Yi Jinn Industrial (TPE:1457) Is Experiencing Growth In Returns On Capital

There are a few key trends to look for if we want to identify the next multi-bagger. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. With that in mind, we've noticed some promising trends at Yi Jinn Industrial (TPE:1457) so let's look a bit deeper.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Yi Jinn Industrial:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

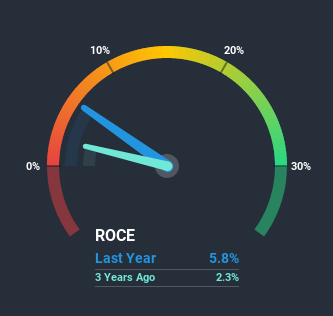

0.058 = NT$905m ÷ (NT$18b - NT$2.3b) (Based on the trailing twelve months to December 2020).

Thus, Yi Jinn Industrial has an ROCE of 5.8%. In absolute terms, that's a low return, but it's much better than the Luxury industry average of 2.8%.

View our latest analysis for Yi Jinn Industrial

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings, revenue and cash flow of Yi Jinn Industrial, check out these free graphs here.

What Can We Tell From Yi Jinn Industrial's ROCE Trend?

We're glad to see that ROCE is heading in the right direction, even if it is still low at the moment. The numbers show that in the last five years, the returns generated on capital employed have grown considerably to 5.8%. Basically the business is earning more per dollar of capital invested and in addition to that, 60% more capital is being employed now too. So we're very much inspired by what we're seeing at Yi Jinn Industrial thanks to its ability to profitably reinvest capital.

The Bottom Line On Yi Jinn Industrial's ROCE

To sum it up, Yi Jinn Industrial has proven it can reinvest in the business and generate higher returns on that capital employed, which is terrific. And investors seem to expect more of this going forward, since the stock has rewarded shareholders with a 97% return over the last five years. With that being said, we still think the promising fundamentals mean the company deserves some further due diligence.

If you want to know some of the risks facing Yi Jinn Industrial we've found 2 warning signs (1 is a bit concerning!) that you should be aware of before investing here.

While Yi Jinn Industrial may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

When trading Yi Jinn Industrial or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1457

Yi Jinn Industrial

Engages in the research and development, production, and sale of polyester textured yarns in Taiwan, rest of Asia, America, Europe, and Africa.

Moderate risk average dividend payer.

Similar Companies

Market Insights

Community Narratives