optoelectronics solutions in Taiwan and internationally.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success