Stock Analysis

Despite lower earnings than a year ago, Shin Zu Shing (TWSE:3376) investors are up 105% since then

Shin Zu Shing Co., Ltd. (TWSE:3376) shareholders have seen the share price descend 14% over the month. But looking back over the last year, the returns have actually been rather pleasing! To wit, it had solidly beat the market, up 91%.

Since the long term performance has been good but there's been a recent pullback of 5.8%, let's check if the fundamentals match the share price.

See our latest analysis for Shin Zu Shing

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over the last twelve months, Shin Zu Shing actually shrank its EPS by 50%.

So we don't think that investors are paying too much attention to EPS. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

Shin Zu Shing's revenue actually dropped 15% over last year. So the fundamental metrics don't provide an obvious explanation for the share price gain.

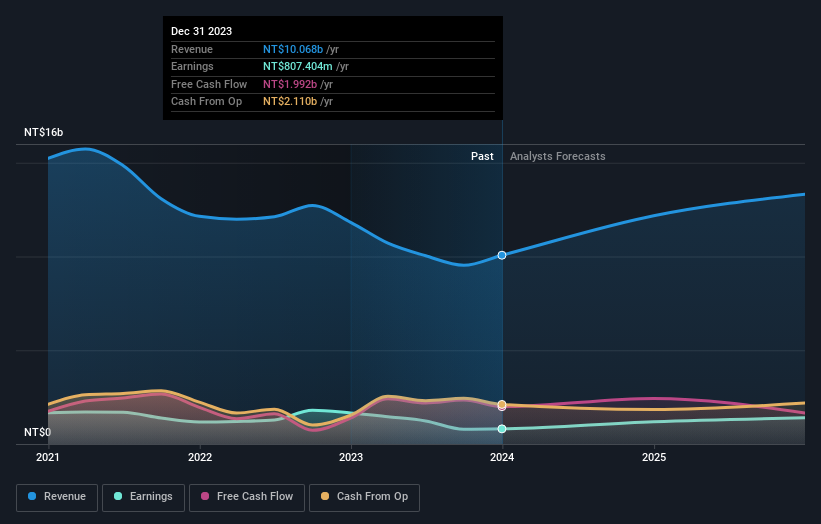

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Shin Zu Shing stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Shin Zu Shing, it has a TSR of 105% for the last 1 year. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that Shin Zu Shing has rewarded shareholders with a total shareholder return of 105% in the last twelve months. Of course, that includes the dividend. That's better than the annualised return of 14% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Shin Zu Shing better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with Shin Zu Shing (including 1 which makes us a bit uncomfortable) .

Of course Shin Zu Shing may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Shin Zu Shing is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3376

Shin Zu Shing

Shin Zu Shing Co., Ltd. engages in the research, design, development, production, assembly, testing, manufacturing, and sale of various precision springs, stamping parts, hinge components, CNC lathes, and metal injection molding in Taiwan, Singapore, and China.

Excellent balance sheet with reasonable growth potential.