- Taiwan

- /

- Real Estate

- /

- TWSE:2501

Institutional owners may ignore Cathay Real Estate Development Co.,Ltd.'s (TWSE:2501) recent NT$3.7b market cap decline as longer-term profits stay in the green

Key Insights

- Given the large stake in the stock by institutions, Cathay Real Estate DevelopmentLtd's stock price might be vulnerable to their trading decisions

- A total of 4 investors have a majority stake in the company with 55% ownership

- Ownership research, combined with past performance data can help provide a good understanding of opportunities in a stock

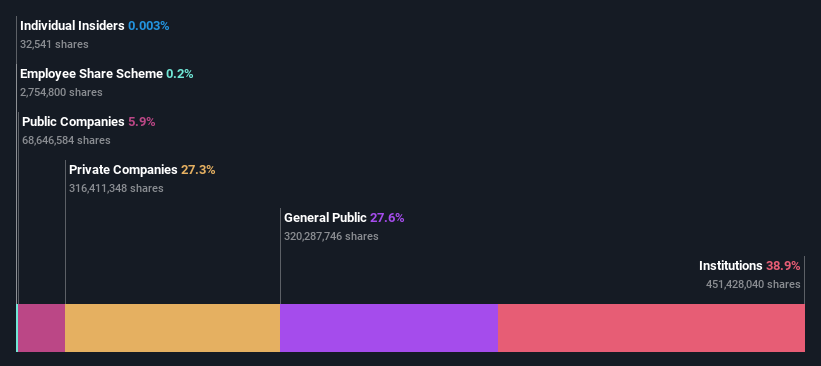

Every investor in Cathay Real Estate Development Co.,Ltd. (TWSE:2501) should be aware of the most powerful shareholder groups. The group holding the most number of shares in the company, around 39% to be precise, is institutions. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

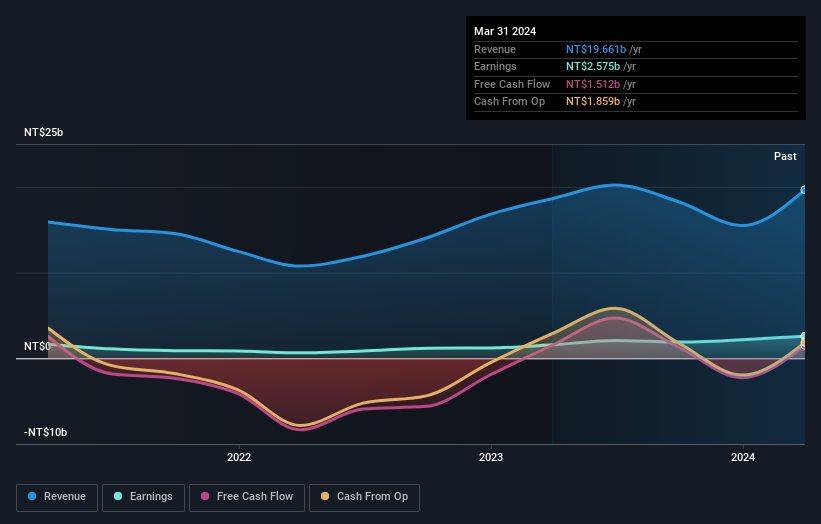

Losing money on investments is something no shareholder enjoys, least of all institutional investors who saw their holdings value drop by 10% last week. However, the 84% one-year returns may have helped alleviate their overall losses. But they would probably be wary of future losses.

Let's delve deeper into each type of owner of Cathay Real Estate DevelopmentLtd, beginning with the chart below.

View our latest analysis for Cathay Real Estate DevelopmentLtd

What Does The Institutional Ownership Tell Us About Cathay Real Estate DevelopmentLtd?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

We can see that Cathay Real Estate DevelopmentLtd does have institutional investors; and they hold a good portion of the company's stock. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Cathay Real Estate DevelopmentLtd, (below). Of course, keep in mind that there are other factors to consider, too.

We note that hedge funds don't have a meaningful investment in Cathay Real Estate DevelopmentLtd. Cathay Life Insurance Employee Pension Fund Administration Committee is currently the company's largest shareholder with 25% of shares outstanding. Meanwhile, the second and third largest shareholders, hold 18% and 6.3%, of the shares outstanding, respectively.

Our research also brought to light the fact that roughly 55% of the company is controlled by the top 4 shareholders suggesting that these owners wield significant influence on the business.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. As far as we can tell there isn't analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of Cathay Real Estate DevelopmentLtd

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our data suggests that insiders own under 1% of Cathay Real Estate Development Co.,Ltd. in their own names. We do note, however, it is possible insiders have an indirect interest through a private company or other corporate structure. It appears that the board holds about NT$908k worth of stock. This compares to a market capitalization of NT$32b. Many investors in smaller companies prefer to see the board more heavily invested. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public, who are usually individual investors, hold a 28% stake in Cathay Real Estate DevelopmentLtd. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Company Ownership

Our data indicates that Private Companies hold 27%, of the company's shares. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Public Company Ownership

We can see that public companies hold 5.9% of the Cathay Real Estate DevelopmentLtd shares on issue. We can't be certain but it is quite possible this is a strategic stake. The businesses may be similar, or work together.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 4 warning signs we've spotted with Cathay Real Estate DevelopmentLtd (including 2 which don't sit too well with us) .

Of course this may not be the best stock to buy. Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2501

Cathay Real Estate DevelopmentLtd

Engages in the construction of residential and commercial buildings for leasing or selling in Taiwan.

Proven track record slight.