Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Lucky Cement Corporation (TPE:1108) does use debt in its business. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Lucky Cement

What Is Lucky Cement's Net Debt?

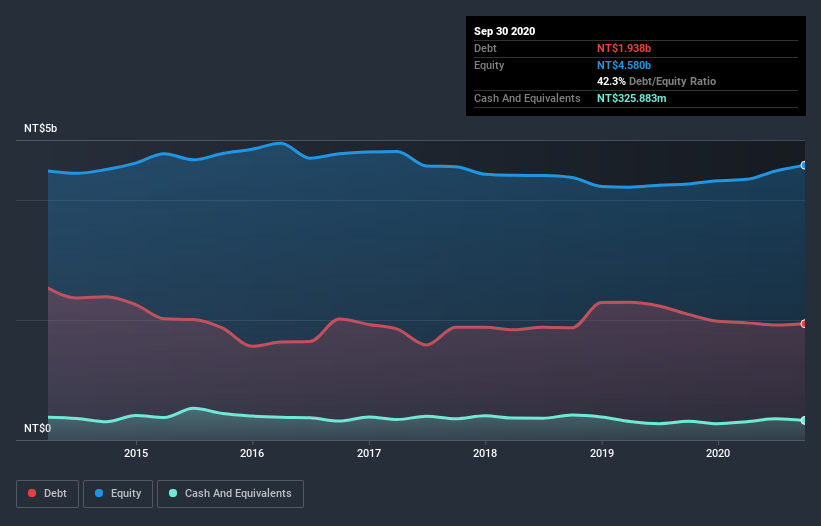

The image below, which you can click on for greater detail, shows that Lucky Cement had debt of NT$1.94b at the end of September 2020, a reduction from NT$2.09b over a year. However, it also had NT$325.9m in cash, and so its net debt is NT$1.61b.

A Look At Lucky Cement's Liabilities

We can see from the most recent balance sheet that Lucky Cement had liabilities of NT$1.98b falling due within a year, and liabilities of NT$1.32b due beyond that. On the other hand, it had cash of NT$325.9m and NT$1.09b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by NT$1.87b.

While this might seem like a lot, it is not so bad since Lucky Cement has a market capitalization of NT$5.04b, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Lucky Cement's net debt is 2.8 times its EBITDA, which is a significant but still reasonable amount of leverage. However, its interest coverage of 15.1 is very high, suggesting that the interest expense on the debt is currently quite low. Notably, Lucky Cement made a loss at the EBIT level, last year, but improved that to positive EBIT of NT$438m in the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But it is Lucky Cement's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. During the last year, Lucky Cement produced sturdy free cash flow equating to 54% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

When it comes to the balance sheet, the standout positive for Lucky Cement was the fact that it seems able to cover its interest expense with its EBIT confidently. However, our other observations weren't so heartening. For example, its net debt to EBITDA makes us a little nervous about its debt. Considering this range of data points, we think Lucky Cement is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 2 warning signs for Lucky Cement you should be aware of, and 1 of them shouldn't be ignored.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Lucky Cement, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1108

Lucky Cement

Manufactures and sells cement, stone, and other cement-related products in the People’s Republic of China.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives