- Japan

- /

- Electrical

- /

- NSE:6623

Asian Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As the Asian markets navigate through a landscape marked by easing U.S.-China trade tensions and mixed economic signals, investors are increasingly looking towards dividend stocks as a stable source of income amidst global uncertainties. In this environment, selecting dividend stocks with strong fundamentals and consistent payout histories can be an effective strategy to enhance portfolio resilience and capitalize on the region's evolving market dynamics.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.46% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.81% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.00% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.96% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.96% | ★★★★★★ |

| Daicel (TSE:4202) | 4.53% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.56% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.70% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.47% | ★★★★★★ |

Click here to see the full list of 1051 stocks from our Top Asian Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

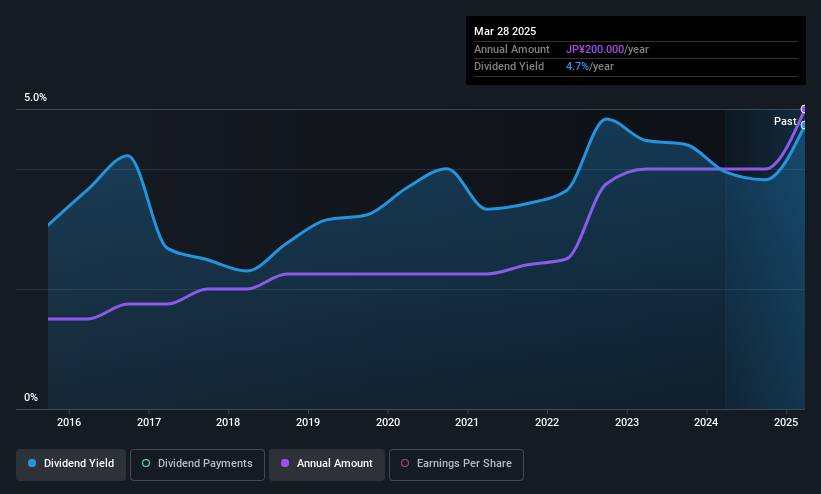

Aichi Electric (NSE:6623)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Aichi Electric Co., Ltd. and its subsidiaries manufacture and sell electric power products in Japan and internationally, with a market cap of ¥56.46 billion.

Operations: Aichi Electric Co., Ltd. operates through various revenue segments focused on the production and distribution of electric power products across domestic and international markets.

Dividend Yield: 3.7%

Aichi Electric offers a stable and reliable dividend yield of 3.66%, slightly below the top quartile in Japan. The company's dividends have grown consistently over the past decade, supported by robust earnings growth of 20.8% last year. With a low payout ratio of 17.8% and cash payout ratio at 32.5%, dividends are well-covered, indicating sustainability and reliability for income-focused investors seeking exposure in Asia's market.

- Delve into the full analysis dividend report here for a deeper understanding of Aichi Electric.

- According our valuation report, there's an indication that Aichi Electric's share price might be on the cheaper side.

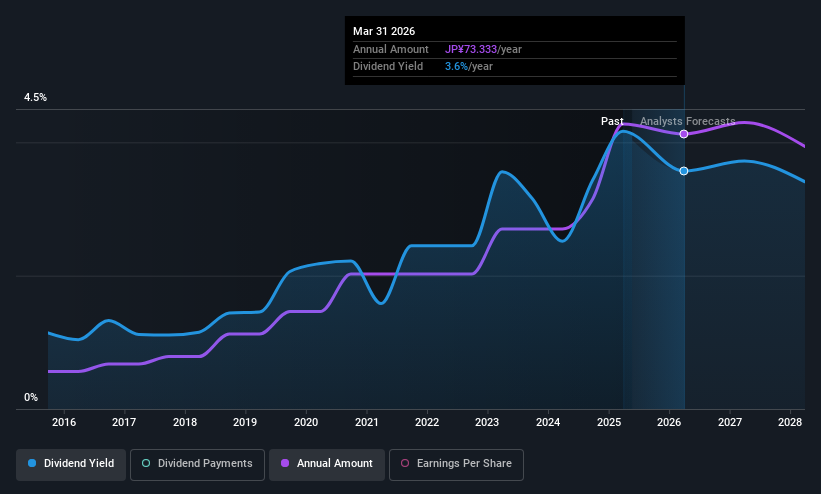

Takuma (TSE:6013)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Takuma Co., Ltd. operates in Japan, focusing on the design, construction, and management of boilers, plant machinery, pollution prevention and environmental equipment plants, as well as heating and cooling systems with a market cap of approximately ¥181.42 billion.

Operations: Takuma Co., Ltd.'s revenue segments include the development and oversight of boilers, plant machinery, environmental equipment plants, and heating and cooling systems in Japan.

Dividend Yield: 3.2%

Takuma's dividend yield of 3.23% is lower than the top 25% in Japan, with dividends growing steadily over the past decade. Although dividends are covered by earnings due to a payout ratio of 55.4%, they are not supported by free cash flows, raising sustainability concerns. Recent buybacks totaling ¥6.43 billion may indicate confidence in financial health, yet investors should weigh this against the lack of free cash flow coverage for dividends.

- Get an in-depth perspective on Takuma's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Takuma shares in the market.

