- Taiwan

- /

- Hospitality

- /

- TWSE:2722

Chateau International Development Co., Ltd.'s (TWSE:2722) Stock Has Shown Weakness Lately But Financial Prospects Look Decent: Is The Market Wrong?

Chateau International Development (TWSE:2722) has had a rough three months with its share price down 18%. However, stock prices are usually driven by a company’s financials over the long term, which in this case look pretty respectable. In this article, we decided to focus on Chateau International Development's ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

See our latest analysis for Chateau International Development

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Chateau International Development is:

3.2% = NT$73m ÷ NT$2.3b (Based on the trailing twelve months to March 2024).

The 'return' is the yearly profit. One way to conceptualize this is that for each NT$1 of shareholders' capital it has, the company made NT$0.03 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Chateau International Development's Earnings Growth And 3.2% ROE

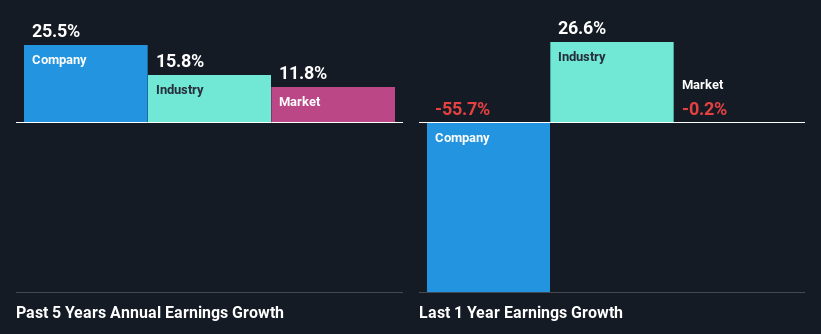

When you first look at it, Chateau International Development's ROE doesn't look that attractive. Next, when compared to the average industry ROE of 17%, the company's ROE leaves us feeling even less enthusiastic. In spite of this, Chateau International Development was able to grow its net income considerably, at a rate of 26% in the last five years. We reckon that there could be other factors at play here. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

As a next step, we compared Chateau International Development's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 16%.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Chateau International Development is trading on a high P/E or a low P/E, relative to its industry.

Is Chateau International Development Using Its Retained Earnings Effectively?

Chateau International Development has a three-year median payout ratio of 43% (where it is retaining 57% of its income) which is not too low or not too high. So it seems that Chateau International Development is reinvesting efficiently in a way that it sees impressive growth in its earnings (discussed above) and pays a dividend that's well covered.

Moreover, Chateau International Development is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years.

Summary

In total, it does look like Chateau International Development has some positive aspects to its business. Even in spite of the low rate of return, the company has posted impressive earnings growth as a result of reinvesting heavily into its business. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. You can see the 3 risks we have identified for Chateau International Development by visiting our risks dashboard for free on our platform here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2722

Chateau International Development

Chateau International Development Co., Ltd.

Flawless balance sheet very low.