- Taiwan

- /

- Medical Equipment

- /

- TPEX:4163

INTAI Technology Corporation (GTSM:4163) On An Uptrend: Could Fundamentals Be Driving The Stock?

INTAI Technology's (GTSM:4163) stock is up by 5.0% over the past week. As most would know, long-term fundamentals have a strong correlation with market price movements, so we decided to look at the company's key financial indicators today to determine if they have any role to play in the recent price movement. Particularly, we will be paying attention to INTAI Technology's ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for INTAI Technology

How Do You Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for INTAI Technology is:

14% = NT$254m ÷ NT$1.9b (Based on the trailing twelve months to September 2020).

The 'return' refers to a company's earnings over the last year. That means that for every NT$1 worth of shareholders' equity, the company generated NT$0.14 in profit.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

INTAI Technology's Earnings Growth And 14% ROE

To begin with, INTAI Technology seems to have a respectable ROE. And on comparing with the industry, we found that the the average industry ROE is similar at 11%. However, we are curious as to how INTAI Technology's decent returns still resulted in flat growth for INTAI Technology in the past five years. So, there could be some other aspects that could potentially be preventing the company from growing. Such as, the company pays out a huge portion of its earnings as dividends, or is faced with competitive pressures.

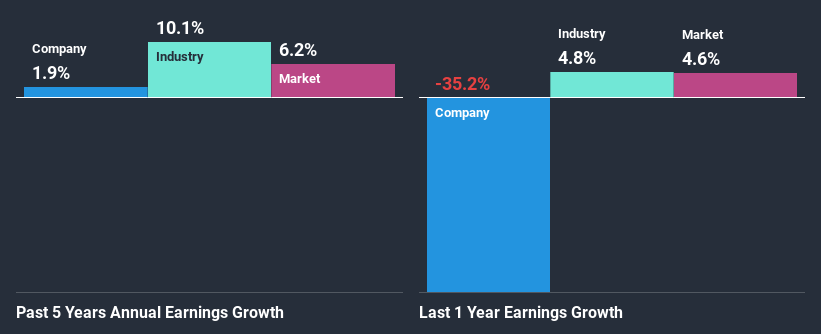

As a next step, we compared INTAI Technology's net income growth with the industry and were disappointed to see that the company's growth is lower than the industry average growth of 10% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about INTAI Technology's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is INTAI Technology Efficiently Re-investing Its Profits?

The high three-year median payout ratio of 55% (meaning, the company retains only 45% of profits) for INTAI Technology suggests that the company's earnings growth was miniscule as a result of paying out a majority of its earnings.

Moreover, INTAI Technology has been paying dividends for nine years, which is a considerable amount of time, suggesting that management must have perceived that the shareholders prefer dividends over earnings growth.

Conclusion

In total, it does look like INTAI Technology has some positive aspects to its business. Yet, the low earnings growth is a bit concerning, especially given that the company has a high rate of return. Investors could have benefitted from the high ROE, had the company been reinvesting more of its earnings. As discussed earlier, the company is retaining a small portion of its profits. Up till now, we've only made a short study of the company's growth data. To gain further insights into INTAI Technology's past profit growth, check out this visualization of past earnings, revenue and cash flows.

If you decide to trade INTAI Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:4163

INTAI Technology

Offers a range of products for the automotive, aerospace, precision hardware, medical device, and electronic communication industries in Taiwan and internationally.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives