- Taiwan

- /

- Semiconductors

- /

- TPEX:3268

The Strong Earnings Posted By Higher Way Electronic (GTSM:3268) Are A Good Indication Of The Strength Of The Business

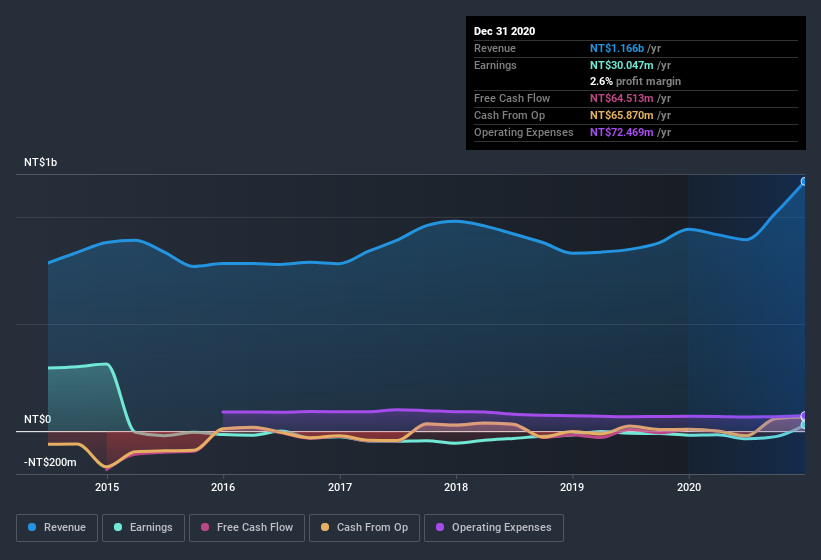

Investors were disappointed with Higher Way Electronic Co., Ltd.'s (GTSM:3268) earnings, despite the strong profit numbers. We did some digging and found some worrying underlying problems.

See our latest analysis for Higher Way Electronic

Our Take On Higher Way Electronic's Profit Performance

Therefore, it seems possible to us that Higher Way Electronic's true underlying earnings power is actually less than its statutory profit. If you'd like to know more about Higher Way Electronic as a business, it's important to be aware of any risks it's facing. In terms of investment risks, we've identified 2 warning signs with Higher Way Electronic, and understanding these should be part of your investment process.

Our examination of Higher Way Electronic has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Higher Way Electronic, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Higher Way Electronic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3268

Higher Way Electronic

Higher Way Electronic Co., Ltd. engaged in the sales of consumer, multimedia, and micro controller IC in Taiwan, Hong Kong, Mainland China, the United States, and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives