- Taiwan

- /

- Metals and Mining

- /

- TPEX:4538

WINSON Machinery's (GTSM:4538) Returns On Capital Tell Us There Is Reason To Feel Uneasy

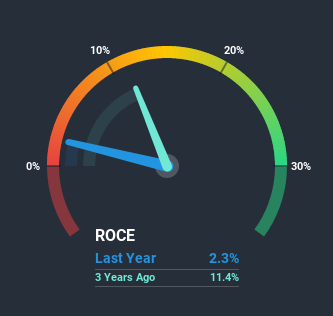

What underlying fundamental trends can indicate that a company might be in decline? More often than not, we'll see a declining return on capital employed (ROCE) and a declining amount of capital employed. Ultimately this means that the company is earning less per dollar invested and on top of that, it's shrinking its base of capital employed. So after glancing at the trends within WINSON Machinery (GTSM:4538), we weren't too hopeful.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for WINSON Machinery, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.023 = NT$16m ÷ (NT$751m - NT$55m) (Based on the trailing twelve months to December 2020).

Thus, WINSON Machinery has an ROCE of 2.3%. In absolute terms, that's a low return and it also under-performs the Metals and Mining industry average of 4.2%.

See our latest analysis for WINSON Machinery

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you'd like to look at how WINSON Machinery has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

What The Trend Of ROCE Can Tell Us

We are a bit worried about the trend of returns on capital at WINSON Machinery. Unfortunately the returns on capital have diminished from the 5.3% that they were earning five years ago. On top of that, it's worth noting that the amount of capital employed within the business has remained relatively steady. Companies that exhibit these attributes tend to not be shrinking, but they can be mature and facing pressure on their margins from competition. If these trends continue, we wouldn't expect WINSON Machinery to turn into a multi-bagger.

The Bottom Line

In summary, it's unfortunate that WINSON Machinery is generating lower returns from the same amount of capital. Yet despite these concerning fundamentals, the stock has performed strongly with a 68% return over the last five years, so investors appear very optimistic. Regardless, we don't feel too comfortable with the fundamentals so we'd be steering clear of this stock for now.

If you want to continue researching WINSON Machinery, you might be interested to know about the 1 warning sign that our analysis has discovered.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

If you’re looking to trade WINSON Machinery, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if WINSON Machinery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:4538

WINSON Machinery

Manufactures and sells machine tool, wind power, ductile iron, and grey iron castings in Taiwan.

Excellent balance sheet with low risk.

Market Insights

Community Narratives