Revenues Working Against Tongtai Machine & Tool Co., Ltd.'s (TWSE:4526) Share Price

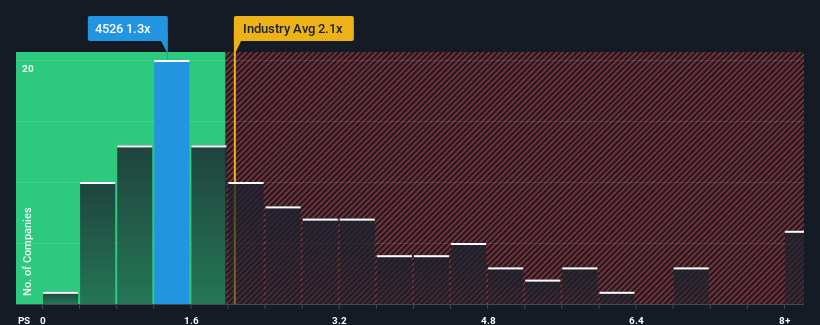

Tongtai Machine & Tool Co., Ltd.'s (TWSE:4526) price-to-sales (or "P/S") ratio of 1.3x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Machinery industry in Taiwan have P/S ratios greater than 2.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Tongtai Machine & Tool

What Does Tongtai Machine & Tool's Recent Performance Look Like?

For instance, Tongtai Machine & Tool's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Tongtai Machine & Tool's earnings, revenue and cash flow.How Is Tongtai Machine & Tool's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Tongtai Machine & Tool's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 24% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 36% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 18% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we are not surprised that Tongtai Machine & Tool is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Tongtai Machine & Tool revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Tongtai Machine & Tool is showing 2 warning signs in our investment analysis, and 1 of those is potentially serious.

If these risks are making you reconsider your opinion on Tongtai Machine & Tool, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Tongtai Machine & Tool might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:4526

Tongtai Machine & Tool

Manufactures and sells machine tools, computer components, computer numerical control lathes, and cutting centers in Taiwan, China, rest of Asia, Europe, and internationally.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.