Here's Why We Don't Think Goodway Machine's (TPE:1583) Statutory Earnings Reflect Its Underlying Earnings Potential

Many investors consider it preferable to invest in profitable companies over unprofitable ones, because profitability suggests a business is sustainable. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. This article will consider whether Goodway Machine's (TPE:1583) statutory profits are a good guide to its underlying earnings.

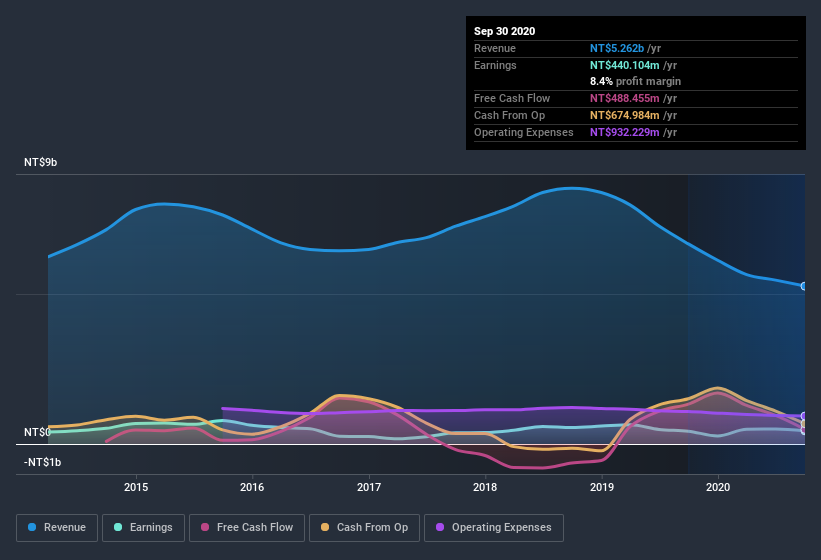

It's good to see that over the last twelve months Goodway Machine made a profit of NT$440.1m on revenue of NT$5.26b. Even though its revenue is down over the last three years, its profit has actually increased, as you can see, below.

View our latest analysis for Goodway Machine

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. As a reuslt, we think it's important to consider how unusual items and the recent tax benefit have influenced Goodway Machine's statutory profit. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Goodway Machine.

The Impact Of Unusual Items On Profit

Importantly, our data indicates that Goodway Machine's profit received a boost of NT$515m in unusual items, over the last year. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. Goodway Machine had a rather significant contribution from unusual items relative to its profit to September 2020. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

An Unusual Tax Situation

Having already discussed the impact of the unusual items, we should also note that Goodway Machine received a tax benefit of NT$65m. It's always a bit noteworthy when a company is paid by the tax man, rather than paying the tax man. Of course, prima facie it's great to receive a tax benefit. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal.

Our Take On Goodway Machine's Profit Performance

In the last year Goodway Machine received a tax benefit, which boosted its profit in a way that might not be much more sustainable than turning prime farmland into gas fields. Furthermore, it also benefitted from a positive unusual item, which boosted the profit result even higher. Considering all this we'd argue Goodway Machine's profits probably give an overly generous impression of its sustainable level of profitability. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Every company has risks, and we've spotted 4 warning signs for Goodway Machine (of which 2 can't be ignored!) you should know about.

Our examination of Goodway Machine has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Goodway Machine, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1583

Goodway Machine

Manufactures and sells CNC lathes and processing machinery in Taiwan, Asia, the United States, Europe, and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives