Stock Analysis

- Taiwan

- /

- Auto Components

- /

- TWSE:1522

Is TYC Brother Industrial Co., Ltd.'s (TWSE:1522) Recent Stock Performance Tethered To Its Strong Fundamentals?

TYC Brother Industrial (TWSE:1522) has had a great run on the share market with its stock up by a significant 42% over the last three months. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. Specifically, we decided to study TYC Brother Industrial's ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for TYC Brother Industrial

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for TYC Brother Industrial is:

12% = NT$1.2b ÷ NT$9.5b (Based on the trailing twelve months to December 2023).

The 'return' is the amount earned after tax over the last twelve months. One way to conceptualize this is that for each NT$1 of shareholders' capital it has, the company made NT$0.12 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

TYC Brother Industrial's Earnings Growth And 12% ROE

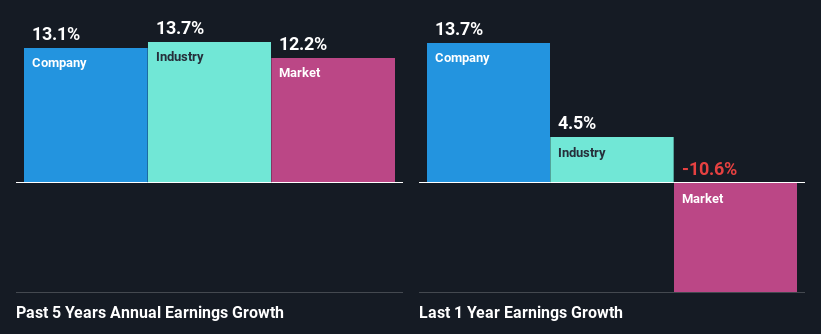

To begin with, TYC Brother Industrial seems to have a respectable ROE. Especially when compared to the industry average of 8.4% the company's ROE looks pretty impressive. This certainly adds some context to TYC Brother Industrial's decent 13% net income growth seen over the past five years.

We then performed a comparison between TYC Brother Industrial's net income growth with the industry, which revealed that the company's growth is similar to the average industry growth of 14% in the same 5-year period.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about TYC Brother Industrial's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is TYC Brother Industrial Making Efficient Use Of Its Profits?

TYC Brother Industrial has a significant three-year median payout ratio of 66%, meaning that it is left with only 34% to reinvest into its business. This implies that the company has been able to achieve decent earnings growth despite returning most of its profits to shareholders.

Moreover, TYC Brother Industrial is determined to keep sharing its profits with shareholders which we infer from its long history of nine years of paying a dividend.

Conclusion

In total, we are pretty happy with TYC Brother Industrial's performance. Especially the high ROE, Which has contributed to the impressive growth seen in earnings. Despite the company reinvesting only a small portion of its profits, it still has managed to grow its earnings so that is appreciable. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. To gain further insights into TYC Brother Industrial's past profit growth, check out this visualization of past earnings, revenue and cash flows.

Valuation is complex, but we're helping make it simple.

Find out whether TYC Brother Industrial is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:1522

TYC Brother Industrial

TYC Brother Industrial Co., Ltd. engages in manufacture and sale of vehicle lighting products in Taiwan.

Solid track record with excellent balance sheet.