- Taiwan

- /

- Auto Components

- /

- TWSE:2243

HORNG SHIUE HOLDING Co., Ltd. (TWSE:2243) Screens Well But There Might Be A Catch

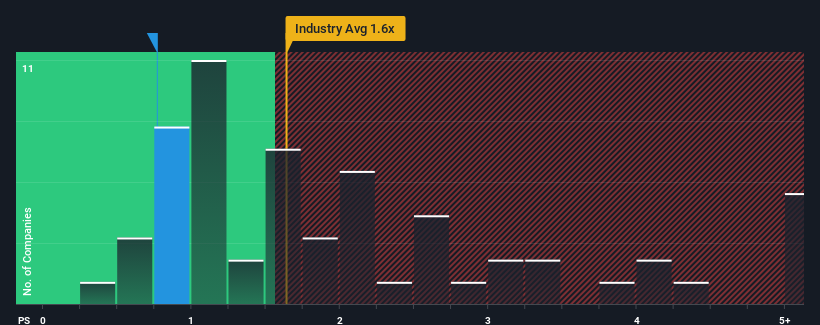

When you see that almost half of the companies in the Auto Components industry in Taiwan have price-to-sales ratios (or "P/S") above 1.6x, HORNG SHIUE HOLDING Co., Ltd. (TWSE:2243) looks to be giving off some buy signals with its 0.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for HORNG SHIUE HOLDING

How Has HORNG SHIUE HOLDING Performed Recently?

As an illustration, revenue has deteriorated at HORNG SHIUE HOLDING over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on HORNG SHIUE HOLDING's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For HORNG SHIUE HOLDING?

The only time you'd be truly comfortable seeing a P/S as low as HORNG SHIUE HOLDING's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 25%. Regardless, revenue has managed to lift by a handy 25% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 6.7% shows it's about the same on an annualised basis.

With this information, we find it odd that HORNG SHIUE HOLDING is trading at a P/S lower than the industry. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of HORNG SHIUE HOLDING revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. While recent

There are also other vital risk factors to consider and we've discovered 4 warning signs for HORNG SHIUE HOLDING (1 doesn't sit too well with us!) that you should be aware of before investing here.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if HORNG SHIUE HOLDING might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2243

HORNG SHIUE HOLDING

Engages in the manufacture, processing, and trading of automotive sheet metal stamping dies and gauges in Asia, South America, Europe, and Africa.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives