As Asian markets navigate a complex landscape marked by Japan's record stock market highs and China's mixed economic signals, investors are increasingly focused on finding stable income sources amid global uncertainties. In this context, dividend stocks offer a compelling option for those seeking consistent returns, making them an attractive consideration in November 2025.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.46% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.77% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.96% | ★★★★★★ |

| SIGMAXYZ Holdings (TSE:6088) | 3.71% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.94% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.88% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.95% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.58% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.67% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.44% | ★★★★★★ |

Click here to see the full list of 1042 stocks from our Top Asian Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Chori (TSE:8014)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chori Co., Ltd. operates in the textiles, chemicals, and machinery sectors both in China and internationally, with a market cap of ¥948.86 billion.

Operations: Chori Co., Ltd. generates revenue from its Chemicals Business, contributing ¥153.95 billion, and its Fibers, Textiles, and Garments segment, contributing ¥147.22 billion, along with a smaller contribution of ¥804 million from its Machinery Business.

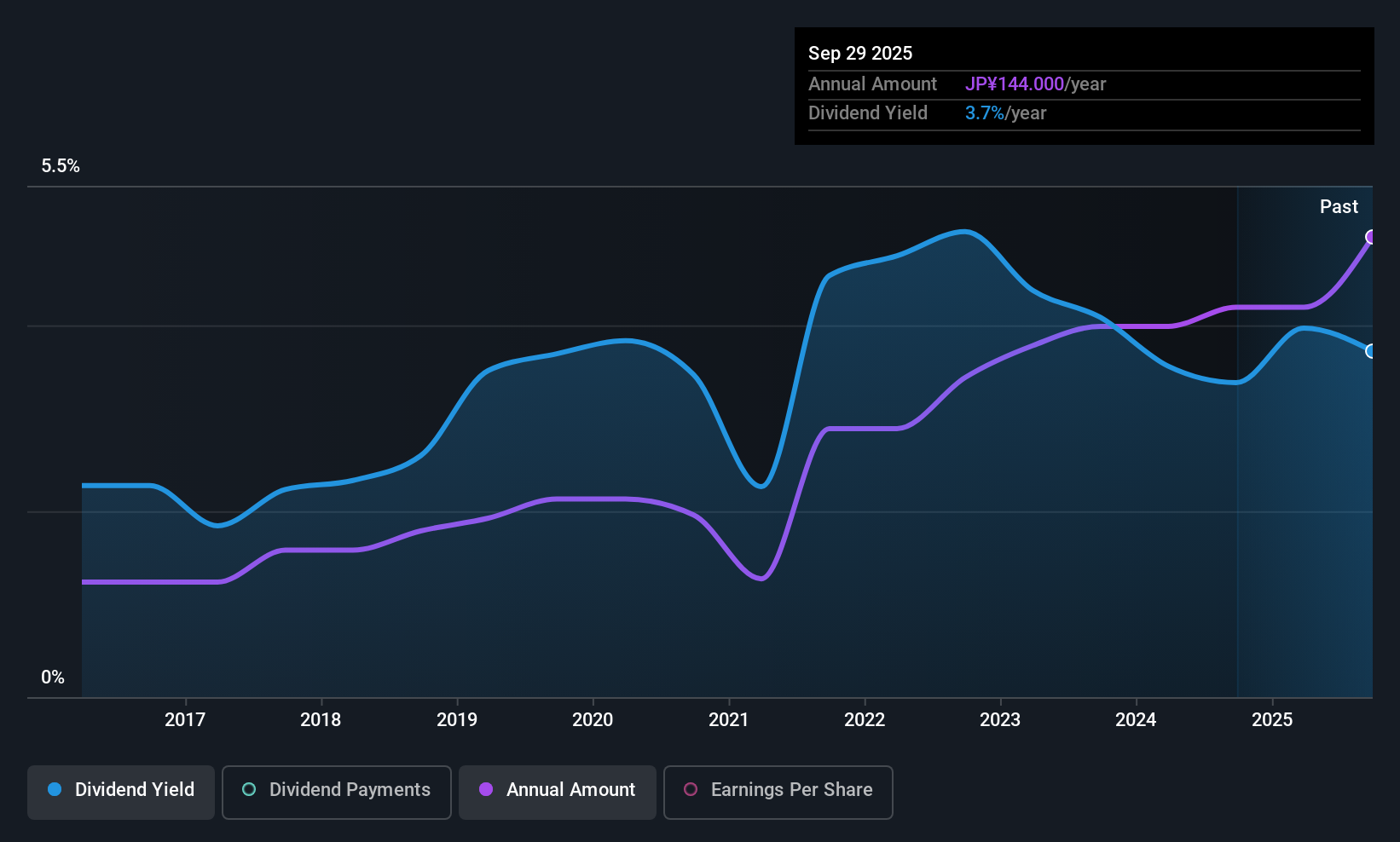

Dividend Yield: 3.7%

Chori Co., Ltd. recently increased its cash dividend to JPY 72.00 per share, up from JPY 61.00 the previous year, with payments commencing December 1, 2025. Despite a volatile and unreliable dividend history over the past decade, Chori's dividends are well covered by earnings and cash flows, with payout ratios of 38.7% and 37.2%, respectively. Trading at a significant discount to its estimated fair value, it offers an attractive yield in Japan's top quartile of dividend payers at 3.74%.

- Get an in-depth perspective on Chori's performance by reading our dividend report here.

- According our valuation report, there's an indication that Chori's share price might be on the cheaper side.

Daiichi Jitsugyo (TSE:8059)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Daiichi Jitsugyo Co., Ltd. is involved in the import, export, and sale of plant and machinery equipment in Japan, with a market cap of approximately ¥91.92 billion.

Operations: Daiichi Jitsugyo Co., Ltd. generates its revenue through the import, export, and sale of plant and machinery equipment in Japan.

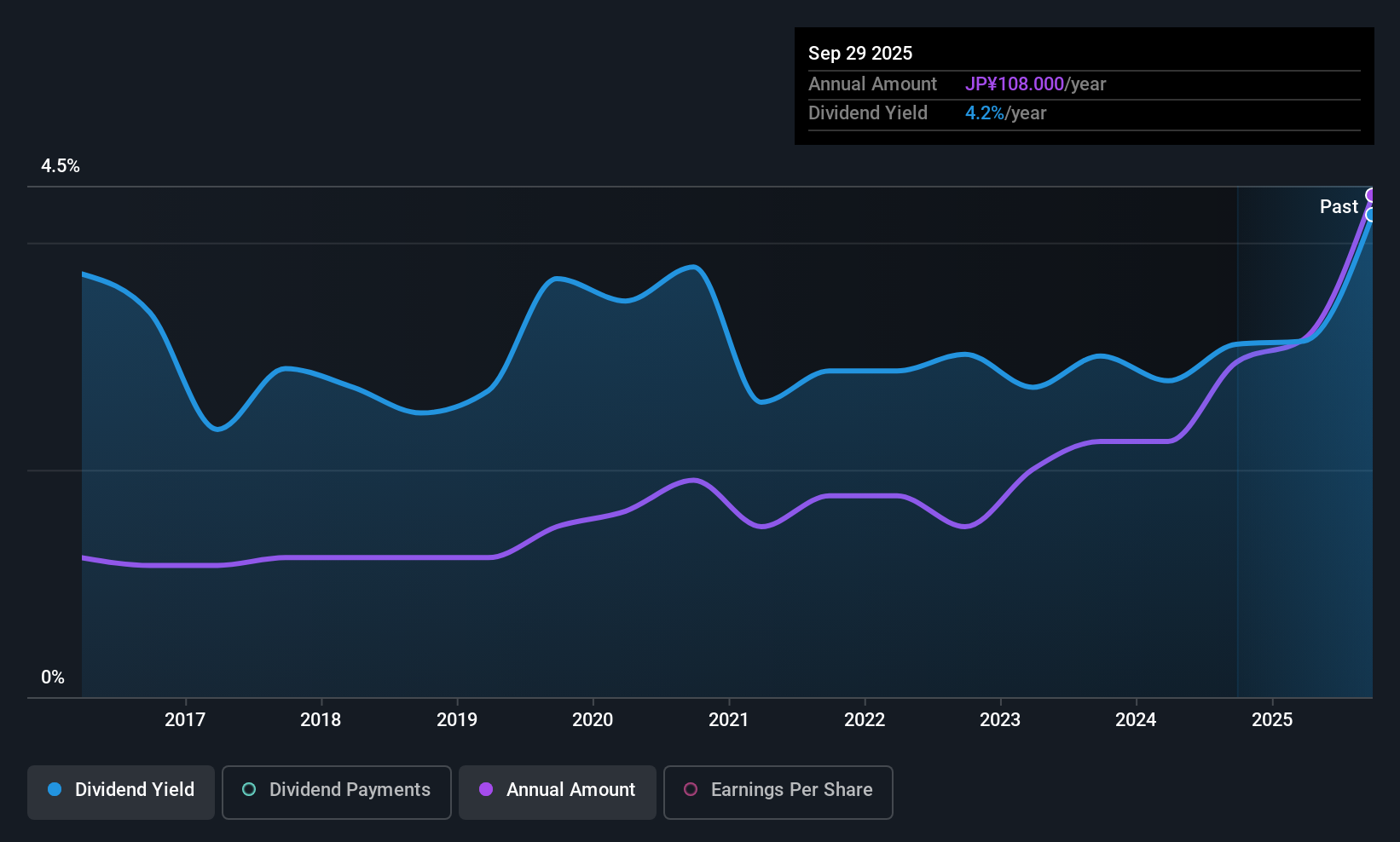

Dividend Yield: 3.7%

Daiichi Jitsugyo's dividends are well covered by earnings and cash flows, with payout ratios of 28.1% and 31.8%, respectively, despite a volatile dividend history over the past decade. The company's recent earnings growth of 17.3% supports its dividend sustainability. Trading significantly below its estimated fair value, Daiichi Jitsugyo offers a competitive yield in Japan's top quartile at 3.75%. Upcoming Q2 results on November 6 may provide further insights into its financial health.

- Click here and access our complete dividend analysis report to understand the dynamics of Daiichi Jitsugyo.

- Our valuation report unveils the possibility Daiichi Jitsugyo's shares may be trading at a discount.

Ton Yi Industrial (TWSE:9907)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ton Yi Industrial Corp. manufactures and sells tinplate and plastic packaging materials in Taiwan, Mainland China, and internationally, with a market cap of NT$31.35 billion.

Operations: Ton Yi Industrial Corp.'s revenue primarily comes from its operations in manufacturing and selling tinplate and plastic packaging materials across Taiwan, Mainland China, and international markets.

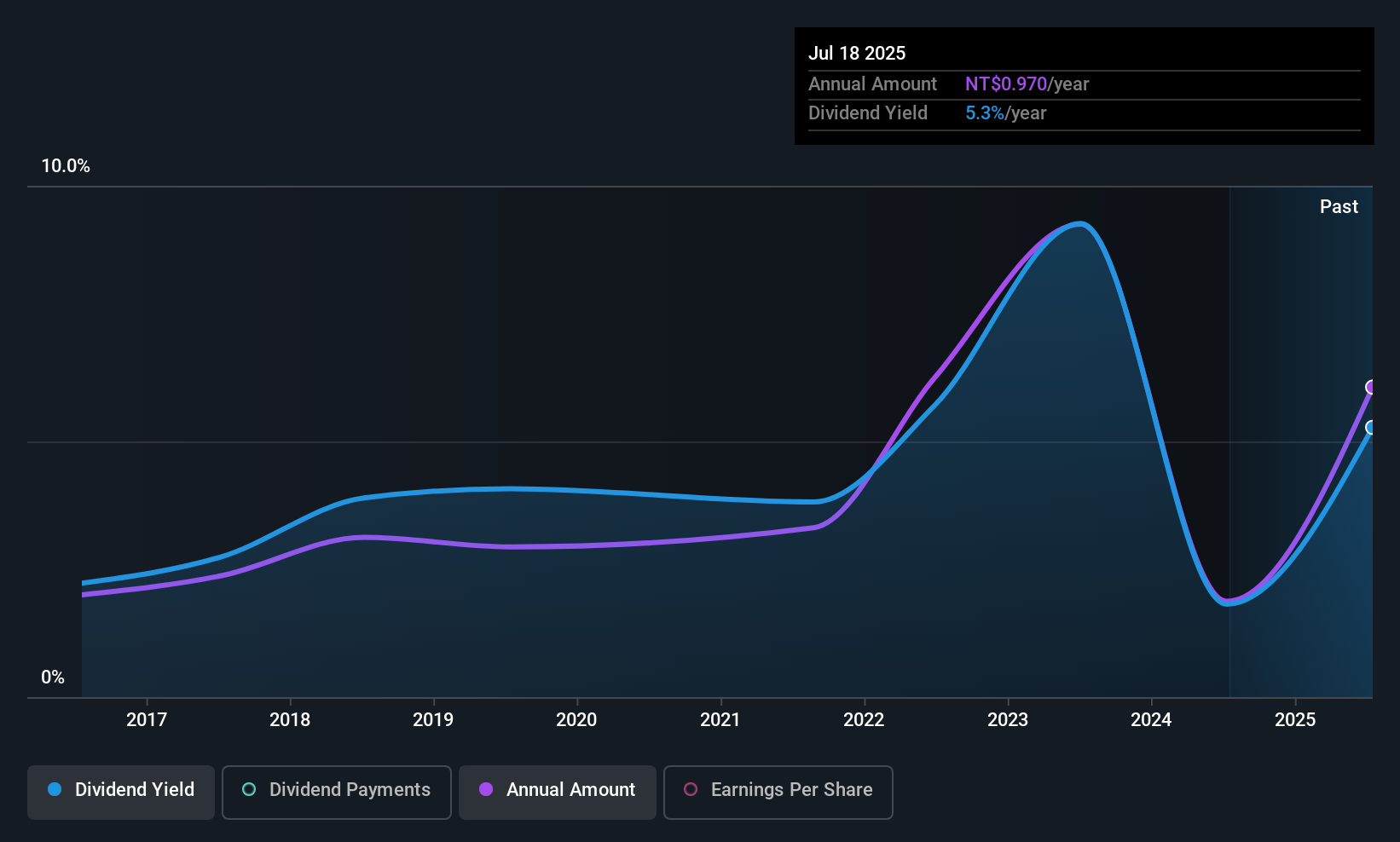

Dividend Yield: 4.9%

Ton Yi Industrial's dividends are reasonably covered by earnings and cash flows, with payout ratios of 70.8% and 39.9%, respectively, despite a history of volatility over the past decade. Recent earnings growth supports dividend sustainability, though its yield of 4.89% is below Taiwan's top quartile. The company trades at a significant discount to its estimated fair value, while recent Q3 results show improved net income at TWD 574.9 million compared to last year’s TWD 457.74 million.

- Unlock comprehensive insights into our analysis of Ton Yi Industrial stock in this dividend report.

- In light of our recent valuation report, it seems possible that Ton Yi Industrial is trading behind its estimated value.

Summing It All Up

- Get an in-depth perspective on all 1042 Top Asian Dividend Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ton Yi Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:9907

Ton Yi Industrial

Engages in the manufacturing and sale of tinplate and plastic packaging materials in Taiwan, Mainland China, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives