- Taiwan

- /

- Semiconductors

- /

- TWSE:6515

Insider-Favored Growth Companies To Watch In June 2024

Reviewed by Simply Wall St

As global markets navigate through a landscape marked by rising inflation and fluctuating benchmarks, investors are keenly watching insider-favored growth companies. These entities, often characterized by high insider ownership, can offer unique resilience and alignment of interests in uncertain economic times.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Gaming Innovation Group (OB:GIG) | 22.1% | 36.2% |

| Elliptic Laboratories (OB:ELABS) | 31.6% | 124.6% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 53% |

| EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

| La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.7% |

| HANA Micron (KOSDAQ:A067310) | 19.8% | 76.8% |

| Vow (OB:VOW) | 31.8% | 97.6% |

| Adocia (ENXTPA:ADOC) | 12.4% | 104.5% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 24.9% | 79.3% |

We're going to check out a few of the best picks from our screener tool.

Cury Construtora e Incorporadora (BOVESPA:CURY3)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cury Construtora e Incorporadora S.A. is a company engaged in real estate operations, with a market capitalization of approximately R$5.72 billion.

Operations: The company generates its revenue primarily from real estate development, totaling R$3.13 billion.

Insider Ownership: 22%

Revenue Growth Forecast: 16.8% p.a.

Cury Construtora e Incorporadora has demonstrated robust growth, with its earnings increasing from BRL 329.89 million in 2023 to BRL 481.77 million in the following year, reflecting a strong upward trajectory. This performance is supported by a significant rise in sales, from BRL 580.5 million to BRL 811.6 million over the same period. Analysts expect Cury's revenue and earnings to continue outpacing the Brazilian market average, though its dividend record remains unstable. Additionally, insider ownership trends and trading data were not specified for recent months, leaving some uncertainty about insider confidence levels moving forward.

- Take a closer look at Cury Construtora e Incorporadora's potential here in our earnings growth report.

- The analysis detailed in our Cury Construtora e Incorporadora valuation report hints at an inflated share price compared to its estimated value.

WinWay Technology (TWSE:6515)

