Stock Analysis

Revenues Tell The Story For Formosa Plastics Corporation (TWSE:1301)

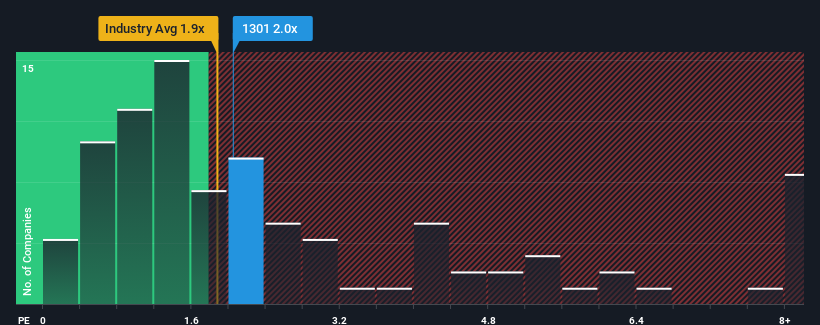

There wouldn't be many who think Formosa Plastics Corporation's (TWSE:1301) price-to-sales (or "P/S") ratio of 2x is worth a mention when the median P/S for the Chemicals industry in Taiwan is similar at about 1.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Formosa Plastics

What Does Formosa Plastics' Recent Performance Look Like?

Recent times haven't been great for Formosa Plastics as its revenue has been falling quicker than most other companies. One possibility is that the P/S is moderate because investors think the company's revenue trend will eventually fall in line with most others in the industry. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Want the full picture on analyst estimates for the company? Then our free report on Formosa Plastics will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Formosa Plastics?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Formosa Plastics' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 4.6% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 5.3% during the coming year according to the nine analysts following the company. That's shaping up to be similar to the 3.8% growth forecast for the broader industry.

With this information, we can see why Formosa Plastics is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Formosa Plastics' P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that Formosa Plastics maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Formosa Plastics you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're helping make it simple.

Find out whether Formosa Plastics is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:1301

Formosa Plastics

Manufactures and sells plastic raw materials, chemical fibers, and petrochemical products in Taiwan, Mainland China, and internationally.

Moderate growth potential with mediocre balance sheet.