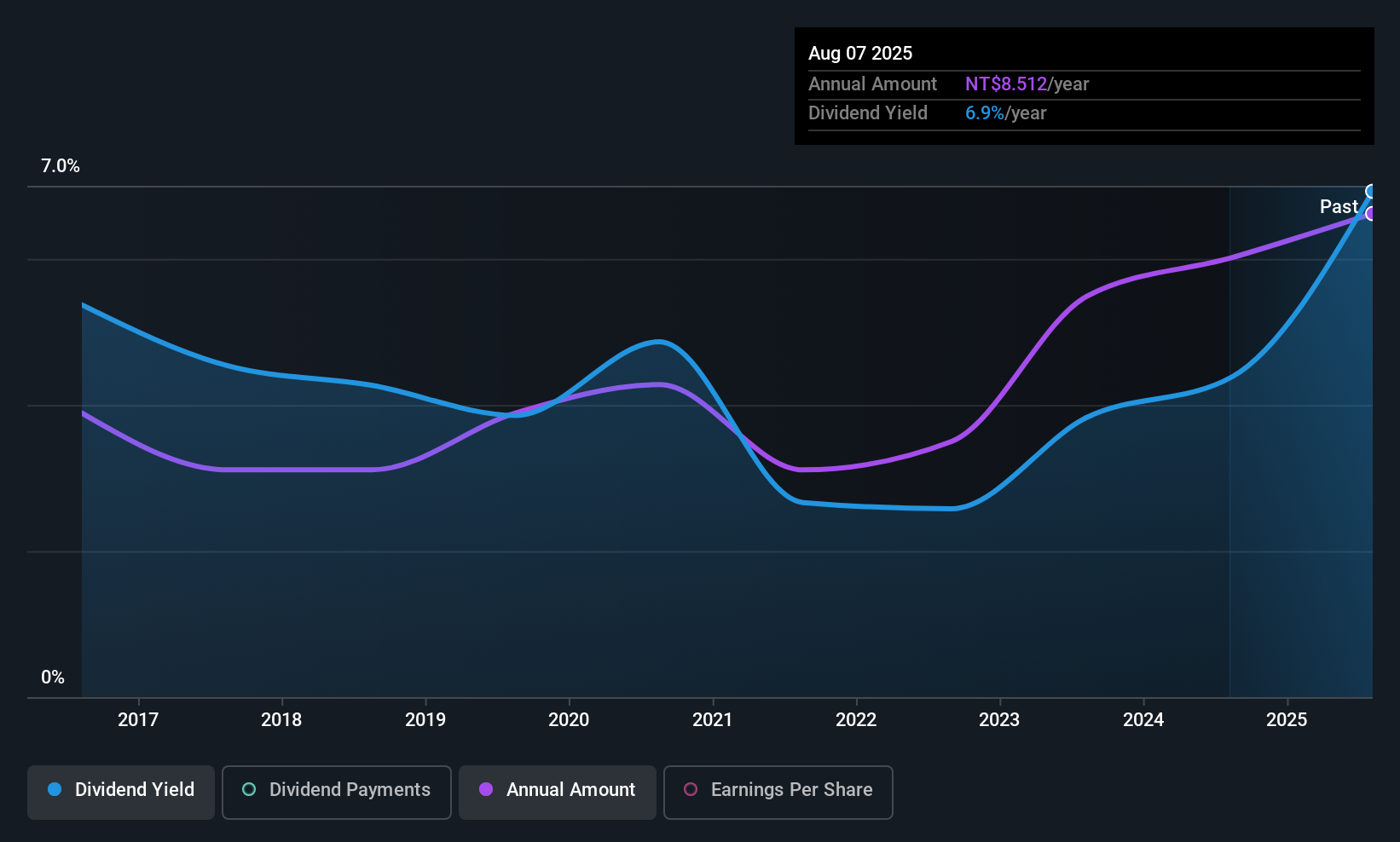

Eurocharm Holdings (TWSE:5288)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Eurocharm Holdings Co., Ltd. is engaged in the manufacturing and sale of motorcycle and auto equipment parts, medical equipment, and machine parts across Taiwan, Vietnam, the United States, and other international markets with a market cap of NT$9.22 billion.

Operations: Eurocharm Holdings Co., Ltd. generates NT$7.07 billion in revenue from its manufacturing and sales of automobile, locomotive parts, and medical equipment.

Dividend Yield: 6.4%

Eurocharm Holdings' dividend yield of 6.42% ranks among the top 25% in Taiwan, supported by a reasonable payout ratio of 61.6%. Despite this, its dividend history is marked by volatility and lack of consistent growth over the past decade. Recent earnings improvements, with net income rising to TWD 244.19 million for Q3, suggest potential stability. The dividends are well-covered by cash flows given a cash payout ratio of 49.1%, enhancing their sustainability prospects despite past unreliability.

- Click here and access our complete dividend analysis report to understand the dynamics of Eurocharm Holdings.

- The valuation report we've compiled suggests that Eurocharm Holdings' current price could be quite moderate.

Taking Advantage

- Embark on your investment journey to our 1051 Top Asian Dividend Stocks selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSE:6623

Aichi Electric

Engages in the manufacture and sale of electric power products in Japan and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives