In a week marked by busy earnings reports and mixed economic signals, global markets experienced some volatility, with major indices like the Nasdaq Composite and S&P MidCap 400 reaching record highs before retreating. Growth stocks lagged behind value shares due to cautious earnings from major tech companies, highlighting the importance of insider ownership in identifying resilient growth companies amid uncertain market conditions. In this context, companies with high insider ownership can be appealing as they often signal confidence from those closest to the business in its long-term potential.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 21.5% |

| Medley (TSE:4480) | 34% | 30.4% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Brightstar Resources (ASX:BTR) | 14.8% | 84.6% |

Here's a peek at a few of the choices from the screener.

Primeton Information Technologies (SHSE:688118)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Primeton Information Technologies, Inc. offers professional software foundation platforms and technical services in China with a market cap of CN¥2.28 billion.

Operations: The company's revenue segments include professional software foundation platforms and technical services in China.

Insider Ownership: 30.8%

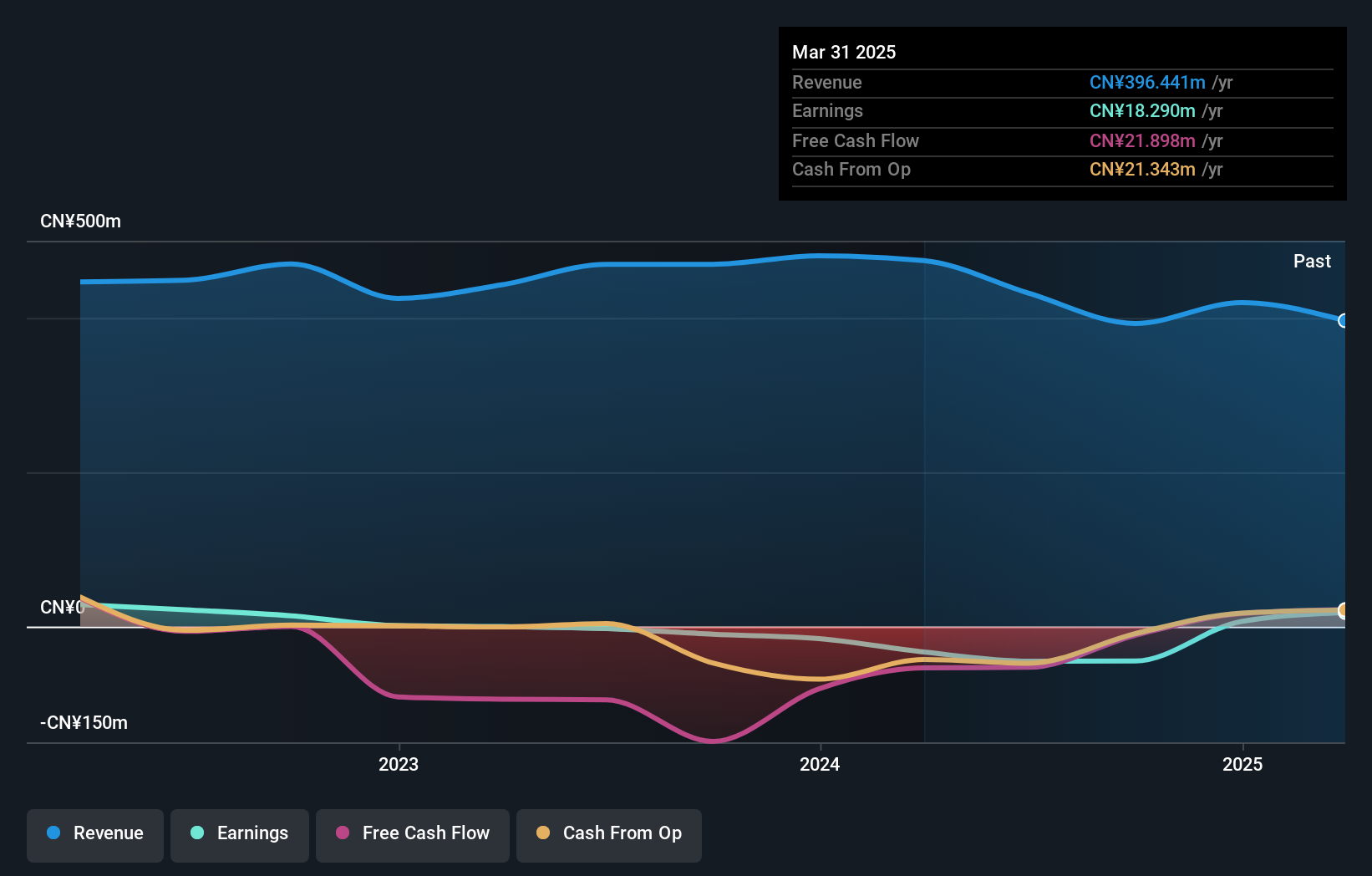

Primeton Information Technologies demonstrates potential as a growth company with high insider ownership, despite recent financial challenges. The company reported declining sales of CNY 205.27 million for the nine months ended September 2024 and a net loss of CNY 68.68 million, reflecting operational hurdles. However, analysts forecast revenue growth at 24.5% annually, surpassing market averages and projecting profitability within three years. Despite high share price volatility, no substantial insider trading activity was noted recently.

- Click here and access our complete growth analysis report to understand the dynamics of Primeton Information Technologies.

- In light of our recent valuation report, it seems possible that Primeton Information Technologies is trading beyond its estimated value.

DongGuan YuTong Optical TechnologyLtd (SZSE:300790)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DongGuan YuTong Optical Technology Ltd (SZSE:300790) specializes in the production and sale of optical components and has a market cap of CN¥5.61 billion.

Operations: Unfortunately, the provided Business operations text does not contain specific details about the revenue segments for DongGuan YuTong Optical Technology Ltd. Please provide the relevant revenue segment information so I can assist you further.

Insider Ownership: 36.8%

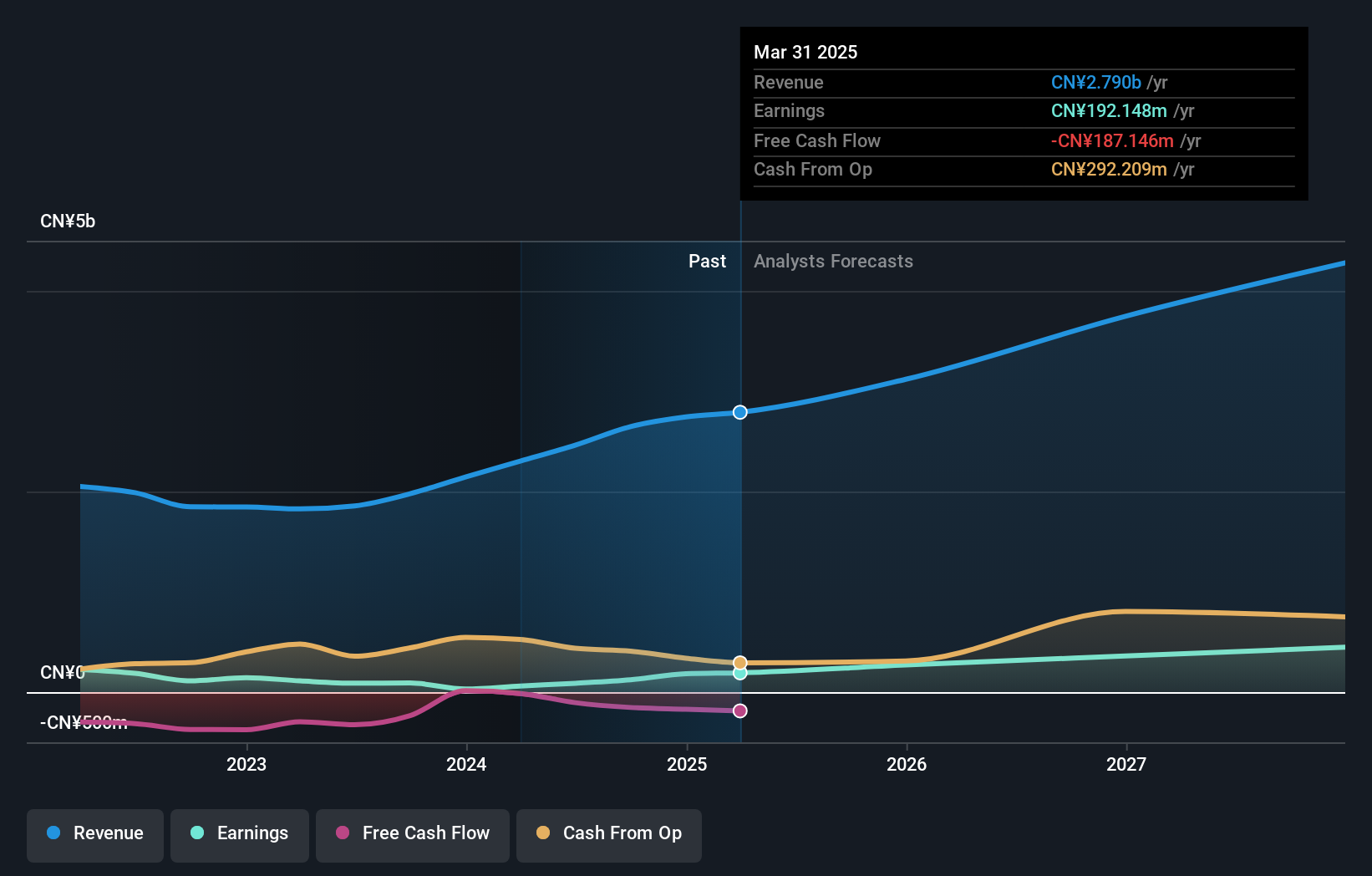

DongGuan YuTong Optical Technology Ltd. shows strong growth potential with high insider ownership, evidenced by a significant rise in net income to CNY 133.31 million for the nine months ended September 2024, up from CNY 41.48 million year-on-year. Despite its debt not being well-covered by operating cash flow, the company's earnings are forecast to grow significantly at 32.4% annually, outpacing the broader CN market's growth expectations of 26.1%.

- Dive into the specifics of DongGuan YuTong Optical TechnologyLtd here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that DongGuan YuTong Optical TechnologyLtd is priced higher than what may be justified by its financials.

Ta Chen Stainless Pipe (TWSE:2027)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ta Chen Stainless Pipe Co., Ltd. manufactures, processes, and sells stainless steel pipes, plates, fittings, and venetian blinds in Taiwan, the United States, China, and internationally with a market cap of NT$76.11 billion.

Operations: The company's revenue segments include NT$22.04 billion from the Screws and Nuts Segment, NT$21.79 billion from Aluminum Products Manufacturing, and NT$77.70 billion from the Stainless Steel and Aluminum Products Department.

Insider Ownership: 11.4%

Ta Chen Stainless Pipe's earnings are forecast to grow significantly at 55.6% annually, surpassing the TW market's 19.4%. Despite a recent decline in net income and sales for Q2 2024, the company remains attractive with a price-to-earnings ratio of 20.2x, below the TW market average of 21.5x. While revenue growth is expected to be modest at 12.4%, insider ownership could align management interests with shareholders despite an unstable dividend history.

- Delve into the full analysis future growth report here for a deeper understanding of Ta Chen Stainless Pipe.

- Our valuation report unveils the possibility Ta Chen Stainless Pipe's shares may be trading at a premium.

Turning Ideas Into Actions

- Get an in-depth perspective on all 1537 Fast Growing Companies With High Insider Ownership by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688118

Primeton Information Technologies

Provides professional software foundation platforms and technical services in China.

Flawless balance sheet with high growth potential.