- Taiwan

- /

- Real Estate

- /

- TWSE:2923

Sino Horizon Holdings Limited's (TWSE:2923) Share Price Not Quite Adding Up

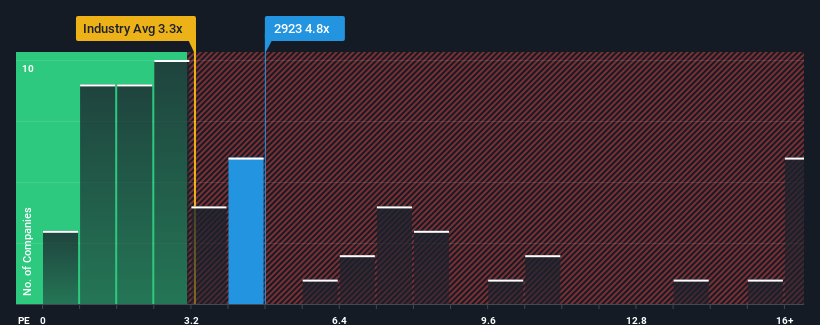

Sino Horizon Holdings Limited's (TWSE:2923) price-to-sales (or "P/S") ratio of 4.8x may not look like an appealing investment opportunity when you consider close to half the companies in the Real Estate industry in Taiwan have P/S ratios below 3.3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Sino Horizon Holdings

How Has Sino Horizon Holdings Performed Recently?

With revenue growth that's exceedingly strong of late, Sino Horizon Holdings has been doing very well. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Sino Horizon Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Sino Horizon Holdings' is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 77% last year. The latest three year period has also seen a 9.0% overall rise in revenue, aided extensively by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 48% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's alarming that Sino Horizon Holdings' P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that Sino Horizon Holdings currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

Before you take the next step, you should know about the 3 warning signs for Sino Horizon Holdings (2 are potentially serious!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2923

Sino Horizon Holdings

Engages in the development, sale, and leasing of real estate properties in mainland China and Taiwan.

Imperfect balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives