- Taiwan

- /

- Real Estate

- /

- TWSE:2539

Undiscovered Gems On None Exchange For November 2024

Reviewed by Simply Wall St

As global markets navigate the challenges of rising U.S. Treasury yields and tepid economic growth, small-cap stocks are feeling the pressure more acutely than their large-cap counterparts, with indices like the S&P 600 reflecting this strain. Despite these headwinds, opportunities remain for discerning investors to uncover lesser-known stocks that may offer potential value amidst broader market volatility. In such an environment, a good stock often exhibits strong fundamentals and resilience to macroeconomic shifts—qualities that can make it stand out as a hidden gem in today's complex financial landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Etihad Atheeb Telecommunication | NA | 26.82% | 62.18% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| United Wire Factories | NA | 4.86% | 0.19% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Zahrat Al Waha For Trading | 80.05% | 4.97% | -15.99% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Tung Ho Steel Enterprise (TWSE:2006)

Simply Wall St Value Rating: ★★★★★★

Overview: Tung Ho Steel Enterprise Corporation, along with its subsidiaries, is engaged in the production and sale of steel products in Taiwan and has a market capitalization of NT$55.79 billion.

Operations: The company generates revenue primarily from the sale of steel products. It navigates costs associated with production, which impact its financial performance. Notably, it has experienced fluctuations in its gross profit margin (%), reflecting changes in production efficiency and market conditions.

Tung Ho Steel, a smaller player in the steel industry, shows a mixed financial picture. Recent earnings for Q3 2024 were TWD 1,080 million, slightly down from TWD 1,163 million last year. Despite this dip, its net debt to equity ratio of 37% is satisfactory and interest payments are well covered with an EBIT coverage of 20x. The company trades at about 35% below estimated fair value and has positive free cash flow. However, earnings are forecasted to decline by around 4% annually over the next three years. These factors highlight both opportunities and challenges ahead for Tung Ho Steel.

- Navigate through the intricacies of Tung Ho Steel Enterprise with our comprehensive health report here.

Learn about Tung Ho Steel Enterprise's historical performance.

Goldsun Building Materials (TWSE:2504)

Simply Wall St Value Rating: ★★★★★★

Overview: Goldsun Building Materials Co., Ltd. operates in the production and sale of premixed concrete, cement, and calcium silicate board across Taiwan and Mainland China, with a market capitalization of NT$66.85 billion.

Operations: Goldsun Building Materials generates revenue primarily from its Taiwan ready-mixed business, contributing NT$18.51 billion, and the Ready-Mixed Cement Business in Mainland China, which adds NT$1.11 billion.

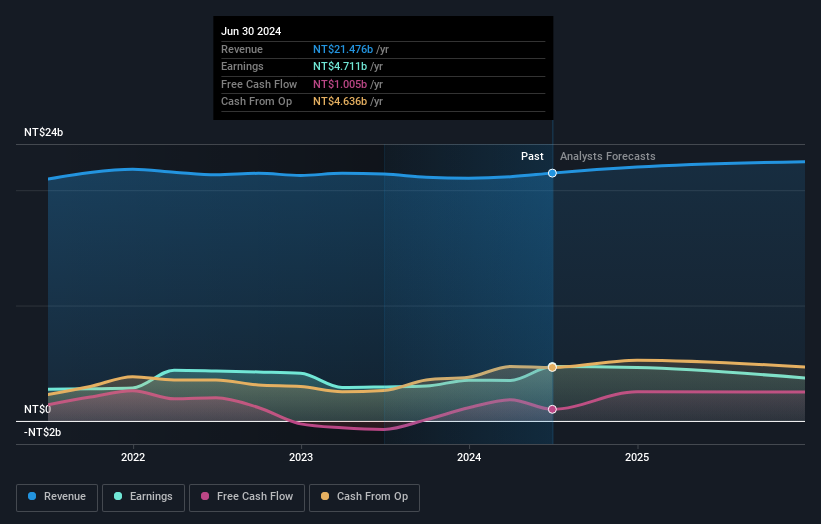

Goldsun Building Materials has shown impressive financial performance, with net income for the second quarter rising to TWD 1.96 billion from TWD 755 million a year earlier. Earnings per share also increased significantly, reaching TWD 1.66 compared to TWD 0.64 in the previous year. Despite these gains, future earnings are forecasted to decline by an average of 16% annually over the next three years, suggesting potential challenges ahead. The company's debt situation appears stable, with a reduced debt-to-equity ratio of 33.5% from five years ago and satisfactory interest coverage at 361 times EBIT, indicating strong financial health and resilience amidst industry fluctuations.

Sakura DevelopmentLtd (TWSE:2539)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sakura Development Co., Ltd specializes in the sale and lease of residential properties, primarily focusing on the Zhongzhangtou area in Taiwan, with a market capitalization of NT$52.10 billion.

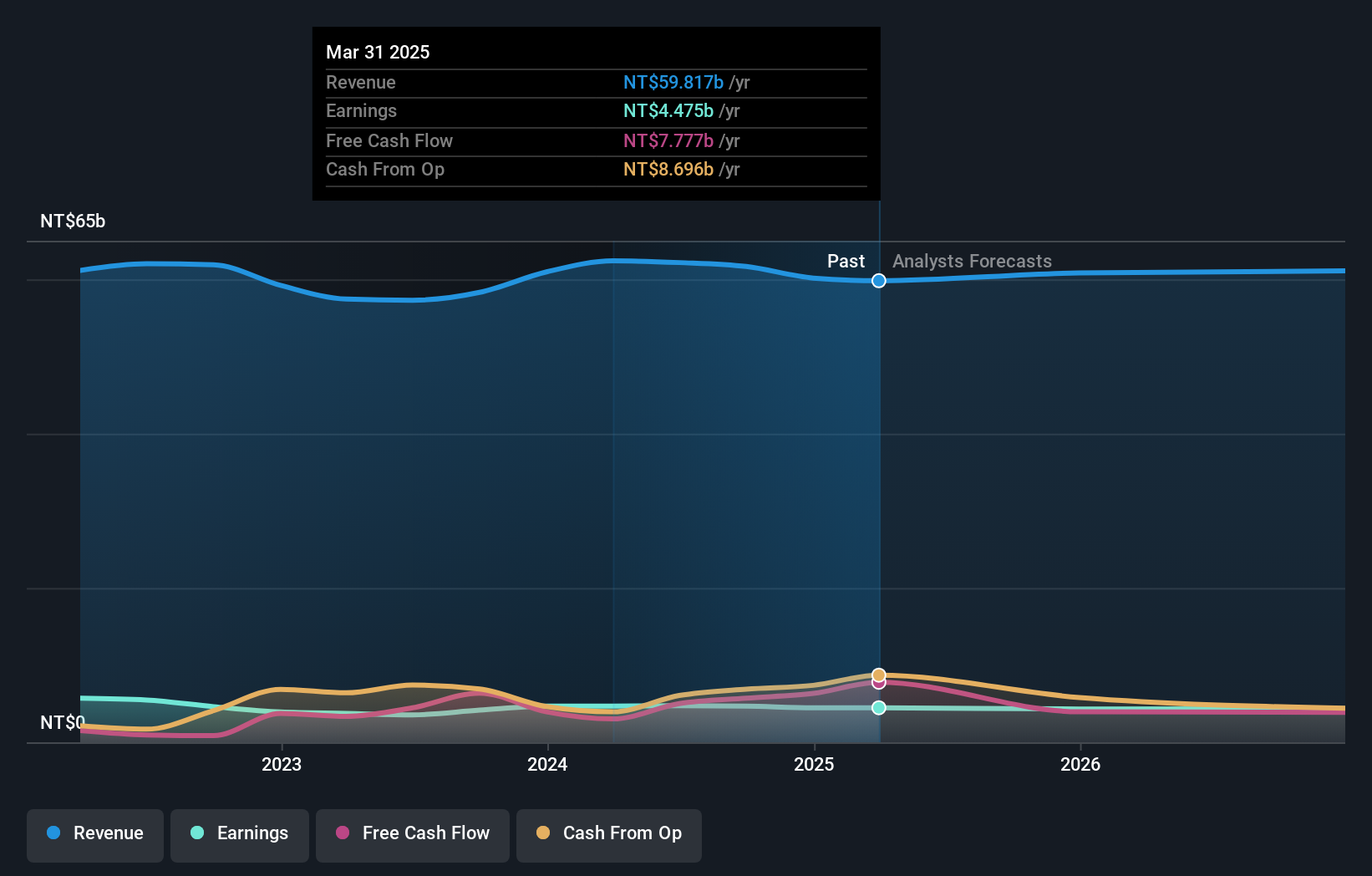

Operations: Sakura Development Ltd generates revenue primarily through the sale and lease of residential properties in Taiwan. The company's financial performance is influenced by its market activities in the Zhongzhangtou area, contributing to its market capitalization of NT$52.10 billion.

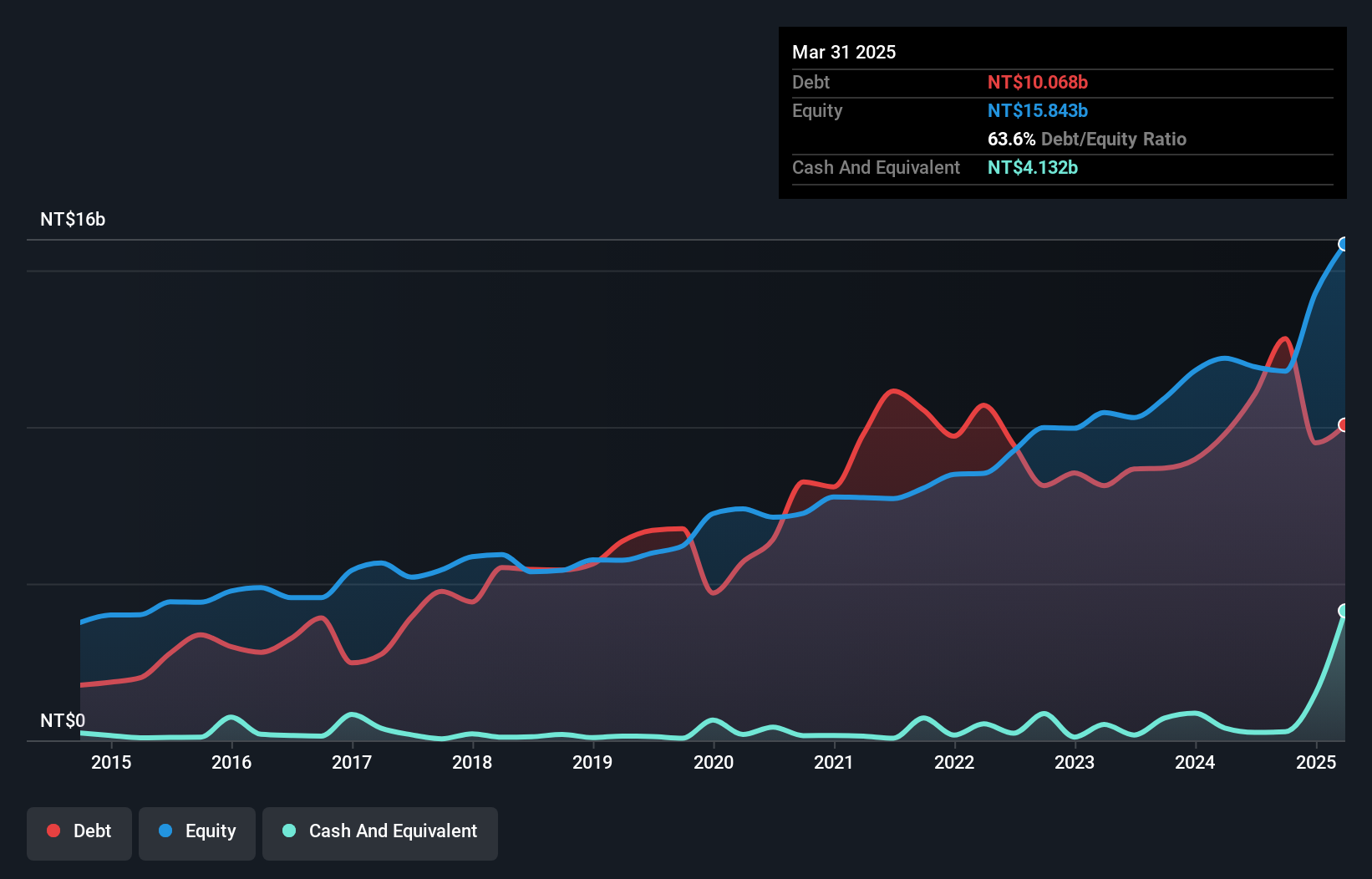

Sakura Development, a smaller player in the real estate sector, has shown impressive earnings growth of 68.4% over the past year, outpacing its industry peers. The company reported second-quarter sales of TWD 478.61 million, up from TWD 409.72 million last year, with net income swinging to TWD 67.41 million from a loss previously recorded. Despite reducing its debt to equity ratio from 112% to 92.7% over five years, it still holds a high net debt to equity ratio at 90.5%. High-quality earnings and sufficient interest coverage add confidence in its financial health moving forward.

- Click here to discover the nuances of Sakura DevelopmentLtd with our detailed analytical health report.

Evaluate Sakura DevelopmentLtd's historical performance by accessing our past performance report.

Make It Happen

- Click here to access our complete index of 4738 Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2539

Sakura DevelopmentLtd

Engages in the sale and lease of residential properties with focus on the Zhongzhangtou area in Taiwan.

Adequate balance sheet with acceptable track record.