- Taiwan

- /

- Semiconductors

- /

- TPEX:5236

Investors Appear Satisfied With Sunplus Innovation Technology Inc.'s (GTSM:5236) Prospects As Shares Rocket 26%

Sunplus Innovation Technology Inc. (GTSM:5236) shareholders have had their patience rewarded with a 26% share price jump in the last month. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

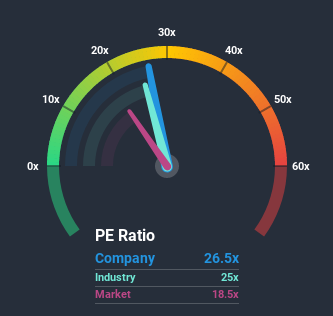

Following the firm bounce in price, Sunplus Innovation Technology's price-to-earnings (or "P/E") ratio of 26.5x might make it look like a sell right now compared to the market in Taiwan, where around half of the companies have P/E ratios below 18x and even P/E's below 13x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for Sunplus Innovation Technology as its earnings have been rising very briskly. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Sunplus Innovation Technology

How Is Sunplus Innovation Technology's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as Sunplus Innovation Technology's is when the company's growth is on track to outshine the market.

If we review the last year of earnings growth, the company posted a terrific increase of 132%. Pleasingly, EPS has also lifted 1,004% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is only predicted to deliver 24% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

In light of this, it's understandable that Sunplus Innovation Technology's P/E sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What We Can Learn From Sunplus Innovation Technology's P/E?

Sunplus Innovation Technology shares have received a push in the right direction, but its P/E is elevated too. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Sunplus Innovation Technology maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Sunplus Innovation Technology that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

If you decide to trade Sunplus Innovation Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:5236

Sunplus Innovation Technology

Researches, develops, manufactures, and markets microcontrollers and system-on-chips with embedded software solutions in Taiwan.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives