- Taiwan

- /

- Medical Equipment

- /

- TPEX:6572

PlexBio (GTSM:6572) Shareholders Have Enjoyed A 11% Share Price Gain

It hasn't been the best quarter for PlexBio Co., Ltd. (GTSM:6572) shareholders, since the share price has fallen 20% in that time. But at least the stock is up over the last year. In that time, it is up 11%, which isn't bad, but is below the market return of 39%.

View our latest analysis for PlexBio

PlexBio wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year PlexBio saw its revenue shrink by 21%. The lacklustre gain of 11% over twelve months, is not a bad result given the falling revenue. Generally we're pretty unenthusiastic about loss making stocks that are not growing revenue.

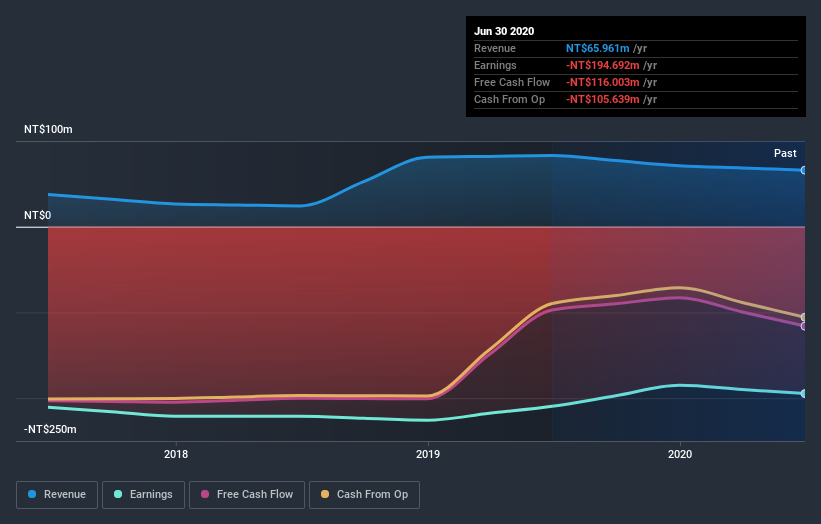

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at PlexBio's financial health with this free report on its balance sheet.

A Different Perspective

PlexBio shareholders are up 11% for the year. Unfortunately this falls short of the market return of around 39%. On the other hand, the TSR over three years was worse, at just 2.6% per year. This suggests the company's position is improving. If the business can justify the share price gain with improving fundamental data, then there could be more gains to come. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 5 warning signs for PlexBio you should be aware of, and 1 of them shouldn't be ignored.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade PlexBio, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6572

PlexBio

Develops and manufactures in vitro diagnostic reagents for molecular biology and immunology projects.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives