- Taiwan

- /

- Consumer Durables

- /

- TWSE:8464

Nien Made Enterprise Co., LTD.'s (TWSE:8464) Shares May Have Run Too Fast Too Soon

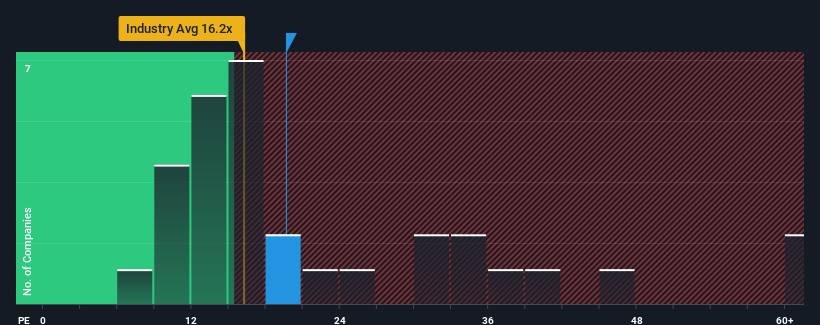

With a median price-to-earnings (or "P/E") ratio of close to 22x in Taiwan, you could be forgiven for feeling indifferent about Nien Made Enterprise Co., LTD.'s (TWSE:8464) P/E ratio of 19.6x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Nien Made Enterprise has been doing a reasonable job lately as its earnings haven't declined as much as most other companies. One possibility is that the P/E is moderate because investors think this relatively better earnings performance might be about to evaporate. You'd much rather the company wasn't bleeding earnings if you still believe in the business. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's earnings continue outplaying the market.

See our latest analysis for Nien Made Enterprise

Is There Some Growth For Nien Made Enterprise?

Nien Made Enterprise's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered a frustrating 9.7% decrease to the company's bottom line. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 19% in total. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 6.9% during the coming year according to the seven analysts following the company. That's shaping up to be materially lower than the 22% growth forecast for the broader market.

With this information, we find it interesting that Nien Made Enterprise is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Nien Made Enterprise's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Nien Made Enterprise's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Plus, you should also learn about this 1 warning sign we've spotted with Nien Made Enterprise.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Nien Made Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:8464

Nien Made Enterprise

Engages in the research, development, design, manufacture, and sale of various types of window coverings and related components in the United States, Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives