- Taiwan

- /

- Auto Components

- /

- TWSE:2243

Investors Still Aren't Entirely Convinced By HORNG SHIUE HOLDING Co., Ltd.'s (TWSE:2243) Revenues Despite 29% Price Jump

Despite an already strong run, HORNG SHIUE HOLDING Co., Ltd. (TWSE:2243) shares have been powering on, with a gain of 29% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 92% in the last year.

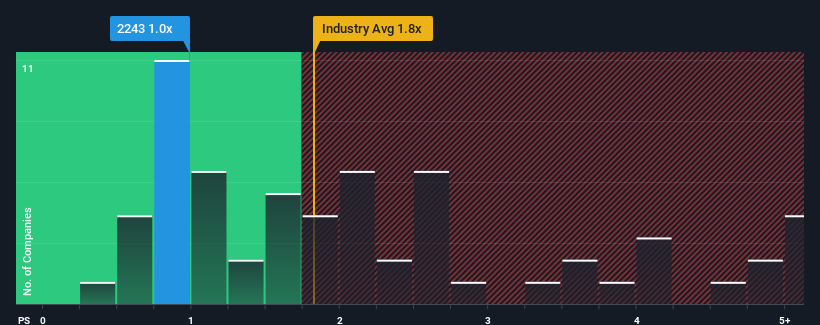

In spite of the firm bounce in price, considering around half the companies operating in Taiwan's Auto Components industry have price-to-sales ratios (or "P/S") above 1.8x, you may still consider HORNG SHIUE HOLDING as an solid investment opportunity with its 1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for HORNG SHIUE HOLDING

What Does HORNG SHIUE HOLDING's P/S Mean For Shareholders?

Recent times have been quite advantageous for HORNG SHIUE HOLDING as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on HORNG SHIUE HOLDING will help you shine a light on its historical performance.How Is HORNG SHIUE HOLDING's Revenue Growth Trending?

HORNG SHIUE HOLDING's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 58% last year. The latest three year period has also seen an excellent 153% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is only predicted to deliver 6.6% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we find it odd that HORNG SHIUE HOLDING is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

HORNG SHIUE HOLDING's stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see HORNG SHIUE HOLDING currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Before you take the next step, you should know about the 2 warning signs for HORNG SHIUE HOLDING (1 is potentially serious!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if HORNG SHIUE HOLDING might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2243

HORNG SHIUE HOLDING

Engages in the manufacture, processing, and trading of automotive sheet metal stamping dies and gauges in Asia, South America, Europe, and Africa.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives