Uncovering None And 2 Other Hidden Gems With Strong Potential

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating consumer confidence and mixed economic indicators, small-cap stocks continue to present intriguing opportunities for investors. Despite recent challenges, such as declining durable goods orders and shifting unemployment dynamics, the S&P 600's performance hints at potential within this segment. In the current market environment, identifying promising stocks often involves looking beyond immediate headlines to uncover companies with solid fundamentals and unique growth drivers that might not yet be fully recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Hong Ho Precision TextileLtd | 7.48% | 36.01% | 84.13% | ★★★★★★ |

| Cresco | 6.62% | 8.15% | 9.94% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| AOKI Holdings | 30.67% | 2.30% | 45.17% | ★★★★★☆ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| GENOVA | 0.65% | 29.95% | 29.18% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Loadstar Capital K.K | 259.54% | 16.85% | 21.57% | ★★★★☆☆ |

| Nippon Sharyo | 60.16% | -1.87% | -14.86% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Neurones (ENXTPA:NRO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Neurones S.A. is an IT services company offering infrastructure, application, and consulting services both in France and internationally with a market capitalization of €1.07 billion.

Operations: Neurones generates revenue primarily from infrastructure services (€483.86 million), application services (€236.52 million), and consulting (€54.53 million).

Neurones, a player in the tech sector, has shown resilience with its earnings growing by 1.8% over the past year, outperforming the IT industry's -4%. Despite a slight rise in its debt to equity ratio from 0% to 2.8% over five years, it comfortably covers interest payments and maintains more cash than total debt. The company is free cash flow positive with recent figures at €42.92 million as of June 2024. With high-quality earnings and active participation in industry forums like CIC Market Solutions Forum, Neurones seems poised for continued relevance within its niche market space.

- Click to explore a detailed breakdown of our findings in Neurones' health report.

Assess Neurones' past performance with our detailed historical performance reports.

Gofore Oyj (HLSE:GOFORE)

Simply Wall St Value Rating: ★★★★★★

Overview: Gofore Oyj offers digital transformation consultancy services to both private and public sectors in Finland and internationally, with a market capitalization of €352.01 million.

Operations: Gofore Oyj generates revenue primarily from its computer services segment, amounting to €188.05 million.

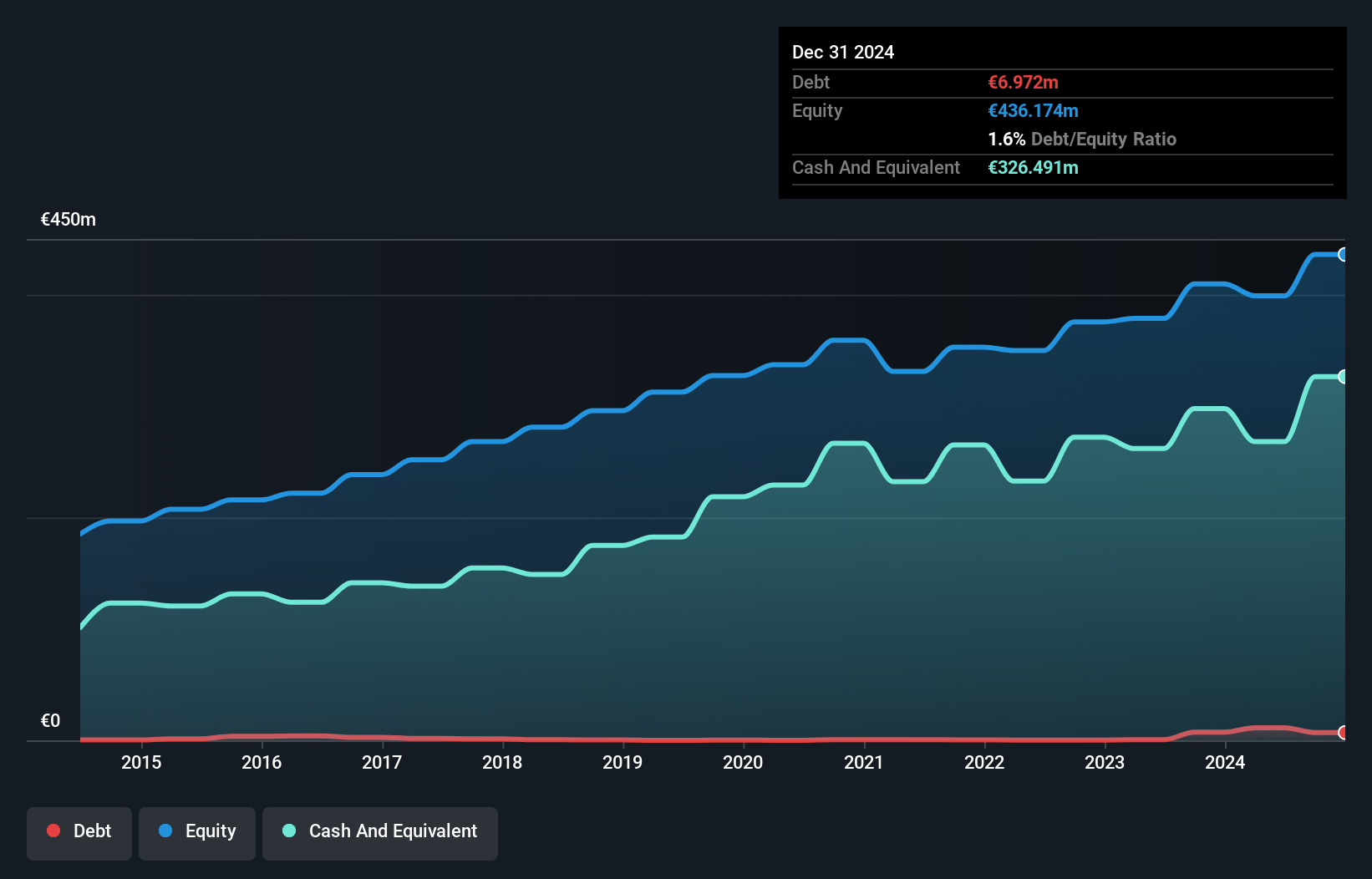

Gofore, a nimble player in the IT sector, is trading at 21.2% below its estimated fair value, showcasing potential for savvy investors. Over the past year, earnings surged by 20.3%, outpacing the industry average of 0.09%, while its debt-to-equity ratio improved from 18.6% to 10% over five years, indicating prudent financial management. Recent leadership changes might influence future strategies as Elja Kirjavainen takes charge of Finnish operations amidst steady executive shifts. Despite a slight dip in third-quarter sales to €39 million from €41 million last year, net income rose to €3.3 million from €2.48 million, reflecting robust profitability and high-quality earnings amidst evolving market dynamics.

- Click here to discover the nuances of Gofore Oyj with our detailed analytical health report.

Gain insights into Gofore Oyj's past trends and performance with our Past report.

Farglory Life Insurance (TPEX:5859)

Simply Wall St Value Rating: ★★★★★☆

Overview: Farglory Life Insurance Co., Ltd. offers a range of insurance products and services in Taiwan and has a market capitalization of approximately NT$22.64 billion.

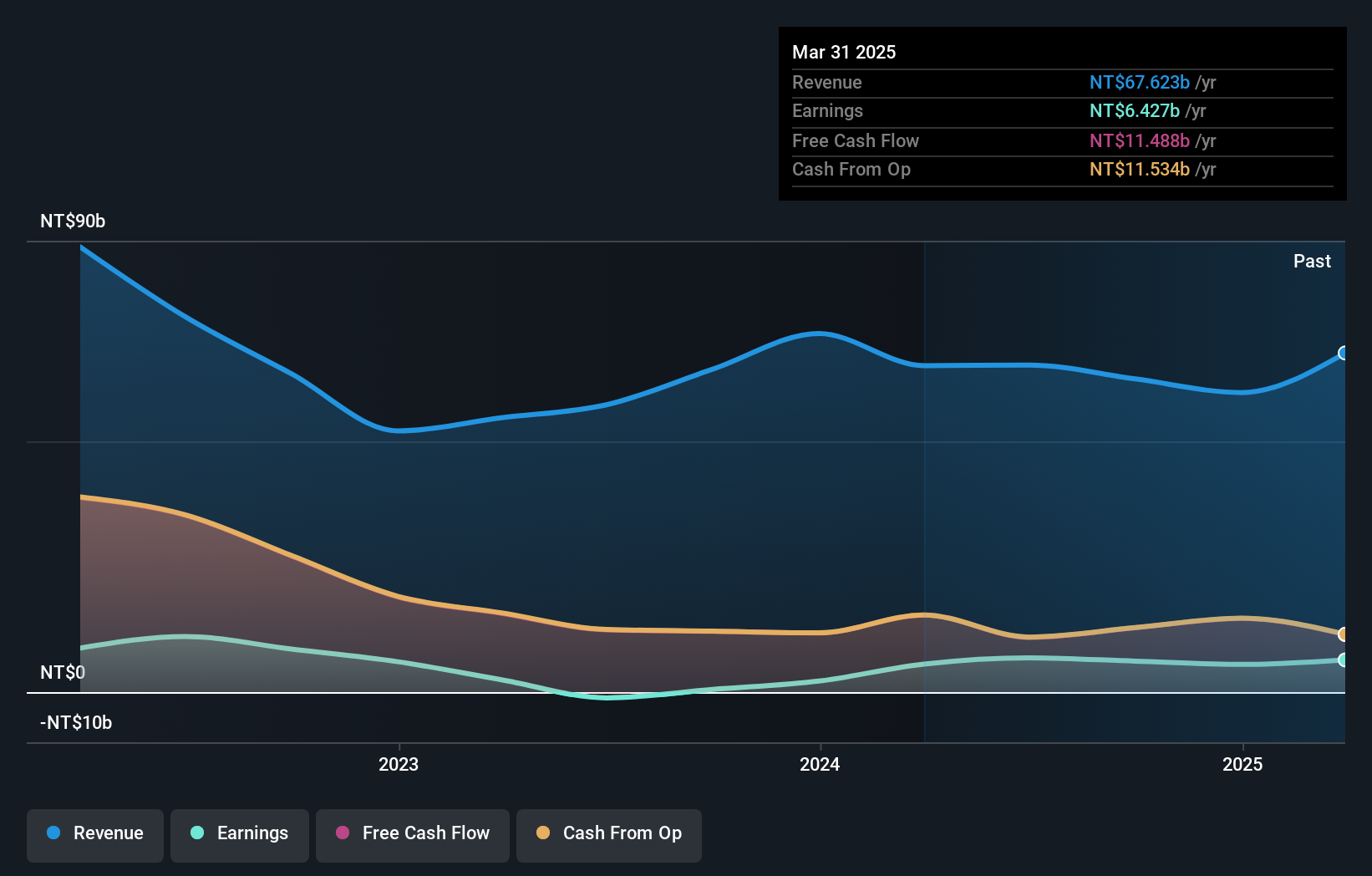

Operations: The primary revenue stream for Farglory Life Insurance comes from its life and health insurance segment, generating NT$65.21 billion. The company's market capitalization is approximately NT$22.64 billion.

Farglory Life Insurance, a smaller player in the insurance sector, has recently turned profitable, making it challenging to compare its growth with the industry's 79.3%. Trading at 84.5% below its estimated fair value indicates potential undervaluation. The company is debt-free and showcases high-quality earnings, suggesting a solid financial foundation. Its free cash flow remains positive, with recent figures showing A$11.76 million as of December 2023 and consistent capital expenditures around A$42 thousand during the same period. This financial health positions Farglory well for future opportunities while highlighting its resilience in a competitive industry landscape.

Seize The Opportunity

- Explore the 4644 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:GOFORE

Gofore Oyj

Provides digital transformation consultancy services for private and public sectors in Finland and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)