In the midst of escalating trade tensions and fluctuating consumer sentiment, global markets have experienced significant volatility, with key indices like the S&P 500 and Nasdaq Composite seeing notable gains despite underlying uncertainties. As investors navigate this complex landscape, identifying stocks that can weather economic shifts and capitalize on emerging opportunities becomes crucial; such stocks often exhibit strong fundamentals, resilience to market fluctuations, and potential for growth even in challenging environments.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Shangri-La Hotel | NA | 15.26% | 23.20% | ★★★★★★ |

| Yibin City Commercial Bank | 136.61% | 11.29% | 20.39% | ★★★★★★ |

| S.A.S. Dragon Holdings | 77.35% | 3.64% | 7.13% | ★★★★★☆ |

| Shanghai Pioneer Holding | 5.59% | 4.81% | 18.86% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Malam - Team | 91.23% | 12.11% | -6.38% | ★★★★★☆ |

| East West Banking | 54.92% | 5.20% | -0.95% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Fengyinhe Holdings | 0.60% | 38.63% | 65.41% | ★★★★☆☆ |

| C. Mer Industries | 114.92% | 13.32% | 73.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Huaihe Energy (Group)Ltd (SHSE:600575)

Simply Wall St Value Rating: ★★★★★☆

Overview: Huaihe Energy (Group) Co., Ltd operates in the logistics and trade sector within China, with a market capitalization of CN¥14.07 billion.

Operations: Huaihe Energy (Group) Co., Ltd generates revenue primarily from its logistics and trade operations. The company's net profit margin has shown variability, reflecting changes in operational efficiency and market conditions.

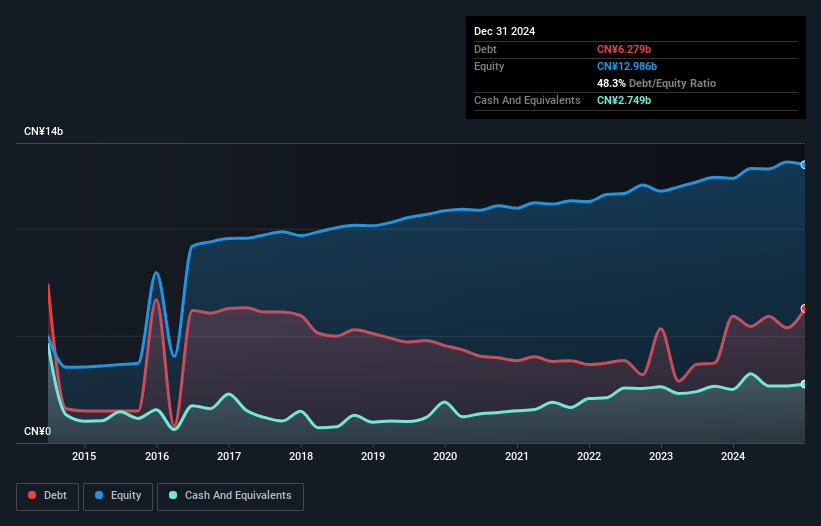

Huaihe Energy, a small player in the energy sector, is trading at 71.3% below its estimated fair value, highlighting potential undervaluation. The company reported sales of CNY 30.02 billion for 2024, up from CNY 27.33 billion in the previous year, with net income reaching CNY 857.8 million compared to last year's CNY 839.62 million. Its net debt to equity ratio stands at a satisfactory 27.2%, suggesting manageable leverage levels despite an increase over five years from 41.9% to 48.3%. With high-quality earnings and positive free cash flow, Huaihe seems positioned for steady growth within its industry context.

- Delve into the full analysis health report here for a deeper understanding of Huaihe Energy (Group)Ltd.

Understand Huaihe Energy (Group)Ltd's track record by examining our Past report.

Wuxi Huadong Heavy Machinery (SZSE:002685)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wuxi Huadong Heavy Machinery Co., Ltd. manufactures and sells container handling equipment and intelligent CNC machine tools in the People's Republic of China, with a market cap of CN¥6.71 billion.

Operations: The company's revenue is primarily derived from the sale of container handling equipment and intelligent CNC machine tools. The net profit margin has shown variability, reflecting changes in operational efficiency and cost management.

