TTY Biopharm Company Limited (GTSM:4105) Analysts Just Cut Their EPS Forecasts Substantially

The latest analyst coverage could presage a bad day for TTY Biopharm Company Limited (GTSM:4105), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Revenue and earnings per share (EPS) forecasts were both revised downwards, with analysts seeing grey clouds on the horizon.

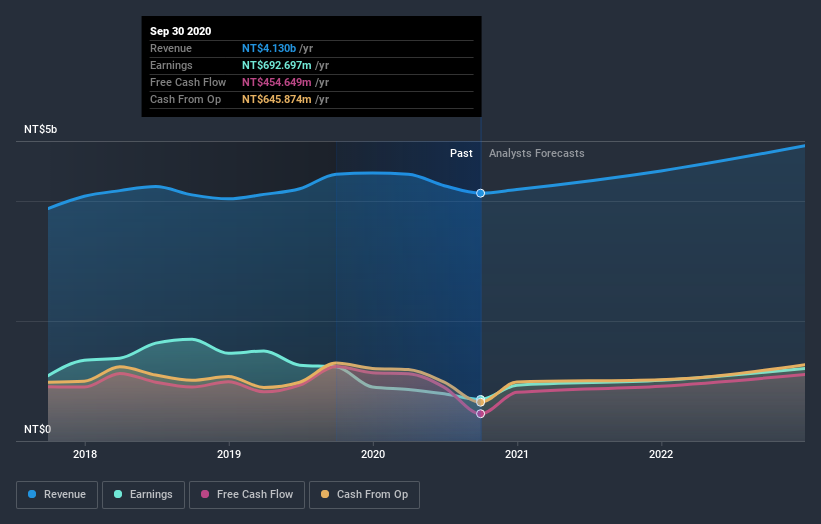

After the downgrade, the five analysts covering TTY Biopharm are now predicting revenues of NT$4.5b in 2021. If met, this would reflect a decent 9.0% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to jump 46% to NT$4.06. Previously, the analysts had been modelling revenues of NT$5.1b and earnings per share (EPS) of NT$4.69 in 2021. Indeed, we can see that the analysts are a lot more bearish about TTY Biopharm's prospects, administering a measurable cut to revenue estimates and slashing their EPS estimates to boot.

View our latest analysis for TTY Biopharm

The consensus price target fell 6.7% to NT$73.86, with the weaker earnings outlook clearly leading analyst valuation estimates. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on TTY Biopharm, with the most bullish analyst valuing it at NT$95.00 and the most bearish at NT$63.00 per share. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. The analysts are definitely expecting TTY Biopharm's growth to accelerate, with the forecast 9.0% growth ranking favourably alongside historical growth of 5.8% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 21% per year. It seems obvious that, while the future growth outlook is brighter than the recent past, TTY Biopharm is expected to grow slower than the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that TTY Biopharm's revenues are expected to grow slower than the wider market. With a serious cut to next year's expectations and a falling price target, we wouldn't be surprised if investors were becoming wary of TTY Biopharm.

A high debt burden combined with a downgrade of this magnitude always gives us some reason for concern, especially if these forecasts are just the first sign of a business downturn. See why we're concerned about TTY Biopharm's balance sheet by visiting our risks dashboard for free on our platform here.

You can also see our analysis of TTY Biopharm's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

If you decide to trade TTY Biopharm, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TTY Biopharm might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:4105

TTY Biopharm

Engages in the development and sale of pharmaceutical and chemical drugs in Taiwan and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives