- Taiwan

- /

- Metals and Mining

- /

- TWSE:2028

Are Wei Chih Steel IndustrialLtd's (TPE:2028) Statutory Earnings A Good Reflection Of Its Earnings Potential?

Statistically speaking, it is less risky to invest in profitable companies than in unprofitable ones. That said, the current statutory profit is not always a good guide to a company's underlying profitability. This article will consider whether Wei Chih Steel IndustrialLtd's (TPE:2028) statutory profits are a good guide to its underlying earnings.

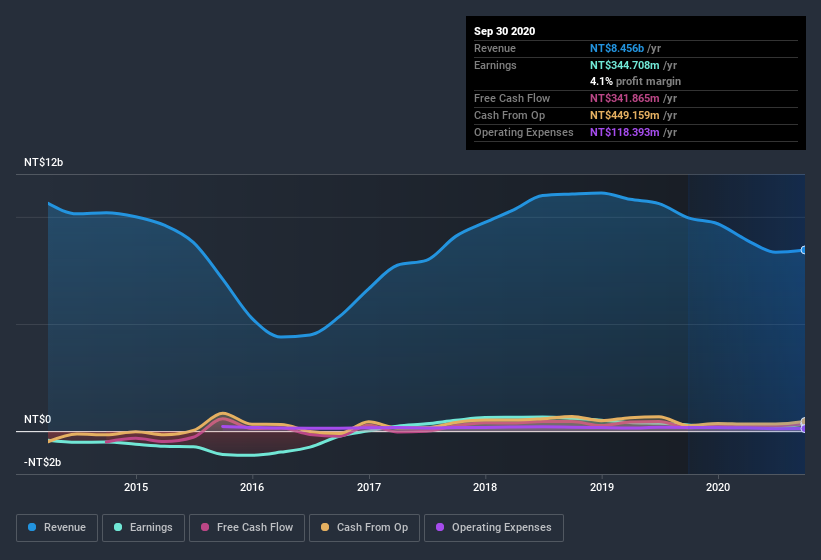

It's good to see that over the last twelve months Wei Chih Steel IndustrialLtd made a profit of NT$344.7m on revenue of NT$8.46b. Below, you can see that both its revenue and its profit have fallen over the last three years.

View our latest analysis for Wei Chih Steel IndustrialLtd

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. This article will focus on the impact unusual items have had on Wei Chih Steel IndustrialLtd's statutory earnings. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Wei Chih Steel IndustrialLtd.

How Do Unusual Items Influence Profit?

For anyone who wants to understand Wei Chih Steel IndustrialLtd's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit gained from NT$62m worth of unusual items. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And that's as you'd expect, given these boosts are described as 'unusual'. If Wei Chih Steel IndustrialLtd doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Our Take On Wei Chih Steel IndustrialLtd's Profit Performance

Arguably, Wei Chih Steel IndustrialLtd's statutory earnings have been distorted by unusual items boosting profit. Therefore, it seems possible to us that Wei Chih Steel IndustrialLtd's true underlying earnings power is actually less than its statutory profit. But at least holders can take some solace from the 19% EPS growth in the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. At Simply Wall St, we found 3 warning signs for Wei Chih Steel IndustrialLtd and we think they deserve your attention.

This note has only looked at a single factor that sheds light on the nature of Wei Chih Steel IndustrialLtd's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Wei Chih Steel IndustrialLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wei Chih Steel Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:2028

Wei Chih Steel Industrial

Wei Chih Steel Industrial Co., Ltd. processing, manufactures and sells steel products in Taiwan, Australia, and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives