The Asian tech market is currently navigating a complex landscape, influenced by global economic shifts such as the U.S.-China trade truce and varied monetary policies across major economies. Despite these challenges, high-growth tech stocks in Asia continue to attract attention for their potential to capitalize on advancements in technology and innovation, offering opportunities for investors seeking growth in a dynamic sector.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 36.36% | 39.76% | ★★★★★★ |

| Suzhou TFC Optical Communication | 34.14% | 35.43% | ★★★★★★ |

| Zhongji Innolight | 29.30% | 30.93% | ★★★★★★ |

| Fositek | 37.36% | 48.39% | ★★★★★★ |

| ASROCK Incorporation | 30.39% | 32.50% | ★★★★★★ |

| Eoptolink Technology | 37.03% | 32.46% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| ISU Petasys | 21.11% | 32.81% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Optowide Technologies (SHSE:688195)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Optowide Technologies Co., Ltd. focuses on the research, development, production, and sale of precision optics and fiber components both in China and internationally with a market cap of CN¥14.21 billion.

Operations: Optowide Technologies specializes in precision optics and fiber components, operating within both domestic and international markets. The company's revenue model is centered around the production and sale of these specialized components, contributing to its market presence.

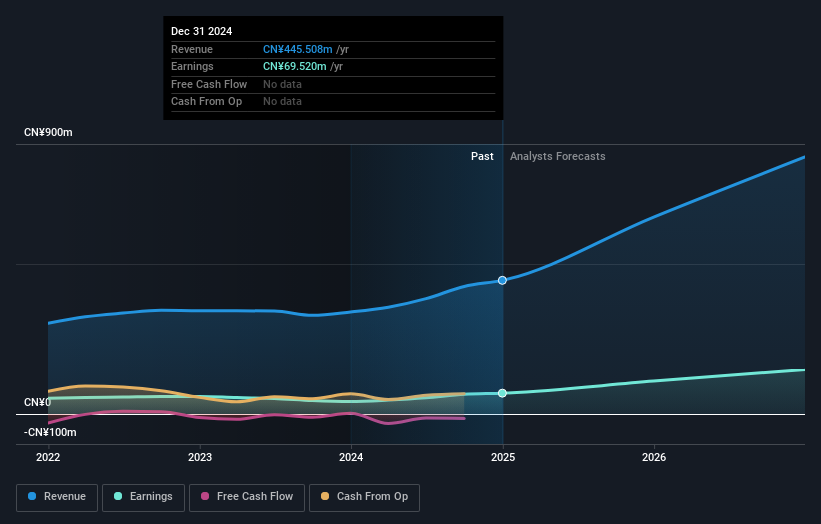

Optowide Technologies has demonstrated robust growth, with a notable 28.8% increase in annualized revenue and an impressive 34.3% rise in earnings per year, outpacing the broader Chinese market's growth rates of 14.3% and 27%, respectively. This performance is underpinned by significant investment in R&D, crucial for maintaining its competitive edge in the fast-evolving tech landscape of Asia. Recent financials reveal a steady climb with net income reaching CNY 63.8 million from last year's CNY 55.48 million, reflecting strong operational execution despite market volatility noted over recent months. As Optowide continues to innovate and expand its market share, these factors collectively underscore its potential amidst Asia's dynamic tech sector.

- Get an in-depth perspective on Optowide Technologies' performance by reading our health report here.

Oracle Corporation Japan (TSE:4716)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Oracle Corporation Japan offers software, hardware, and cloud products and solutions in Japan with a market capitalization of ¥1.79 trillion.

Operations: Oracle Corporation Japan generates revenue through its diverse portfolio of software, hardware, and cloud solutions. The company operates in the Japanese market with a focus on delivering integrated technology products and services.

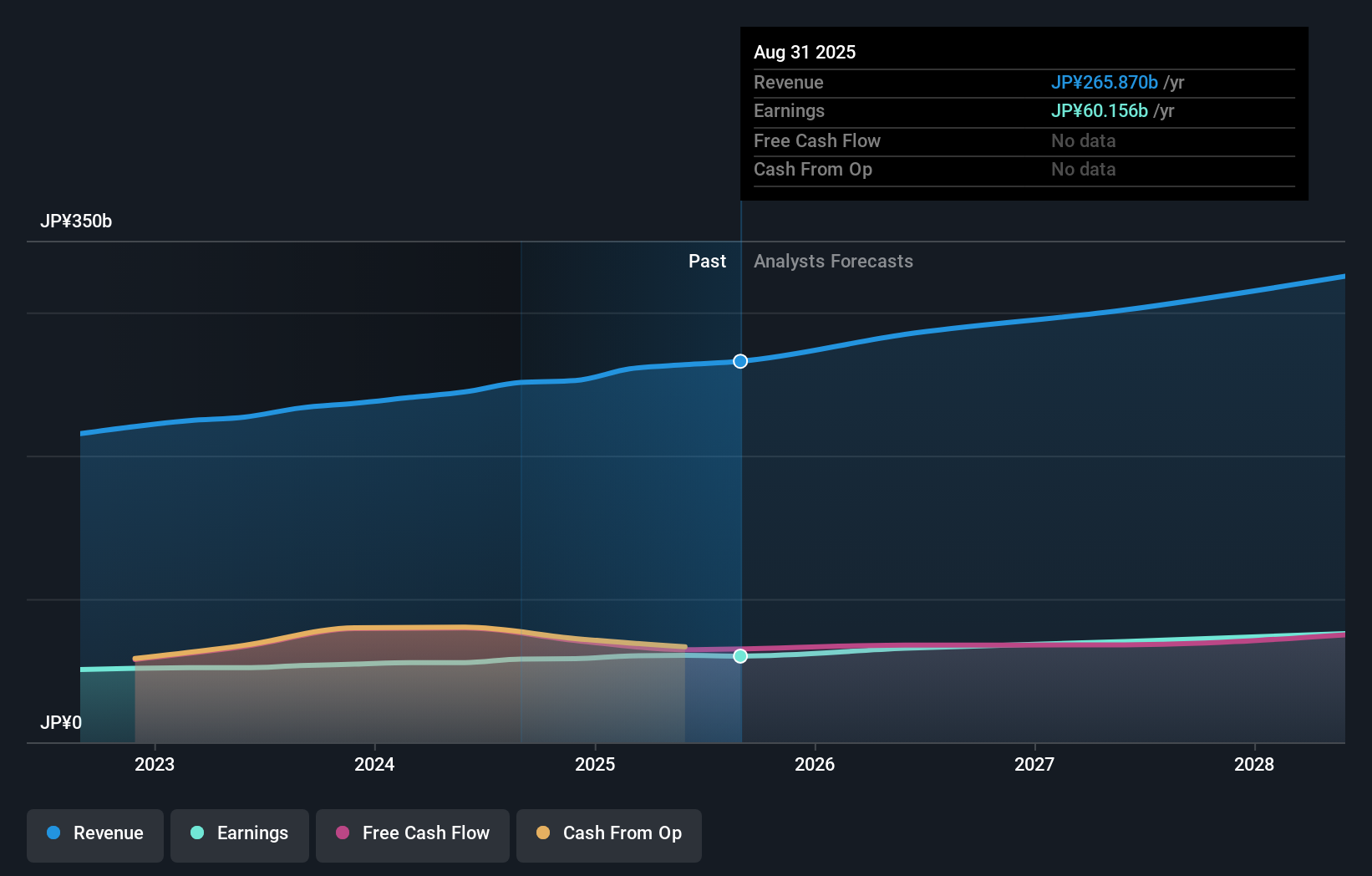

Oracle Corporation Japan, a pivotal entity in Asia's tech landscape, has been navigating the competitive market with strategic finesse. With an 8.3% annual growth in revenue and a similar uptick in earnings, the company outperforms Japan's average market growth of 4.5%. This is bolstered by its commitment to innovation as reflected in its R&D spending trends which align closely with industry demands for continuous technological advancement. Recent corporate announcements include their upcoming Q1 2026 earnings call scheduled for September 25, 2025, indicating proactive investor communications amidst evolving market dynamics. This approach not only sustains but potentially accelerates their market position by leveraging advanced technologies and operational efficiencies to meet diverse client needs effectively.

- Dive into the specifics of Oracle Corporation Japan here with our thorough health report.

Assess Oracle Corporation Japan's past performance with our detailed historical performance reports.

PharmaEssentia (TWSE:6446)

Simply Wall St Growth Rating: ★★★★★★

Overview: PharmaEssentia Corporation is a biopharmaceutical company focused on developing treatments for human diseases, operating both in Taiwan and internationally, with a market capitalization of NT$182.51 billion.

Operations: The company generates revenue primarily from the research and development of new drugs, amounting to NT$12.63 billion.

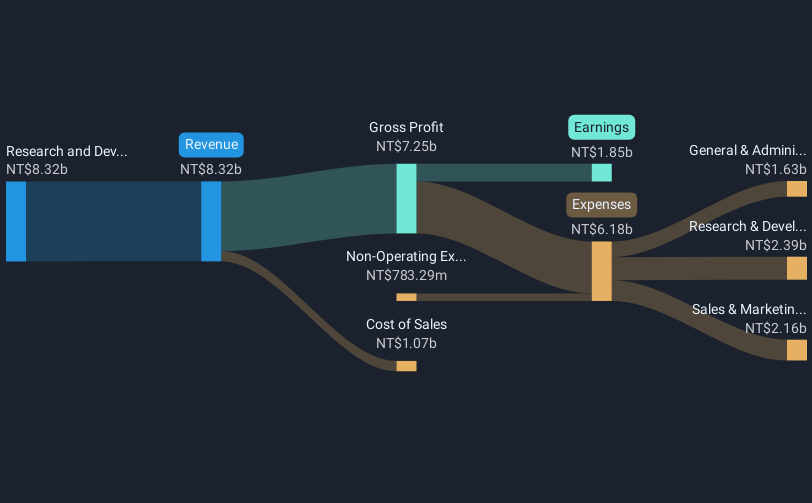

PharmaEssentia, amidst a robust Asian tech sector, has demonstrated significant financial growth with third-quarter sales soaring to TWD 3.89 billion from TWD 2.71 billion year-over-year, and net income more than doubling to TWD 1.47 billion. This trend is echoed in their nine-month performance, with sales reaching TWD 10.75 billion and net income at TWD 3.57 billion, reflecting a substantial increase from the previous period's figures. These results are underpinned by PharmaEssentia's strategic focus on R&D investments which have been pivotal in driving these impressive earnings and revenue growth rates of approximately 50.9% and 34% annually respectively—far outpacing industry averages.

- Navigate through the intricacies of PharmaEssentia with our comprehensive health report here.

Explore historical data to track PharmaEssentia's performance over time in our Past section.

Taking Advantage

- Embark on your investment journey to our 176 Asian High Growth Tech and AI Stocks selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6446

PharmaEssentia

A biopharmaceutical company engages in treatment for human diseases in Taiwan and internationally.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives