- Taiwan

- /

- Auto Components

- /

- TWSE:5288

Here's Why Eurocharm Holdings (TPE:5288) Can Manage Its Debt Responsibly

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Eurocharm Holdings Co., Ltd. (TPE:5288) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Eurocharm Holdings

How Much Debt Does Eurocharm Holdings Carry?

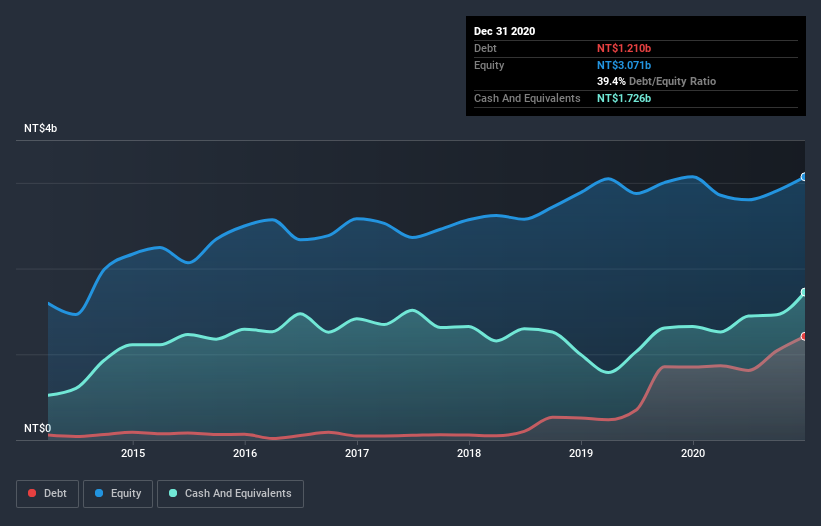

As you can see below, at the end of December 2020, Eurocharm Holdings had NT$1.21b of debt, up from NT$850.4m a year ago. Click the image for more detail. However, it does have NT$1.73b in cash offsetting this, leading to net cash of NT$515.6m.

How Healthy Is Eurocharm Holdings' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Eurocharm Holdings had liabilities of NT$2.17b due within 12 months and liabilities of NT$38.3m due beyond that. Offsetting these obligations, it had cash of NT$1.73b as well as receivables valued at NT$905.1m due within 12 months. So it actually has NT$421.8m more liquid assets than total liabilities.

This surplus suggests that Eurocharm Holdings has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Eurocharm Holdings boasts net cash, so it's fair to say it does not have a heavy debt load!

On the other hand, Eurocharm Holdings saw its EBIT drop by 5.2% in the last twelve months. If earnings continue to decline at that rate the company may have increasing difficulty managing its debt load. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Eurocharm Holdings's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. Eurocharm Holdings may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Looking at the most recent three years, Eurocharm Holdings recorded free cash flow of 40% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Eurocharm Holdings has net cash of NT$515.6m, as well as more liquid assets than liabilities. So we don't have any problem with Eurocharm Holdings's use of debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 1 warning sign for Eurocharm Holdings you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade Eurocharm Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Eurocharm Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:5288

Eurocharm Holdings

Manufactures and sells motorcycle and auto equipment parts, medical equipment, and machine parts in Taiwan, Vietnam, the United States, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success