When we're researching a company, it's sometimes hard to find the warning signs, but there are some financial metrics that can help spot trouble early. A business that's potentially in decline often shows two trends, a return on capital employed (ROCE) that's declining, and a base of capital employed that's also declining. This reveals that the company isn't compounding shareholder wealth because returns are falling and its net asset base is shrinking. On that note, looking into Ta Yih Industrial (TPE:1521), we weren't too upbeat about how things were going.

What is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on Ta Yih Industrial is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

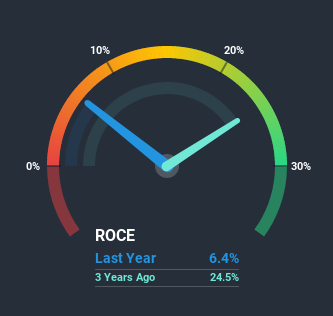

0.064 = NT$120m ÷ (NT$3.6b - NT$1.7b) (Based on the trailing twelve months to September 2020).

So, Ta Yih Industrial has an ROCE of 6.4%. On its own that's a low return, but compared to the average of 4.7% generated by the Auto Components industry, it's much better.

Check out our latest analysis for Ta Yih Industrial

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Ta Yih Industrial's past further, check out this free graph of past earnings, revenue and cash flow.

So How Is Ta Yih Industrial's ROCE Trending?

We are a bit worried about the trend of returns on capital at Ta Yih Industrial. Unfortunately the returns on capital have diminished from the 23% that they were earning five years ago. And on the capital employed front, the business is utilizing roughly the same amount of capital as it was back then. Since returns are falling and the business has the same amount of assets employed, this can suggest it's a mature business that hasn't had much growth in the last five years. If these trends continue, we wouldn't expect Ta Yih Industrial to turn into a multi-bagger.

Another thing to note, Ta Yih Industrial has a high ratio of current liabilities to total assets of 48%. This can bring about some risks because the company is basically operating with a rather large reliance on its suppliers or other sorts of short-term creditors. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

In Conclusion...

In summary, it's unfortunate that Ta Yih Industrial is generating lower returns from the same amount of capital. Investors haven't taken kindly to these developments, since the stock has declined 11% from where it was five years ago. With underlying trends that aren't great in these areas, we'd consider looking elsewhere.

One more thing: We've identified 4 warning signs with Ta Yih Industrial (at least 1 which shouldn't be ignored) , and understanding them would certainly be useful.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

When trading Ta Yih Industrial or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Ta Yih Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1521

Ta Yih Industrial

Engages in the manufacture, sale, and trading of vehicle and auto-bicycle parts in Taiwan and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives