- Taiwan

- /

- Consumer Durables

- /

- TWSE:8464

Nien Made Enterprise Co., LTD.'s (TWSE:8464) Business Is Yet to Catch Up With Its Share Price

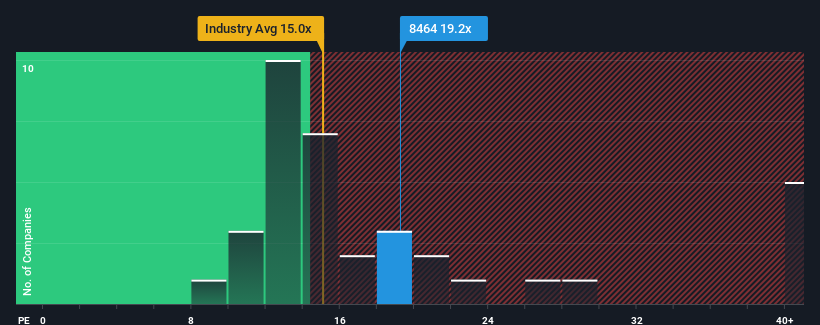

There wouldn't be many who think Nien Made Enterprise Co., LTD.'s (TWSE:8464) price-to-earnings (or "P/E") ratio of 19.2x is worth a mention when the median P/E in Taiwan is similar at about 21x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Nien Made Enterprise certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Nien Made Enterprise

How Is Nien Made Enterprise's Growth Trending?

Nien Made Enterprise's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered an exceptional 15% gain to the company's bottom line. As a result, it also grew EPS by 23% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 11% as estimated by the ten analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 24%, which is noticeably more attractive.

With this information, we find it interesting that Nien Made Enterprise is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Nien Made Enterprise's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Nien Made Enterprise with six simple checks will allow you to discover any risks that could be an issue.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Nien Made Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:8464

Nien Made Enterprise

Engages in the research, development, design, manufacture, and sale of various types of window coverings and related components in the United States, Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives