What Yulon Motor Company Ltd.'s (TWSE:2201) P/S Is Not Telling You

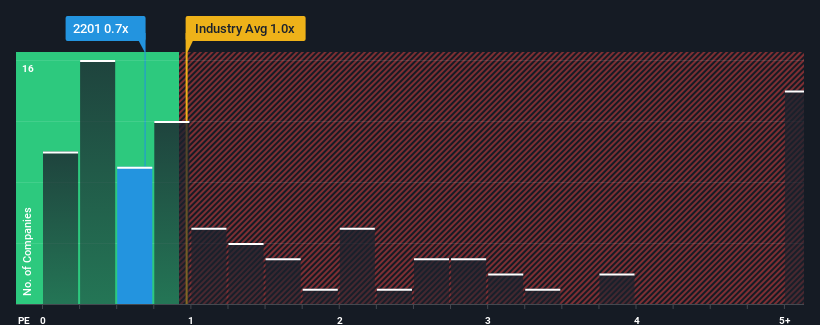

There wouldn't be many who think Yulon Motor Company Ltd.'s (TWSE:2201) price-to-sales (or "P/S") ratio of 0.7x is worth a mention when the median P/S for the Auto industry in Taiwan is similar at about 1.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Yulon Motor

How Has Yulon Motor Performed Recently?

Yulon Motor could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Yulon Motor.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Yulon Motor's to be considered reasonable.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 6.8% over the next year. Meanwhile, the rest of the industry is forecast to expand by 11%, which is noticeably more attractive.

In light of this, it's curious that Yulon Motor's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

When you consider that Yulon Motor's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

It is also worth noting that we have found 2 warning signs for Yulon Motor (1 makes us a bit uncomfortable!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Yulon Motor, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2201

Yulon Motor

Manufactures and markets automobiles and related parts in Taiwan, China, and the Philippines.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives