Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Hai Kwang Enterprise Corporation (TPE:2038) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Hai Kwang Enterprise

How Much Debt Does Hai Kwang Enterprise Carry?

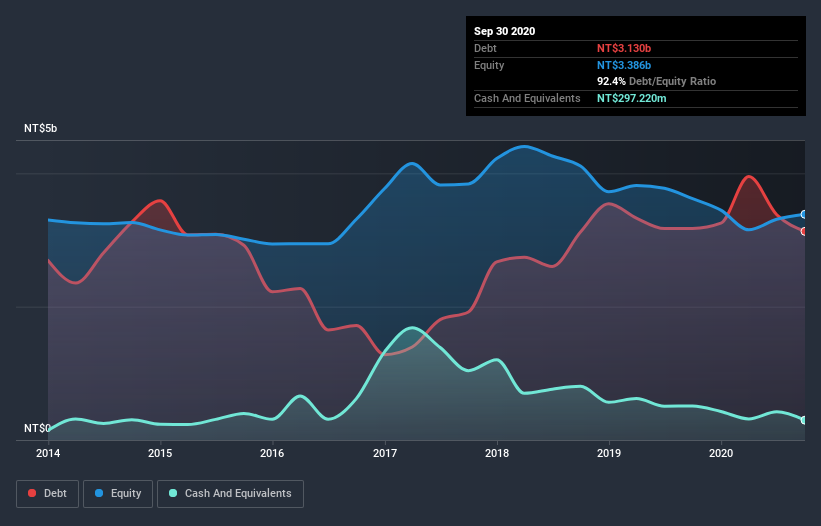

The chart below, which you can click on for greater detail, shows that Hai Kwang Enterprise had NT$3.13b in debt in September 2020; about the same as the year before. However, it also had NT$297.2m in cash, and so its net debt is NT$2.83b.

How Strong Is Hai Kwang Enterprise's Balance Sheet?

We can see from the most recent balance sheet that Hai Kwang Enterprise had liabilities of NT$2.73b falling due within a year, and liabilities of NT$1.57b due beyond that. Offsetting these obligations, it had cash of NT$297.2m as well as receivables valued at NT$447.1m due within 12 months. So it has liabilities totalling NT$3.55b more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's NT$2.98b market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Weak interest cover of 0.14 times and a disturbingly high net debt to EBITDA ratio of 13.7 hit our confidence in Hai Kwang Enterprise like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. One redeeming factor for Hai Kwang Enterprise is that it turned last year's EBIT loss into a gain of NT$3.8m, over the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Hai Kwang Enterprise will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. During the last year, Hai Kwang Enterprise burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

On the face of it, Hai Kwang Enterprise's interest cover left us tentative about the stock, and its conversion of EBIT to free cash flow was no more enticing than the one empty restaurant on the busiest night of the year. But at least its EBIT growth rate is not so bad. Taking into account all the aforementioned factors, it looks like Hai Kwang Enterprise has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 2 warning signs for Hai Kwang Enterprise you should be aware of, and 1 of them is a bit unpleasant.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade Hai Kwang Enterprise, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hai Kwang Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:2038

Hai Kwang Enterprise

Engages in the manufacturing and sales of billets and reinforcing steel bars in Taiwan.

Low risk with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives