- Taiwan

- /

- Consumer Durables

- /

- TWSE:6743

AMPACS Corporation (TWSE:6743) Soars 30% But It's A Story Of Risk Vs Reward

AMPACS Corporation (TWSE:6743) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 30%.

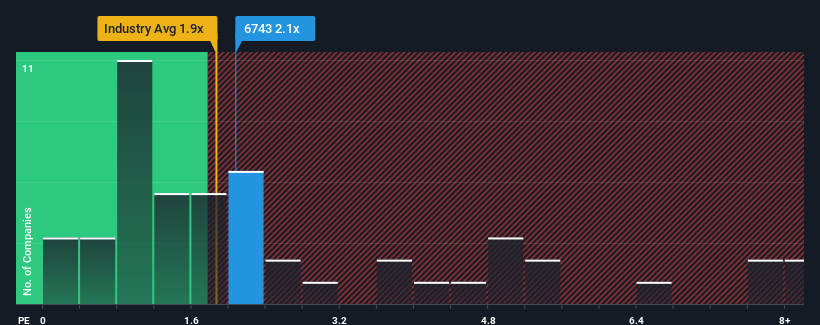

Even after such a large jump in price, you could still be forgiven for feeling indifferent about AMPACS' P/S ratio of 2.1x, since the median price-to-sales (or "P/S") ratio for the Consumer Durables industry in Taiwan is also close to 1.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for AMPACS

What Does AMPACS' P/S Mean For Shareholders?

Recent times have been advantageous for AMPACS as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on AMPACS.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like AMPACS' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 21% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 24% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 69% as estimated by the lone analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 8.1%, which is noticeably less attractive.

With this information, we find it interesting that AMPACS is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

AMPACS' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at AMPACS' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 2 warning signs for AMPACS (1 is concerning!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6743

AMPACS

Designs, manufactures, and sells consumer electronics and the development of plastic components and molds.

Good value with proven track record.

Market Insights

Community Narratives