First Financial Holding (TWSE:2892) Eyes Expansion with Dividend Growth Despite Earnings Challenges

Reviewed by Simply Wall St

Take a closer look at First Financial Holding's potential here.

Competitive Advantages That Elevate First Financial Holding

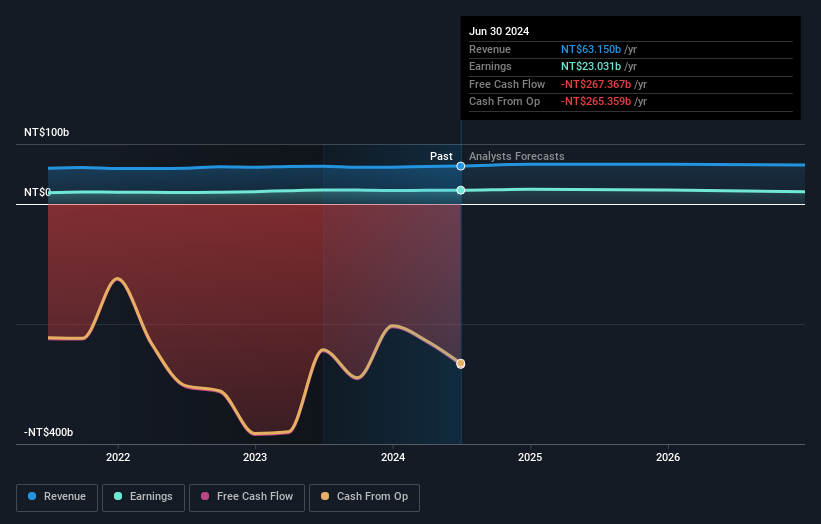

Building on its financial performance, First Financial Holding has demonstrated strong earnings growth of 6.1% annually over the past five years, underscoring its market position. The company reported a solid performance in the first half of the year, achieving TWD 6.8 billion, setting a strong foundation for the full-year target of TWD 13 billion. Additionally, high-quality earnings and a net profit margin of 36.5% reflect effective management strategies, as highlighted by Annie Lee's positive outlook on adjusted net interest margins. This financial health not only provides a cash runway but also positions the company well against market fluctuations.

Vulnerabilities Impacting First Financial Holding

However, certain vulnerabilities persist, such as a low return on equity at 9.1% and a 7.3% earnings decline over the past year. The company faces challenges with charge-offs, as noted by Annie Lee, which can impact profitability and investor confidence. Furthermore, the forecasted revenue growth of 1.2% annually lags behind the market average of 12.5%, indicating potential struggles in maintaining competitive momentum. The valuation, with a Price-To-Earnings Ratio of 16.6x, suggests the company is trading higher than the industry average, which may not align with its growth metrics.

Areas for Expansion and Innovation for First Financial Holding

Opportunities for expansion are evident, particularly in fee income growth, projected to reach TWD 560 million. Management's confidence in maintaining momentum suggests potential for further growth, as expressed by Annie Lee. The company's proactive tightening measures in response to market conditions could enhance stability and profitability, with dividends currently covered by earnings at 50.3% and forecasted to remain so in three years at 54.9%.

Key Risks and Challenges That Could Impact First Financial Holding's Success

Nevertheless, external factors such as economic headwinds and regulatory challenges pose significant risks. The high net debt to equity ratio of 94.2% is another concern, potentially impacting financial health. The dynamic nature of market competition, as acknowledged by Annie Lee, requires continuous adaptation to maintain strategic positioning amidst fluctuating market dynamics.

Conclusion

First Financial Holding's impressive earnings growth of 6.1% annually over the past five years and its strong net profit margin of 36.5% underscore its effective management strategies and resilience against market fluctuations. However, challenges such as a low return on equity of 9.1% and a 7.3% earnings decline highlight areas for improvement, particularly in enhancing profitability and investor confidence. The company's Price-To-Earnings Ratio of 16.6x, while higher than the industry average, suggests that despite its premium valuation, it is still trading below its estimated fair value of NT$27.82, indicating potential for future appreciation if growth metrics align with market expectations. Opportunities for expansion, especially in fee income growth, alongside proactive measures to stabilize profitability, could bolster its market position, but external risks and a high net debt to equity ratio necessitate careful navigation to sustain long-term success.

Seize The Opportunity

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TWSE:2892

First Financial Holding

Through its subsidiaries, provides various in Taiwan, Asia, the United States, and internationally.

Flawless balance sheet second-rate dividend payer.