- Taiwan

- /

- Auto Components

- /

- TWSE:4551

Global PMX Co., Ltd.'s (TWSE:4551) P/E Is Still On The Mark Following 27% Share Price Bounce

Global PMX Co., Ltd. (TWSE:4551) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 9.0% in the last twelve months.

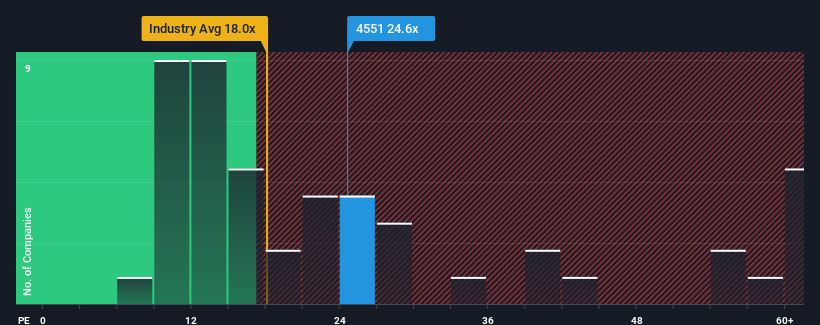

Following the firm bounce in price, given around half the companies in Taiwan have price-to-earnings ratios (or "P/E's") below 21x, you may consider Global PMX as a stock to potentially avoid with its 24.6x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Global PMX hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Global PMX

Is There Enough Growth For Global PMX?

There's an inherent assumption that a company should outperform the market for P/E ratios like Global PMX's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 44%. As a result, earnings from three years ago have also fallen 57% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 24% per annum as estimated by the seven analysts watching the company. That's shaping up to be materially higher than the 13% per year growth forecast for the broader market.

With this information, we can see why Global PMX is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Global PMX shares have received a push in the right direction, but its P/E is elevated too. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Global PMX maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Global PMX you should know about.

You might be able to find a better investment than Global PMX. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:4551

Global PMX

Manufactures, processes, and sells precision metal components for automotive products, hard disk drives, medical equipment, and various industrial products primarily in the United States, China, Germany, France, Italy, and Japan.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives