Stock Analysis

- Taiwan

- /

- Auto Components

- /

- TWSE:2228

What Type Of Returns Would Iron Force Industrial's(TPE:2228) Shareholders Have Earned If They Purchased Their SharesFive Years Ago?

Ideally, your overall portfolio should beat the market average. But even the best stock picker will only win with some selections. At this point some shareholders may be questioning their investment in Iron Force Industrial Co., Ltd. (TPE:2228), since the last five years saw the share price fall 55%. We also note that the stock has performed poorly over the last year, with the share price down 32%. The last week also saw the share price slip down another 6.8%.

Check out our latest analysis for Iron Force Industrial

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

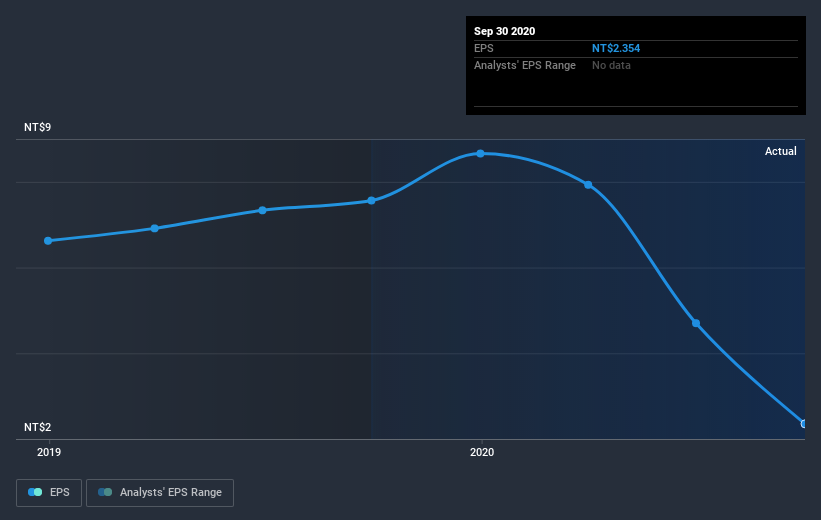

Looking back five years, both Iron Force Industrial's share price and EPS declined; the latter at a rate of 22% per year. The share price decline of 15% per year isn't as bad as the EPS decline. The relatively muted share price reaction might be because the market expects the business to turn around.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on Iron Force Industrial's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Iron Force Industrial's TSR for the last 5 years was -44%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market gained around 36% in the last year, Iron Force Industrial shareholders lost 28% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Iron Force Industrial is showing 3 warning signs in our investment analysis , and 1 of those is a bit concerning...

Of course Iron Force Industrial may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

When trading Iron Force Industrial or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Iron Force Industrial is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:2228

Iron Force Industrial

Manufactures and trades in auto parts, and display rack household products in Taiwan and internationally.

Solid track record with excellent balance sheet and pays a dividend.