Stock Analysis

- Taiwan

- /

- Consumer Durables

- /

- TWSE:2417

AVerMedia Technologies (TPE:2417) Has Rewarded Shareholders With An Exceptional 480% Total Return On Their Investment

For many, the main point of investing in the stock market is to achieve spectacular returns. And highest quality companies can see their share prices grow by huge amounts. For example, the AVerMedia Technologies, Inc. (TPE:2417) share price is up a whopping 457% in the last half decade, a handsome return for long term holders. And this is just one example of the epic gains achieved by some long term investors. In more good news, the share price has risen 7.1% in thirty days. This could be related to the recent financial results that were recently released - you could check the most recent data by reading our company report.

See our latest analysis for AVerMedia Technologies

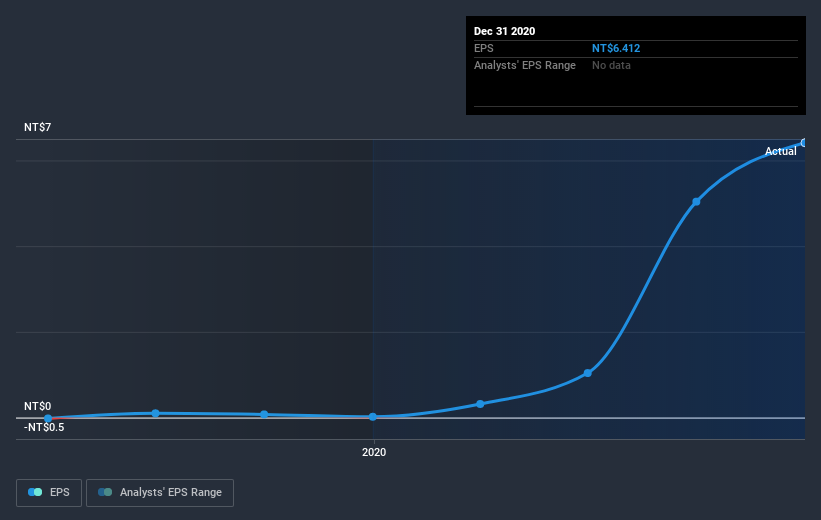

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the five years of share price growth, AVerMedia Technologies moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that AVerMedia Technologies has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on AVerMedia Technologies' balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of AVerMedia Technologies, it has a TSR of 480% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that AVerMedia Technologies shareholders have received a total shareholder return of 326% over the last year. And that does include the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 42% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand AVerMedia Technologies better, we need to consider many other factors. Take risks, for example - AVerMedia Technologies has 1 warning sign we think you should be aware of.

Of course AVerMedia Technologies may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

When trading AVerMedia Technologies or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:2417

AVerMedia Technologies

Designs, manufactures, and sells audio and video computer peripherals and solutions for content creation, live streaming, video conferencing cameras, ear-phone-free speakerphones, and edge AI computing applications.

Adequate balance sheet with questionable track record.