- China

- /

- Electronic Equipment and Components

- /

- SZSE:002106

Uncovering None And 2 Other Hidden Gems with Strong Potential

Reviewed by Simply Wall St

In a week marked by volatility, global markets have been influenced by a mix of economic indicators and geopolitical developments. The U.S. Federal Reserve's decision to hold interest rates steady amidst persistent inflation concerns, coupled with competitive pressures in the AI sector, has created an uncertain backdrop for investors. In this environment, identifying promising small-cap stocks that exhibit resilience and growth potential becomes crucial for navigating market fluctuations effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Riyadh Cement | NA | 1.82% | -1.49% | ★★★★★★ |

| Yuen Foong Yu Consumer Products | 27.23% | 0.46% | -3.46% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yashima Denki | 2.71% | -1.00% | 18.12% | ★★★★★★ |

| Baazeem Trading | 9.82% | -2.04% | -2.06% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Kuo Yang Construction | 83.40% | -32.54% | -39.68% | ★★★★☆☆ |

| Loadstar Capital K.K | 259.54% | 16.85% | 21.57% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Shenzhen Laibao Hi-Tech (SZSE:002106)

Simply Wall St Value Rating: ★★★★★★

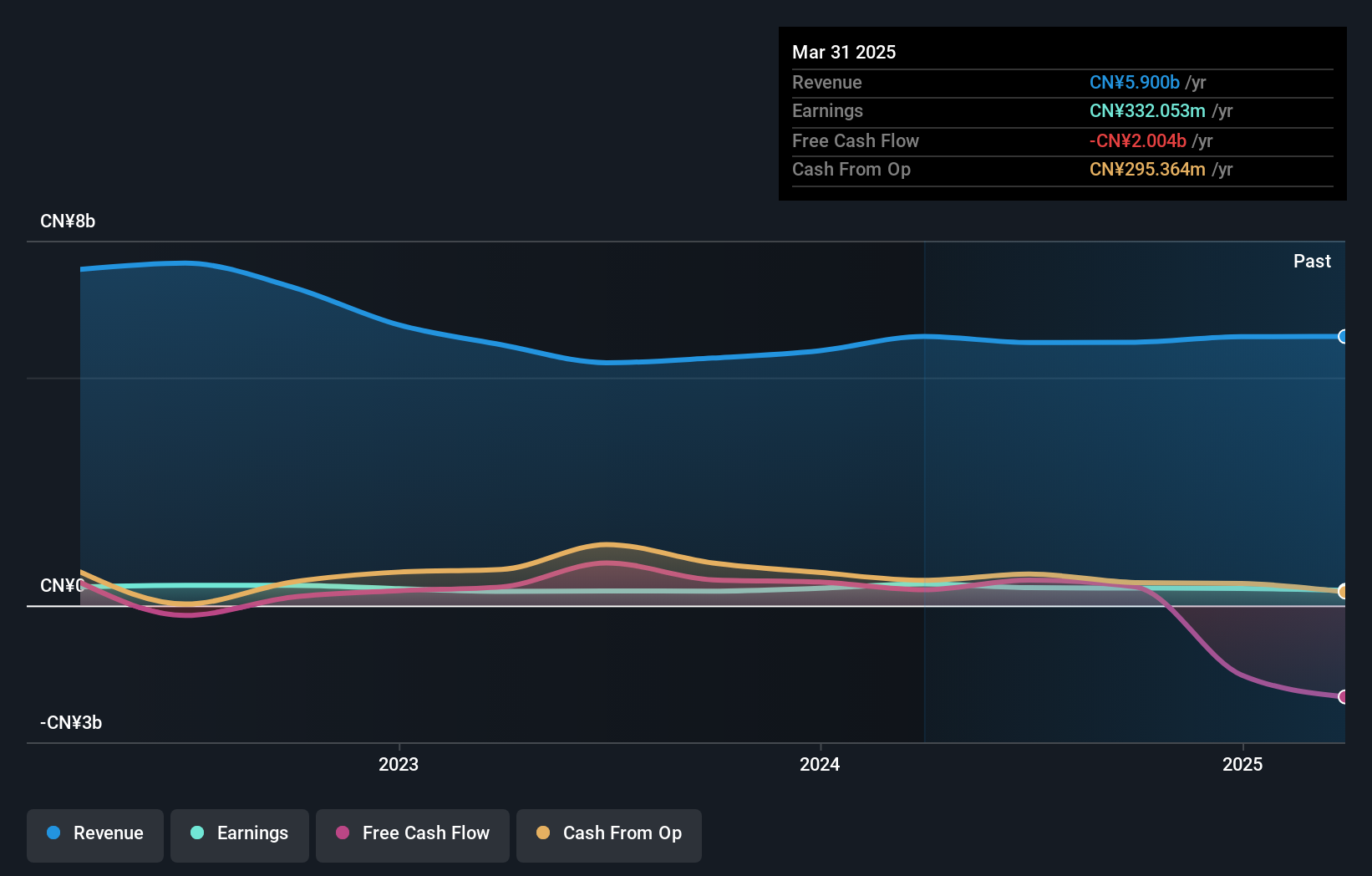

Overview: Shenzhen Laibao Hi-Tech Co., Ltd. focuses on the research, development, production, and sale of upstream materials and touch devices for flat panel displays in China, with a market capitalization of CN¥7.60 billion.

Operations: Laibao Hi-Tech generates revenue through the sale of upstream materials and touch devices for flat panel displays. The company has a market capitalization of CN¥7.60 billion, indicating its substantial presence in the industry.

Laibao Hi-Tech, a nimble player in the electronics sector, boasts high-quality earnings and is debt-free, which eliminates concerns about interest coverage. Its recent earnings growth of 21.9% outpaces the broader electronic industry’s 2.3%, highlighting its competitive edge. The company appears attractively valued with a price-to-earnings ratio of 20.7x, notably lower than the CN market average of 34.9x. Free cash flow has been positive recently, with figures like US$934 million as of June 2023 suggesting robust operational efficiency and financial health that could support future endeavors or expansions within its field.

Jiangsu Yunyi ElectricLtd (SZSE:300304)

Simply Wall St Value Rating: ★★★★★★

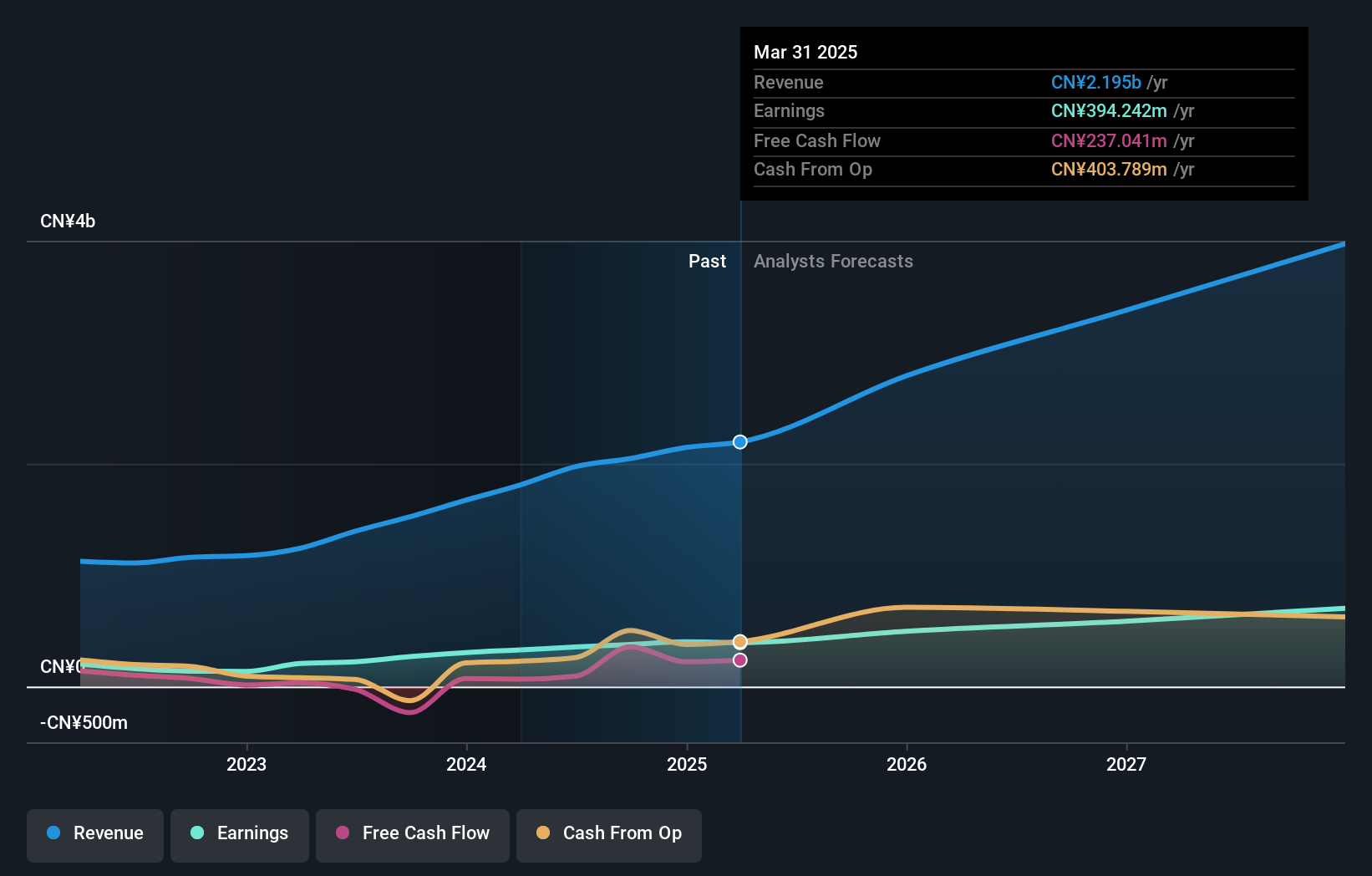

Overview: Jiangsu Yunyi Electric Co., Ltd. engages in the research, development, manufacturing, marketing, and sale of automotive electronic parts both in China and internationally, with a market capitalization of CN¥7.27 billion.

Operations: The company generates revenue primarily from the sale of automotive electronic parts, with a focus on both domestic and international markets. It operates within a competitive industry, impacting its pricing strategies and cost management. The net profit margin reflects the company's efficiency in converting revenue into actual profit after accounting for all expenses.

Jiangsu Yunyi Electric, a dynamic player in the auto components sector, showcases impressive financial health with earnings growth of 40.9% over the past year, outpacing the industry average of 10.5%. The company is trading at a substantial discount, about 61% below estimated fair value, indicating potential upside for investors. Its debt-to-equity ratio has significantly improved from 13.8% to just 0.3% over five years, reflecting prudent financial management. A recent shareholders meeting highlighted plans for employee stock ownership and potential changes to business scope, suggesting strategic moves to align interests and expand operations further in its market niche.

Alar Pharmaceuticals (TPEX:6785)

Simply Wall St Value Rating: ★★★★★★

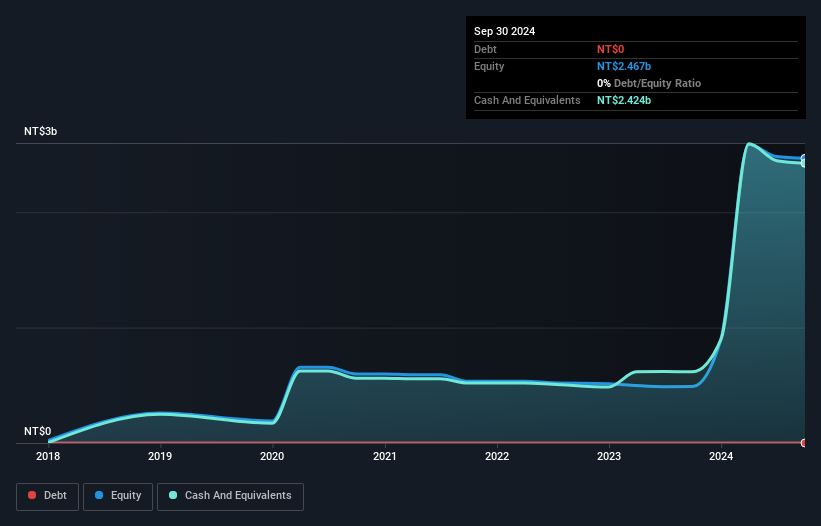

Overview: Alar Pharmaceuticals Inc. is a drug development company specializing in long-acting release drug products for CNS disorders and chronic diseases in Taiwan, with a market cap of NT$9.42 billion.

Operations: Alar Pharmaceuticals generates revenue primarily from its New Drug Research and Development Department, amounting to NT$474.29 million.

Alar Pharmaceuticals, a smaller player in the pharmaceuticals industry, has recently turned profitable, showcasing high-quality earnings and free cash flow positivity. The company is trading at 30% below its estimated fair value and carries no debt compared to five years ago when it had a debt-to-equity ratio of 0.9. Recent developments include receiving approval for Phase I clinical trials for ALA-3000 Injection in the US and obtaining a patent allowance for ketamine pamoate in Brazil, which could bolster international licensing opportunities. Despite reporting a net loss of TWD 15 million last quarter, Alar's financial health appears stable with promising prospects ahead.

- Delve into the full analysis health report here for a deeper understanding of Alar Pharmaceuticals.

Gain insights into Alar Pharmaceuticals' past trends and performance with our Past report.

Make It Happen

- Click this link to deep-dive into the 4717 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002106

Shenzhen Laibao Hi-Tech

Engages in the research and development, production, and sale of upstream materials and touch devices for flat panel displays in China.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives