Asia Polymer's (TWSE:1308) Shareholders Will Receive A Smaller Dividend Than Last Year

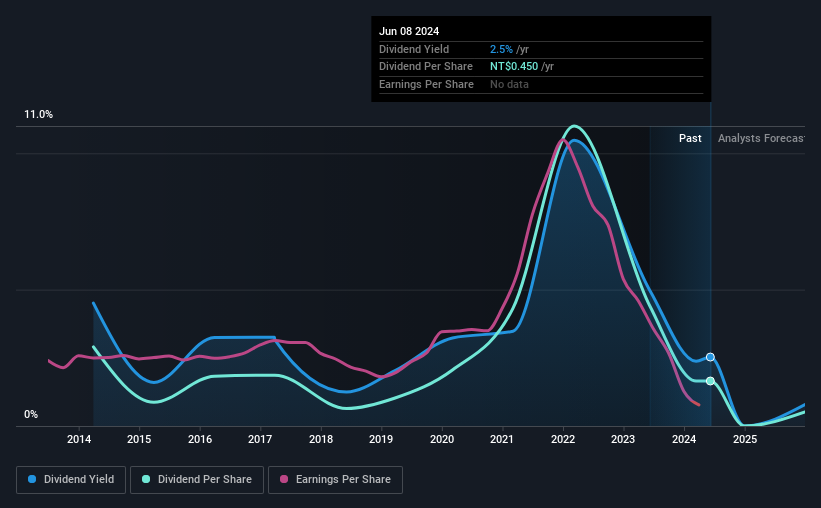

Asia Polymer Corporation (TWSE:1308) has announced that on 23rd of August, it will be paying a dividend ofNT$0.45, which a reduction from last year's comparable dividend. This payment takes the dividend yield to 2.5%, which only provides a modest boost to overall returns.

Check out our latest analysis for Asia Polymer

Asia Polymer's Distributions May Be Difficult To Sustain

Even a low dividend yield can be attractive if it is sustained for years on end. While Asia Polymer is not profitable, it is paying out less than 75% of its free cash flow, which means that there is plenty left over for reinvestment into the business. In general, cash flows are more important than the more traditional measures of profit so we feel pretty comfortable with the dividend at this level.

Looking forward, earnings per share is forecast to expand by 78.9% over the next year. While it is good to see income moving in the right direction, it still looks like the company won't achieve profitability. The healthy cash flows are definitely a good sign though, so we wouldn't panic just yet, especially with the earnings growing.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The annual payment during the last 10 years was NT$0.791 in 2014, and the most recent fiscal year payment was NT$0.45. Doing the maths, this is a decline of about 5.5% per year. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

Asia Polymer May Find It Hard To Grow The Dividend

Given that the track record hasn't been stellar, we really want to see earnings per share growing over time. Earnings per share has been crawling upwards at 4.3% per year. Earnings growth isn't particularly strong, and if the company isn't able to become profitable fairly soon, the dividend could come under pressure.

In Summary

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 1 warning sign for Asia Polymer that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:1308

Asia Polymer

Designs, develops, manufactures, and sells low density polyethylene (LDPE) and ethylene vinyl acetate copolymer (EVA) in Taiwan, Asia, and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives