Bonny Worldwide's (TWSE:8467) three-year earnings growth trails the massive shareholder returns

For us, stock picking is in large part the hunt for the truly magnificent stocks. You won't get it right every time, but when you do, the returns can be truly splendid. For example, the Bonny Worldwide Limited (TWSE:8467) share price is up a whopping 503% in the last three years, a handsome return for long term holders. It's also good to see the share price up 38% over the last quarter. Anyone who held for that rewarding ride would probably be keen to talk about it.

The past week has proven to be lucrative for Bonny Worldwide investors, so let's see if fundamentals drove the company's three-year performance.

View our latest analysis for Bonny Worldwide

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

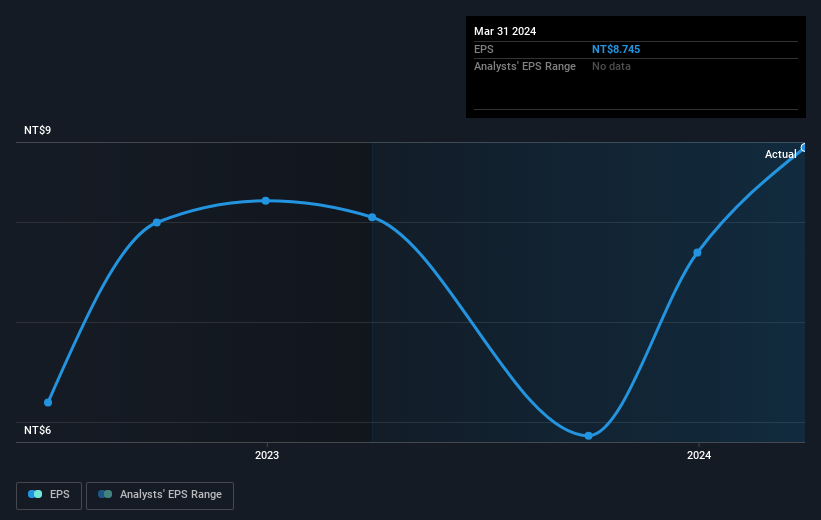

During three years of share price growth, Bonny Worldwide achieved compound earnings per share growth of 169% per year. This EPS growth is higher than the 82% average annual increase in the share price. Therefore, it seems the market has moderated its expectations for growth, somewhat.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on Bonny Worldwide's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Bonny Worldwide's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Bonny Worldwide's TSR of 549% for the 3 years exceeded its share price return, because it has paid dividends.

A Different Perspective

We're pleased to report that Bonny Worldwide shareholders have received a total shareholder return of 286% over one year. That's better than the annualised return of 41% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Bonny Worldwide that you should be aware of before investing here.

We will like Bonny Worldwide better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Bonny Worldwide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8467

Bonny Worldwide

Engages in the manufacture and sale of OEM and ODM carbon fiber rackets and related sporting goods.

Outstanding track record with excellent balance sheet.