- Taiwan

- /

- Auto Components

- /

- TWSE:1533

Investors are selling off Mobiletron ElectronicsLtd (TWSE:1533), lack of profits no doubt contribute to shareholders one-year loss

It's easy to match the overall market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Unfortunately the Mobiletron Electronics Co.,Ltd. (TWSE:1533) share price slid 37% over twelve months. That contrasts poorly with the market return of 31%. At least the damage isn't so bad if you look at the last three years, since the stock is down 29% in that time. Unfortunately the share price momentum is still quite negative, with prices down 18% in thirty days. We do note, however, that the broader market is down 8.1% in that period, and this may have weighed on the share price.

Since Mobiletron ElectronicsLtd has shed NT$483m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for Mobiletron ElectronicsLtd

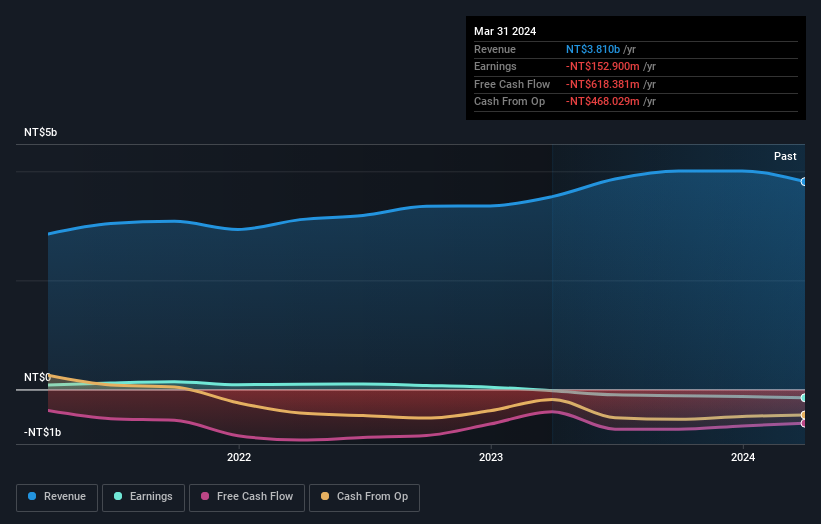

Because Mobiletron ElectronicsLtd made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Mobiletron ElectronicsLtd grew its revenue by 7.8% over the last year. While that may seem decent it isn't great considering the company is still making a loss. Given this fairly low revenue growth (and lack of profits), it's not particularly surprising to see the stock down 37% in a year. It's important not to lose sight of the fact that profitless companies must grow. So remember, if you buy a profitless company then you risk being a profitless investor.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Mobiletron ElectronicsLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 31% in the last year, Mobiletron ElectronicsLtd shareholders lost 37%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 2%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Mobiletron ElectronicsLtd better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with Mobiletron ElectronicsLtd .

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1533

Mobiletron ElectronicsLtd

Engages in the production and sale of electronic components for the automotive industry in Taiwan.

Slightly overvalued with imperfect balance sheet.