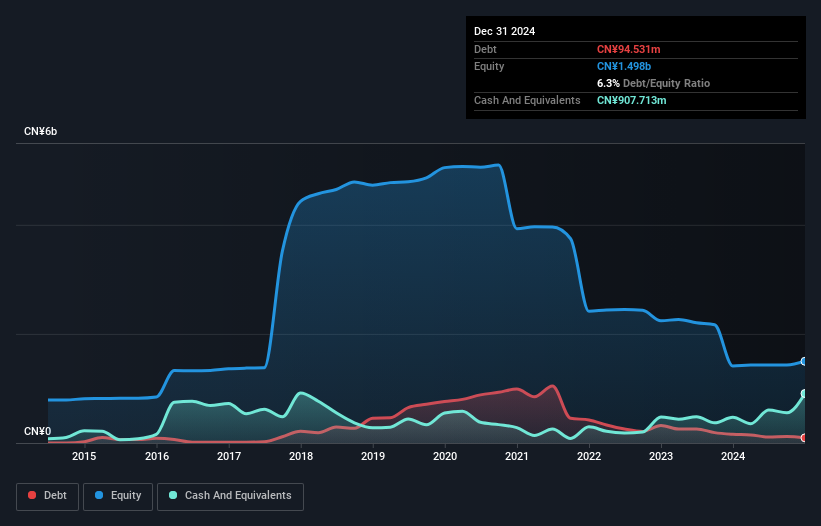

Wuxi Huadong Heavy Machinery, a nimble player in the machinery sector, has turned heads with its recent financial turnaround. The company reported an impressive revenue of CNY 1.18 billion for 2024, up from CNY 671 million the previous year, while net income soared to CNY 123 million from a loss of CNY 811 million. Basic earnings per share climbed to CNY 0.12 from a loss of CNY 0.80 last year. This profitability is backed by high-quality earnings and a solid debt position with more cash than total debt, showcasing its potential as an intriguing investment opportunity in the industry landscape.

- Navigate through the intricacies of Wuxi Huadong Heavy Machinery with our comprehensive health report here.

Learn about Wuxi Huadong Heavy Machinery's historical performance.

Mega Union Technology (TPEX:6944)

Simply Wall St Value Rating: ★★★★★★

Overview: Mega Union Technology Inc. specializes in planning and designing water and wastewater recovery systems for industrial applications, with a market capitalization of NT$26.22 billion.

Operations: Mega Union Technology generates revenue primarily from its Engineering Business Group, which accounts for NT$7.52 billion, while the Other Business Group contributes NT$2.78 billion.

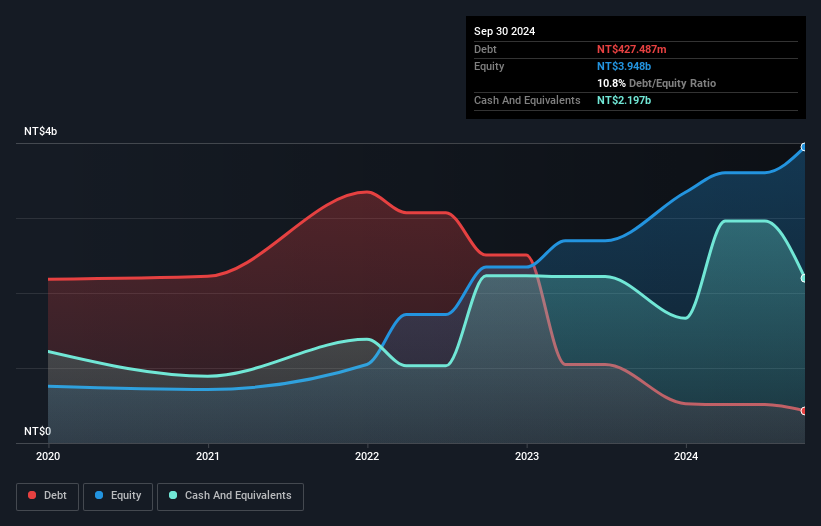

Mega Union Technology, a promising player in its field, has shown impressive financial strides. The company's earnings growth of 41% over the past year outpaced the Machinery industry's 23%, reflecting robust performance. With a debt-to-equity ratio significantly reduced from 288% to just 9% over five years, Mega Union demonstrates effective debt management. Despite recent share price volatility, its price-to-earnings ratio of 17x remains attractive compared to the TW market average of 18x. Recent earnings reports highlight net income rising to TWD 1.51 billion from TWD 1.07 billion last year, showcasing strong profitability and potential for future expansion.

- Click to explore a detailed breakdown of our findings in Mega Union Technology's health report.

Explore historical data to track Mega Union Technology's performance over time in our Past section.

Summing It All Up

- Gain an insight into the universe of 3238 Global Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Huadong Heavy Machinery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002685

Wuxi Huadong Heavy Machinery

Manufactures and sells container handling equipment and intelligent CNC machine tools in the People's Republic of China.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives