- Taiwan

- /

- Commercial Services

- /

- TPEX:8354

The Koan Hao Technology (GTSM:8354) Share Price Has Gained 40% And Shareholders Are Hoping For More

By buying an index fund, you can roughly match the market return with ease. But if you choose individual stocks with prowess, you can make superior returns. For example, Koan Hao Technology Co., Ltd. (GTSM:8354) shareholders have seen the share price rise 40% over three years, well in excess of the market return (14%, not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 13% in the last year , including dividends .

See our latest analysis for Koan Hao Technology

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

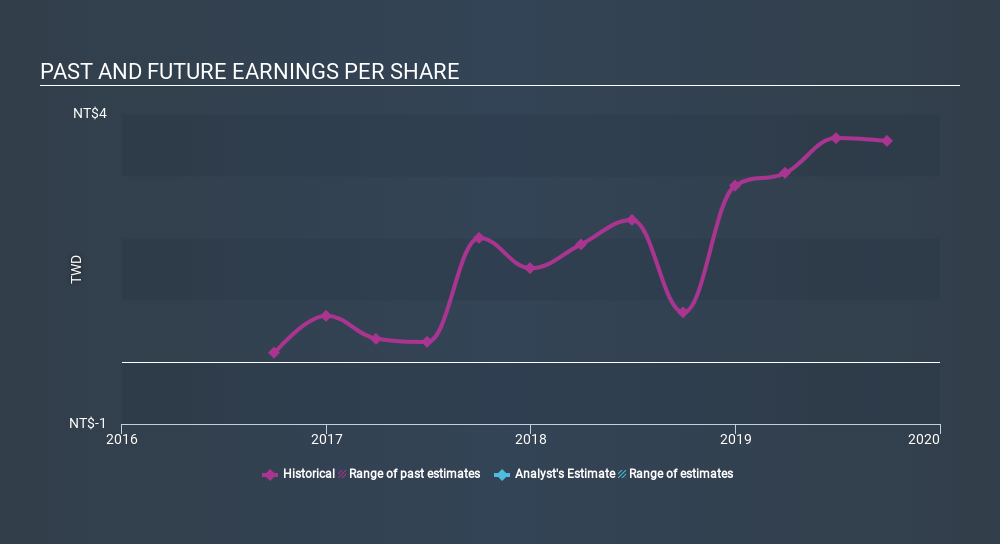

Koan Hao Technology was able to grow its EPS at 186% per year over three years, sending the share price higher. This EPS growth is higher than the 12% average annual increase in the share price. Therefore, it seems the market has moderated its expectations for growth, somewhat. This cautious sentiment is reflected in its (fairly low) P/E ratio of 5.23.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Koan Hao Technology's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Koan Hao Technology's TSR for the last 3 years was 51%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Koan Hao Technology's TSR for the year was broadly in line with the market average, at 13%. That gain looks pretty satisfying, and it is even better than the five-year TSR of 10% per year. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. It's always interesting to track share price performance over the longer term. But to understand Koan Hao Technology better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with Koan Hao Technology (including 1 which is is a bit unpleasant) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TPEX:8354

Koan Hao Technology

Manufactures and processes trademark paper, tape, and other products in Taiwan, Vietnam, China, and internationally.

Slight risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success