- Taiwan

- /

- Electrical

- /

- TWSE:6781

November 2024's Top Stocks Estimated To Be Trading Below Their Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating earnings reports and economic indicators, investors are keenly observing the performance of major indices, which recently experienced a busy week with mixed outcomes. Amid these conditions, identifying stocks that may be trading below their intrinsic value can offer potential opportunities for investors looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Avant Group (TSE:3836) | ¥1971.00 | ¥3936.15 | 49.9% |

| Nordic Waterproofing Holding (OM:NWG) | SEK175.60 | SEK349.53 | 49.8% |

| Elica (BIT:ELC) | €1.725 | €3.44 | 49.8% |

| On the Beach Group (LSE:OTB) | £1.534 | £3.07 | 50% |

| Cosmax (KOSE:A192820) | ₩157400.00 | ₩314256.00 | 49.9% |

| KeePer Technical Laboratory (TSE:6036) | ¥3920.00 | ¥7817.96 | 49.9% |

| SciDev (ASX:SDV) | A$0.615 | A$1.23 | 49.8% |

| SBI Sumishin Net Bank (TSE:7163) | ¥2709.00 | ¥5400.10 | 49.8% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €8.36 | €16.67 | 49.8% |

| Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266) | CN¥63.90 | CN¥127.25 | 49.8% |

Let's review some notable picks from our screened stocks.

Suzhou Recodeal Interconnect SystemLtd (SHSE:688800)

Overview: Suzhou Recodeal Interconnect System Co., Ltd develops, produces, and sells connection systems and microwave components globally, with a market cap of CN¥6.68 billion.

Operations: The company's revenue is primarily derived from its Electric Equipment segment, which generated CN¥2.10 billion.

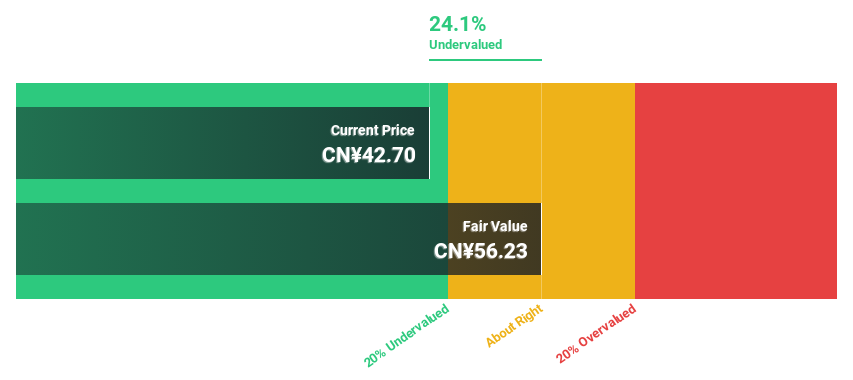

Estimated Discount To Fair Value: 24.1%

Suzhou Recodeal Interconnect System Ltd. is trading at CN¥42.7, 24.1% below its estimated fair value of CN¥56.23, highlighting potential undervaluation based on cash flows despite a volatile share price recently. Revenue and earnings are forecast to grow significantly faster than the market at 21% and 35.5% per year, respectively, though profit margins have declined from last year’s figures. Recent earnings show sales of CN¥1.59 billion with net income rising modestly to CN¥105.96 million.

- Our growth report here indicates Suzhou Recodeal Interconnect SystemLtd may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Suzhou Recodeal Interconnect SystemLtd stock in this financial health report.

Shanghai Pret Composites (SZSE:002324)

Overview: Shanghai Pret Composites Co., Ltd. focuses on the R&D, production, sale, and service of polymer and composite materials in China with a market cap of CN¥9.51 billion.

Operations: Shanghai Pret Composites Co., Ltd. generates revenue through its activities in the research, development, production, sale, and service of polymer and composite materials within China.

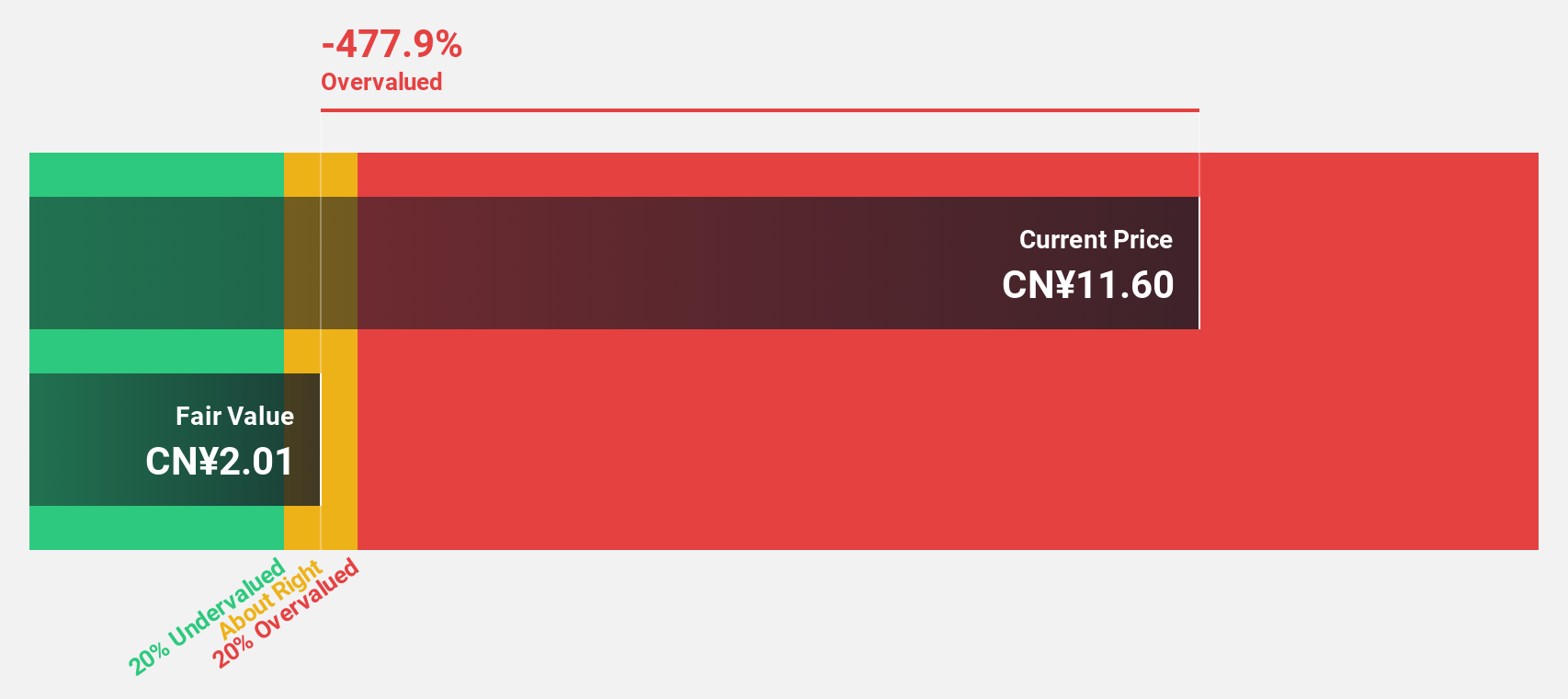

Estimated Discount To Fair Value: 26.8%

Shanghai Pret Composites is trading at CN¥8.97, significantly below its estimated fair value of CN¥12.25, indicating potential undervaluation based on cash flows. Despite earnings and revenue forecasts to grow substantially faster than the Chinese market at 45.4% and 28.2% per year respectively, recent results show a decline with sales of CN¥5.74 billion and net income dropping to CN¥209.15 million from last year’s figures, while profit margins decreased from 5% to 3.5%.

- The growth report we've compiled suggests that Shanghai Pret Composites' future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Shanghai Pret Composites.

Advanced Energy Solution Holding (TWSE:6781)

Overview: Advanced Energy Solution Holding Co., Ltd. operates in the energy sector and has a market cap of NT$42.97 billion.

Operations: The company's revenue is primarily generated from its Batteries / Battery Systems segment, amounting to NT$9.22 billion.

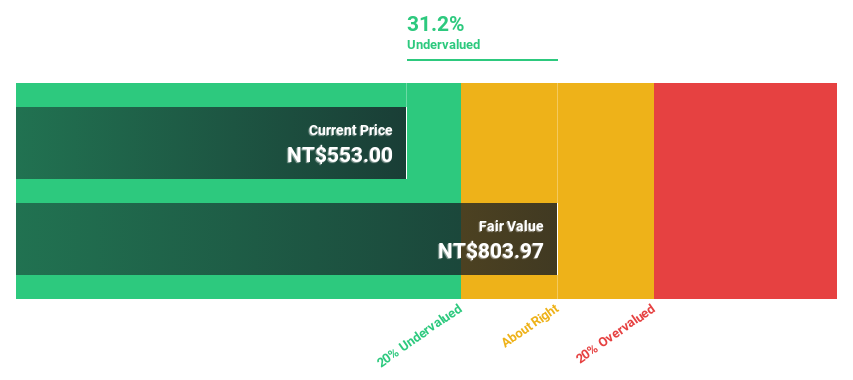

Estimated Discount To Fair Value: 31.2%

Advanced Energy Solution Holding is trading at NT$553, significantly below its estimated fair value of NT$803.97, suggesting undervaluation based on cash flows. While earnings are projected to grow significantly at 31.2% annually, surpassing the TW market's average growth rate, recent financials show a decline in sales and net income for the first half of 2024 compared to last year. The dividend yield of 2.1% lacks strong free cash flow coverage.

- Our expertly prepared growth report on Advanced Energy Solution Holding implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Advanced Energy Solution Holding here with our thorough financial health report.

Summing It All Up

- Unlock our comprehensive list of 956 Undervalued Stocks Based On Cash Flows by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6781

Advanced Energy Solution Holding

Advanced Energy Solution Holding Co., Ltd.

Excellent balance sheet with reasonable growth potential.