Simply Wall St Growth Rating: ★★★★★☆

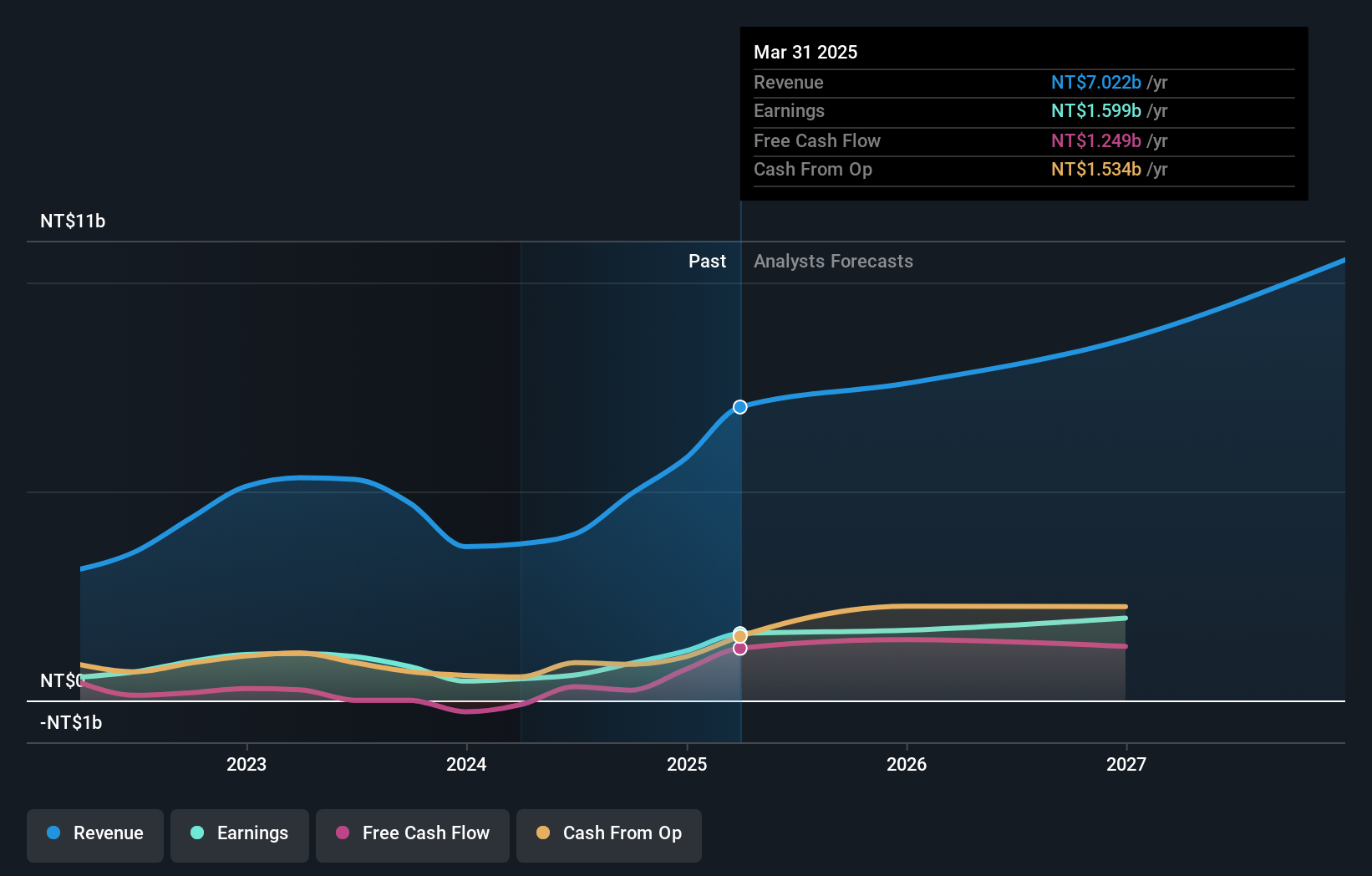

Overview: WinWay Technology Co., Ltd. operates in the design, manufacture, and sale of optoelectronic product test fixtures, integrated circuit test interfaces, and related components across Taiwan, the United States, China, Europe, Canada, and Asia with a market cap of NT$30.46 billion.

Operations: The company generates revenue primarily from the manufacture and sales of photoelectric product testing tools, totaling NT$3.75 billion.

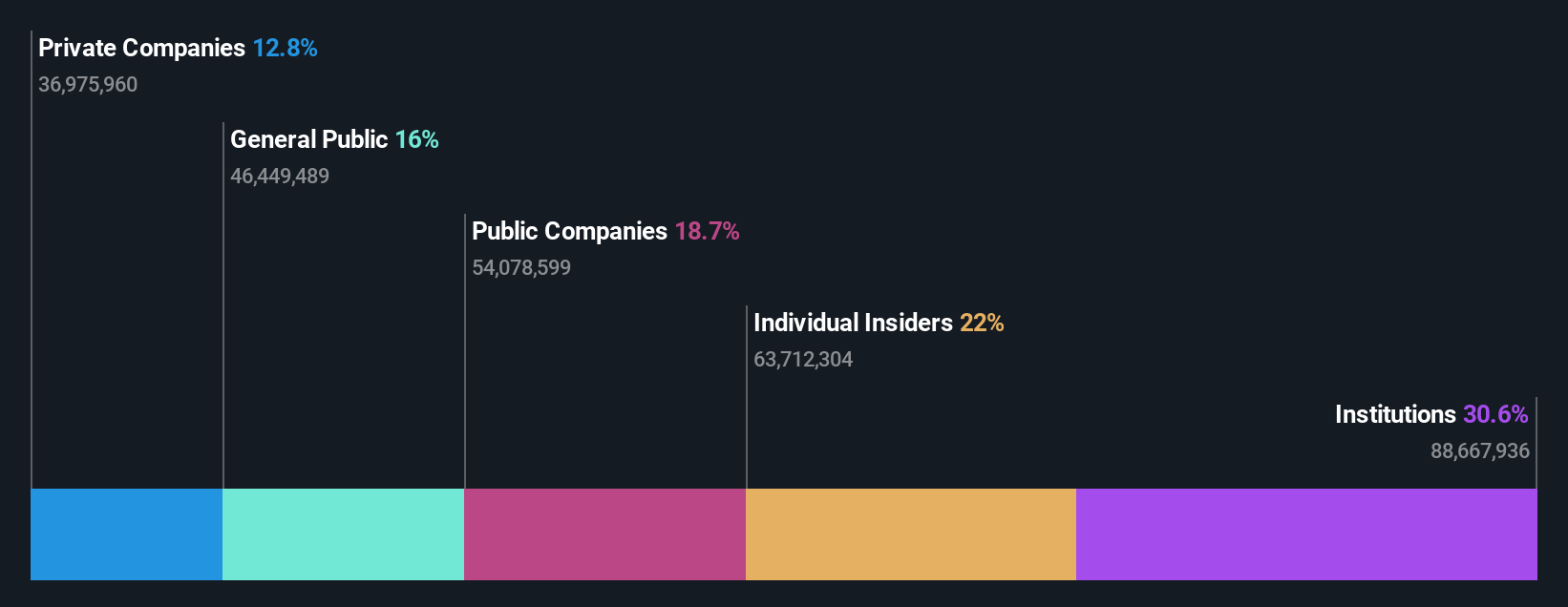

Insider Ownership: 22.9%

Revenue Growth Forecast: 26.4% p.a.

WinWay Technology has shown promising growth with a reported 44.84% forecast in annual earnings growth, outpacing the Taiwan market average significantly. Despite a highly volatile share price recently, the company's revenue is also expected to grow at 26.4% annually, exceeding the market norm of 11.3%. However, profit margins have declined from last year's 21.1% to 13.9%. Recent activities include strong Q1 performance and upcoming shareholder meetings to discuss amendments to corporate bylaws.

- Click to explore a detailed breakdown of our findings in WinWay Technology's earnings growth report.

- In light of our recent valuation report, it seems possible that WinWay Technology is trading beyond its estimated value.

Merida Industry (TWSE:9914)

Simply Wall St Growth Rating: ★★★★☆☆

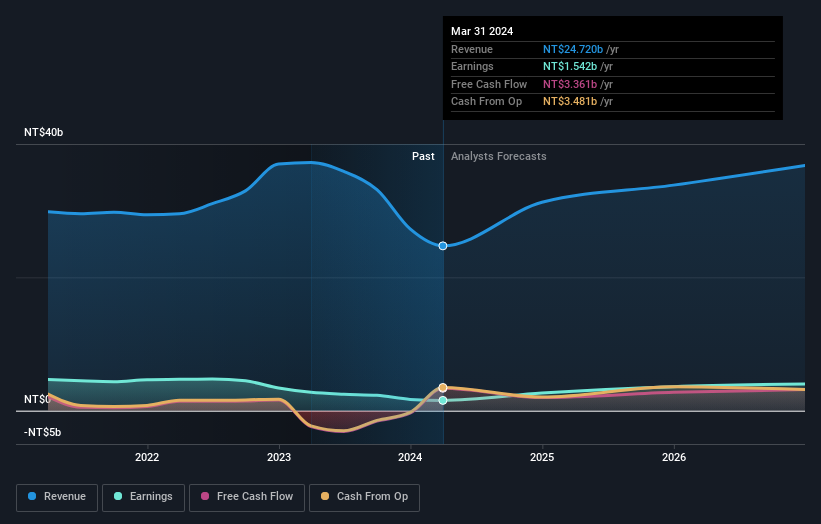

Overview: Merida Industry Co., Ltd. is a Taiwan-based company that manufactures and sells bicycles and components across regions including Taiwan, China, Hong Kong, Europe, and the United States, with a market capitalization of NT$70.71 billion.

Operations: The firm generates its revenue by manufacturing and selling bicycles and components across Taiwan, China, Hong Kong, Europe, and the United States.

Insider Ownership: 26.8%

Revenue Growth Forecast: 12.7% p.a.

Merida Industry has experienced a notable decrease in sales and net income as reported in its recent Q1 2024 results, with sales dropping to TWD 5.85 billion from TWD 8.39 billion year-over-year. Despite this downturn, earnings are expected to grow by a significant 32.72% annually over the next three years, outpacing the Taiwan market's average. However, its dividend coverage is weak, and it faces challenges with a low forecast return on equity of 15.5%. Additionally, Merida was recently delisted from OTC Equity due to being an inactive security.

- Click here to discover the nuances of Merida Industry with our detailed analytical future growth report.

- Our valuation report here indicates Merida Industry may be overvalued.

Seize The Opportunity

- Explore the 1470 names from our Fast Growing Companies With High Insider Ownership screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if WinWay Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6515

WinWay Technology

Designs, processes, and sells optoelectronic product test fixtures, integrated circuit test interfaces, and fixtures and their components in Taiwan, the Americas, China, Asia, Europe, and Canada.

High growth potential with excellent balance sheet.