- Taiwan

- /

- Auto Components

- /

- TWSE:2243

HORNG SHIUE HOLDING Co., Ltd.'s (TWSE:2243) Shares Leap 30% Yet They're Still Not Telling The Full Story

Despite an already strong run, HORNG SHIUE HOLDING Co., Ltd. (TWSE:2243) shares have been powering on, with a gain of 30% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 48% in the last year.

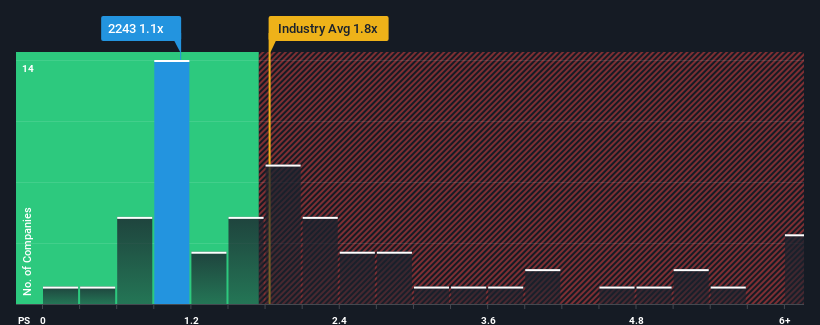

In spite of the firm bounce in price, considering around half the companies operating in Taiwan's Auto Components industry have price-to-sales ratios (or "P/S") above 1.8x, you may still consider HORNG SHIUE HOLDING as an solid investment opportunity with its 1.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for HORNG SHIUE HOLDING

How HORNG SHIUE HOLDING Has Been Performing

For instance, HORNG SHIUE HOLDING's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on HORNG SHIUE HOLDING will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on HORNG SHIUE HOLDING's earnings, revenue and cash flow.How Is HORNG SHIUE HOLDING's Revenue Growth Trending?

HORNG SHIUE HOLDING's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.8%. Still, the latest three year period has seen an excellent 73% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

When compared to the industry's one-year growth forecast of 9.2%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it odd that HORNG SHIUE HOLDING is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

The latest share price surge wasn't enough to lift HORNG SHIUE HOLDING's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of HORNG SHIUE HOLDING revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for HORNG SHIUE HOLDING that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if HORNG SHIUE HOLDING might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2243

HORNG SHIUE HOLDING

Engages in the manufacture, processing, and trading of automotive sheet metal stamping dies and gauges in Asia, South America, Europe, and Africa.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives